The Federal Reserve Board is said to be behind credit card giant Capital One's acquisition of rival Discover

The Fed Is Behind the Capital One/Discover Merger

https://www.thebignewsletter.com/p/the-fed-is-behind-the-capital-onediscover

According to Mr. Stoller, the reason Capital One is trying to acquire Discover has to do with a loophole that the Federal Reserve System (FRS) inserted into banking law. Stoller also pointed out that if the acquisition were to go through, it could impact the relationships that millions of businesses have with their payment systems.

Capital One's acquisition of Discover may seem like one credit card company buying another credit card company. However, Stoller points out that ``this is more like a merger by a large tech company, where a bank is trying to transform itself into a cross-industry, app store-like platform with authority.''

In the United States, credit card issuers (banks) are regulated separately as issuers, and credit card networks are regulated separately as networks. This regulation also includes a price cap on debit cards. However, due to loopholes added by the Fed to banking laws, 'issuers that own credit card networks are completely unregulated,' Stoller noted. In other words, if Capital One's acquisition of Discover is approved, Capital One will be able to set prices in ways that rival credit card companies cannot.

In fact, Capital One co-founder and CEO Richard Fairbank said of the acquisition, 'The holy grail for us was to become an issuer with our own credit card network,' He revealed that acquiring the network was an important element for this acquisition.

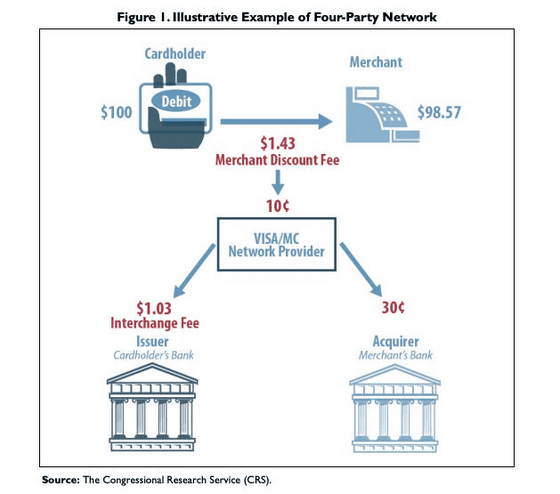

There is a big difference between Visa, Mastercard and American Express. Visa and Mastercard do not issue their own cards; their customers, such as banks, issue Visa and Mastercard branded credit cards. Therefore, when a credit card user uses their card to purchase something at a retail store, a merchant discount fee is charged to the company providing the credit card network such as Visa or Mastercard, the card issuer, and the

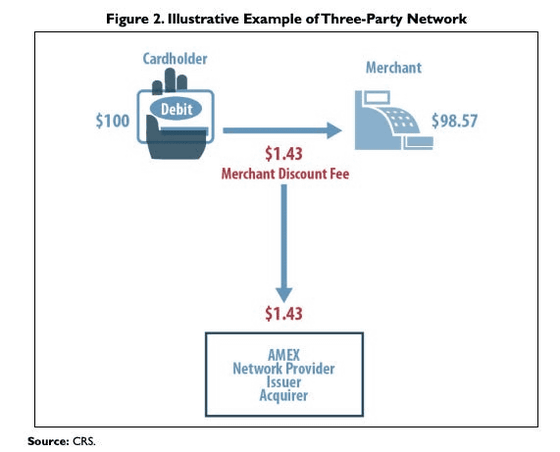

On the other hand, in the case of American Express, only American Express can issue credit cards of the same brand. Therefore, American Express is not a standard credit card network, but strictly speaking, it can be said to be a ``three-party system'' consisting of consumers, merchants, and American Express,'' Stoller said. American Express is a credit card network that it has built on its own and provides its own credit card services, so the major difference is that American Express can collect all the fees incurred by itself.

Discover, on the other hand, is a regular credit card network, but also a three-party system like American Express. By using Discover's credit card network, banks can issue Discover brand cards like Visa and Mastercard, but Discover also issues credit cards under its own Discover name.

In a typical credit card system, multiple intermediaries are involved, so the fees incurred each time a user uses a card are divided into multiple organizations. Credit card fees are slowly rising, but retailers still have to adapt to meet customer demand by accepting popular credit cards such as Visa, Mastercard, American Express, and Discover. As a result, credit card companies have strong market power, Stoller points out.

In 2010, the United States also noticed structural flaws in this credit card network, and an amendment bill (Durbin Amendment) was proposed to regulate credit card networks. The Durbin Amendment was included in the Dodd-Frank Act and would require the Federal Reserve to impose a cap on debit card fees. However, the Fed excludes third-party networks from this regulation. In addition, there are no regulations for Kujilet cards in the first place.

Capital One's CEO Fairbank said of the Discover deal, ``The Durbin Amendment was intentionally designed to limit credit card networks like Visa and MasterCard, which negotiate terms and prices, etc., with merchants on behalf of thousands of banks.'' Applies to you. Discover and American Express allow you to deal directly with merchants without an intermediary. As they are both credit card issuers and networks, there are no intermediaries. The Durbin Amendment does not apply to Discover or American Express. 'It was created to intentionally exclude networks such as American Express,' he explained to investors, making it clear that Discover's intention to acquire the company.

If the Discover acquisition is completed, Capital One intends to immediately transfer its debit cards to Discover. Stoller points out that if this happens, retail stores will have to choose between ``losing customers who want to use Discover'' or ``accepting Capital One's higher fees.''

It is unclear whether regulators will give the go-ahead for Capital One's acquisition of Discover, but lawyer Stephen Aschettino said, ``Among the list of hurdles that Capital One must overcome, antitrust is probably I think the law is more important than anything else, but that can take time.'

Related Posts:

in Note, Posted by logu_ii