Is Intel's only way to recover if it splits off its foundry business?

By Morton Lin

Intel, which has been struggling with the rise of TSMC and AMD, is trying to turn itself around by promoting a new strategy called ' IDM 2.0 ' to expand foundry services under CEO Patrick Gelsinger, who took office in 2021. However, analyst Ben Thompson, who runs the technology blog Stratechery , argues that Intel should make a bold move to split up the company in order to turn things around.

Intel Honesty – Stratechery by Ben Thompson

https://stratechery.com/2024/intel-honesty/

Intel has developed a system in which it carries out everything from chip research and development to manufacturing in-house, but in recent years it has fallen behind AMD in chip design, while falling behind TSMC in chip manufacturing. Therefore, Gelsinger has decided to focus on not only Intel's chips but also the chip manufacturing of its partner companies by expanding its foundry business, which undertakes chip manufacturing for other companies.

However, Intel's second quarter 2024 financial results reported on August 1, 2024 showed a deficit of approximately 240 billion yen, and it announced that it would lay off more than 15,000 employees. It also revealed that it would cut research and development and marketing expenditures by billions of dollars (several hundred billion yen) each year until 2026, and reduce capital expenditures by more than 20% in 2024. As a result of this financial statement announcement, Intel's stock price recorded a sharp drop of 26%, the worst since 1974, and the lowest price since 2013 .

Intel announces second quarter 2024 financial results, announces deficit of over 240 billion yen and cuts about 15,000 jobs - GIGAZINE

Thompson points out that Intel's design and manufacturing divisions are a drag on each other's business. First, the reality of the chip industry is that 'design is more profitable than manufacturing,' and NVIDIA, which designs chips, has a gross margin of 60-65%, while TSMC, which manufactures NVIDIA chips, has a gross margin of nearly 50%. However, Intel's manufacturing division has been centered on manufacturing its own chips, so it has had a profit margin close to NVIDIA's for many years.

This means that Intel's manufacturing division's top priority is to manufacture its own chips, which leads to poor service for potential foundry customers. It also puts a risk on third-party chip design companies that compete with Intel to hand over chip blueprints to 'foundries that prioritize Intel chips.' Thompson points out that these issues are obstacles to Gelsinger's Intel turnaround plan.

The only way to solve these problems, Thompson argues, is to 'spin off Intel's manufacturing business and operate it as an independent company.' Of course, it takes time to build a system for working with third parties, but by making the manufacturing division an independent company, the biggest incentive for large-scale change is the 'need to survive.'

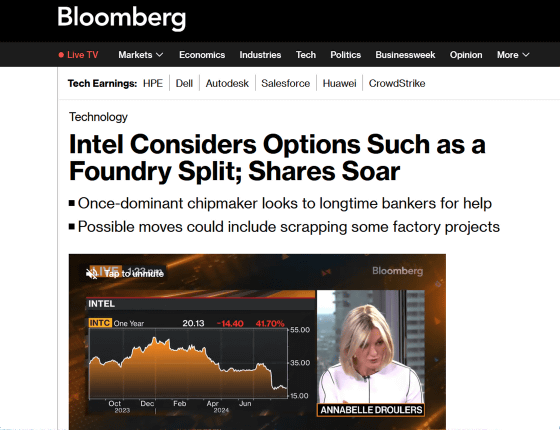

In fact, Intel is reportedly considering options, including splitting off its foundry business, following its second-quarter 2024 financial results, but these discussions are still in the early stages. Bloomberg, a foreign newspaper, said that Intel is likely to choose to postpone plans to expand its production facilities before reaching a drastic decision such as splitting off its foundry business.

Intel Exploring Options, Including Splitting Businesses, to Cope With Slump - Bloomberg

https://www.bloomberg.com/news/articles/2024-08-30/intel-is-said-to-explore-options-to-cope-with-historic-slump

Thompson said the fundamental problem people need to face is that Intel's manufacturing division does not produce the highest quality chips or the most advanced chips, so there is no reason for it to exist on a market basis. Gelsinger argues that most of TSMC and other foundries' cutting-edge manufacturing facilities are in Asia, and that investing in Intel is important to balance the geopolitics , but this means that if the US government or high-tech companies want to have options other than Taiwan, they will have to bear the costs of helping Intel.

In the United States , the Creating Helpful Incentives to Produce Semiconductors and Science Act (CHIPS Act) was enacted in August 2022, which includes a provision to allocate approximately $52.7 billion (approximately 7.93 trillion yen) to strengthen semiconductor manufacturing capacity in the United States over the next five years . It is expected that Intel will also receive large subsidies and loans. However, these funds will be provided only if Intel achieves certain standards in semiconductor manufacturing, so Intel has not yet received the funds.

Biden-Harris' Dream of US Chip Renaissance in Doubt as Intel Struggles - Bloomberg

https://www.bloomberg.com/news/articles/2024-09-04/intel-s-money-woes-throw-biden-team-s-chip-strategy-into-turmoil

Also, in September 2024, it was revealed that Intel's foundries were unable to pass Broadcom's tests.

Report reveals that Intel's semiconductor manufacturing business failed to pass Broadcom's test - GIGAZINE

Bloomberg reports that 'Intel's woes could also jeopardize the company's ability to establish a secure supply of cutting-edge chips for the Pentagon and achieve a policy goal of making one-fifth of the world's most advanced processors in the U.S. by 2030.'

Thompson believes that rather than directly giving subsidies or loans to companies, the US government should implement a purchase guarantee policy in which the government would 'guarantee a certain amount of processors that meet the standards and are manufactured in the US.' This would ensure that 'Intel-spun out foundries with Intel's expertise and facilities' could become self-sustaining companies, Thompson argued.

Intel's Chief Financial Officer, David Zinsner, said he expects Intel's foundry business to begin generating 'meaningful revenue' by 2027.

Intel manufacturing business will see 'meaningful' revenue in 2027, CFO says | Reuters

https://www.reuters.com/technology/intel-manufacturing-business-will-see-meaningful-revenue-2027-cfo-says-2024-09-04/

Related Posts:

in Note, Posted by log1h_ik