Plans are underway to turn X (formerly Twitter) into a payments app

Elon Musk, who acquired X (formerly Twitter), has revealed

Documents Show How Musk's X Plans to Become the Next Venmo - Bloomberg

https://www.bloomberg.com/news/articles/2024-06-18/documents-show-how-musk-sx-plans-to-become-the-next-venmo

Musk has repeatedly called for the need for revenue sources other than advertising revenue, which has accounted for more than 90% of X's sales, and payment services are expected to be one of them. In order to become a payment service, X has submitted more than 350 pages of documents to regulators in 11 states regarding a money transfer business license. According to Bloomberg, which obtained the documents through a public records request, X does not seem to plan to impose large fees on the payment service, and it is stated that X is only aiming to integrate the payment service into X in order to increase the number of users and popularize the service.

X's payment service will allow users to add and store funds in their accounts, make payments to other users and businesses, and use the payment service to purchase products in physical stores. Bloomberg, which reported on X's payment service plans, said, 'It will include a Venmo -like payment function.'

X's regulatory filings also included financial details of the company. Musk acquired X in late 2022, but it has been revealed that the company has been struggling since then. According to the filing, X's revenue for the first half of 2023 was $1.48 billion, which is 40% lower than the revenue in the first half of 2022, before Musk acquired the company. X also recorded a loss of $456 million in the first quarter of 2023.

Musk also bought X for $44 billion, but the document states that he owns about 75% of the company's stock. The document also states that no other investors own more than 10% of X's stock.

X has established a wholly owned subsidiary, X Payments, for its payment services and has also set up a dedicated

Bloomberg has reached out to X and Musk for comment on the documents X filed with state regulators, but has not received a response at the time of writing.

Harshita Rawat, a senior payments analyst at Sanford C. Bernstein, said that while many big tech companies, including Google and Meta, have integrated payment services into their products, they have 'had very little success.'[14] The relationship between an individual and their bank is 'very sticky,' and 'it's very, very, very hard to get people to switch.'

Regarding fees for payment services, X wrote, 'Because our overall goal is to attract users to X, we do not plan to impose fees on all services,' and 'We plan to impose minimal fees at the launch of the service.' In fact, major payment apps such as Venmo, which is a competing service, do not impose fees on peer-to-peer payments. Bloomberg reports that X may take a similar measure, as most major payment apps only impose small fees on retailers, not on consumers.

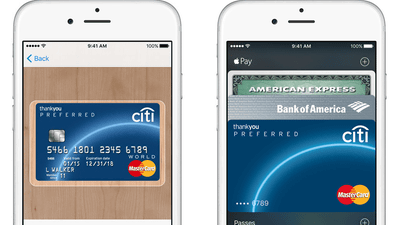

Musk has also publicly stated that he plans to make X a kind of savings account by offering extremely high interest rates on X's payment services. Chris Stanley, Chief Information Security Officer for X's payment division, also spoke about X's payment service outlook, saying, 'You can store money in X and send it to X Payments users. Think of it like Venmo at first. Then, as things evolve, you'll be able to earn interest, buy products, and eventually use it to make purchases in stores (think of it like Apple Pay).'

Not just tipping. I can pull money into X and store it in my X Wallet and send money to any X Payments user. Think Venmo at first. Then, as things evolve, you can gain interest, buy products, eventually use it to buy things in stores (think Apple Pay), etc. The end goal is if you…

— Christopher Stanley (@cstanley) April 22, 2024

X already has deals with payment service providers Stripe and Adyen to process credit and debit card transactions on its platform, and X Payments is expected to work with these partners. X Payments also has a partnership with Citibank, according to a filing with Massachusetts regulators in August 2023.

Related Posts:

in Software, Posted by logu_ii