Taiwan earthquake causes memory manufacturers to stop announcing DRAM prices, further price hikes expected

It has been reported that memory manufacturers have suspended the publication of contract prices, which are used in price negotiations, in order to assess the impact of damage to some semiconductor factories caused by the earthquake that occurred off the eastern coast of Taiwan on April 3, 2024. Since memory prices had been on the rise even before the earthquake, there are concerns that prices will rise further.

Memory makers reportedly stop publishing contract DRAM prices following Taiwan earthquake — further price hikes are expected | Tom's Hardware

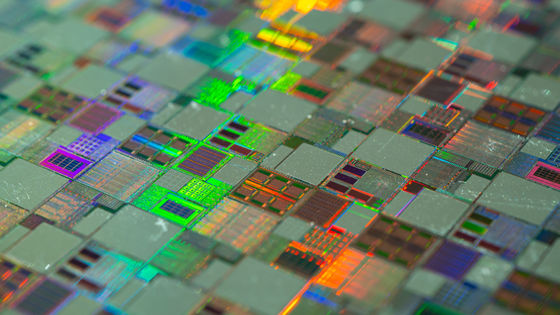

The Taiwan earthquake has reportedly caused some silicon wafer factories to suspend operations, affecting manufacturers such as Micron, Samsung, and SK Hynix, causing disruptions to semiconductor supplies.

Even before the disaster, the semiconductor industry had been aiming to raise prices to recoup past losses that occurred around 2022-2023, so this move could lead to a price surge that exceeds previous expectations. IT news site Tom's Hardware points out.

In the past, memory prices have become unstable due to production interruptions caused by natural disasters or major accidents. For example, a major

Before the earthquake, the growth rate of contract prices for DRAM and NAND flash memory in the second quarter of 2024 had slowed slightly compared to the previous quarter. In particular, the contract price of NAND flash memory increased by more than 20% in the first quarter, but fluctuated between 15% and 20% in the second quarter.

Immediately after the earthquake, Micron suspended its product estimates for the second quarter of 2024, citing the impact on local production and the supply chain, and competitors quickly followed suit. An industry source told Tom's Hardware, 'When such a large earthquake occurs, memory factories usually stop production, so the supply of memory wafers will also be affected.'

by albyantoniazzi

Memory module manufacturers, struggling with chip inventory shortages, are bracing for rising costs. Originally, the memory module industry had hoped that price increases would be halted due to increased supplier utilization rates, but chipmakers have made significant cuts to production to maintain prices in light of weak demand in 2023.

In addition, downstream customers such as server makers have been aggressively building up inventory in anticipation of a memory supply shortage, which is also expected to push up prices.

While semiconductor contract prices are expected to rise, the spot market, or physical market, is weak due to sluggish demand from the consumer sector after the Lunar New Year, and it is reported that supply still appears to be surplus.

Related Posts:

in Hardware, Posted by log1l_ks