Bitcoin has risen for 11 consecutive days and recovered to $ 20,000 before the collapse of FTX, the background of optimism that inflation has passed its peak

The price of Bitcoin exceeded $ 20,000 (about 2.56 million yen) for the first time since November 2022, recovering to the level before the virtual currency exchange

Bitcoin Surges Above $21,000 Amid Optimism Around Inflation - Bloomberg

https://www.bloomberg.com/news/articles/2023-01-14/bitcoin-surges-above-21-000-amid-optimism-around-inflation-ftx

Bitcoin spikes above $21,000: is the crypto bear market over? - MarketWatch

https://www.marketwatch.com/story/bitcoin-spikes-above-21-000-is-the-crypto-bear-market-over-11673711967

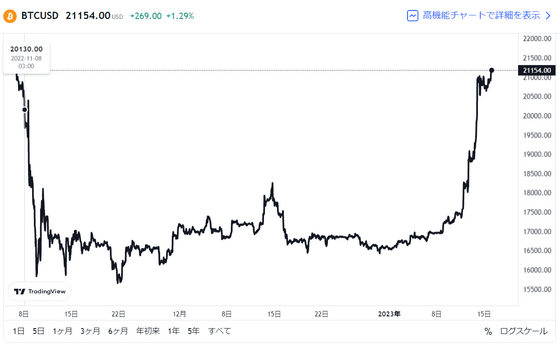

Below is a chart showing the price movement of Bitcoin in dollar terms. After FTX went bankrupt on November 8, 2022, the price of Bitcoin dropped to the $ 16,000 (about 2.04 million yen) level, but it surged from the beginning of 2023 and reached 11 on January 14. Record a streak. It temporarily exceeded $ 21,000 (about $ 2.68 million), and has maintained the $ 20,000 range since then.

by

Virtual currencies other than Bitcoin are also rising, and Ethereum, the second largest market capitalization after Bitcoin, surged about 10% from January 13th to 14th, and altcoins such as Cardano and Dogecoin were also strong.

According to a survey by CoinGecko, which provides cryptocurrency price information, the market capitalization of all cryptocurrencies has exceeded $1 trillion (about 128 trillion yen) for the first time since November 2022.

The cryptocurrency market is doing well because inflation in the United States, which drives the global economy, may have started to subside. The U.S. Bureau of Labor Statistics announced on January 12 that the December consumer price index (CPI) was 6.5% year-on-year. The CPI has slowed from 7.1% in November to its lowest reading since November 2021.

With inflation settling down and price rises slowing down, the Federal Reserve Board (FRB) in the United States will loosen its tightening grip on the economy. Stock indices such as the Nasdaq 100 Index also rose. However, the Fed will continue to raise rates until there are more decisive signs of slowing inflation.

Sean Farrell, head of digital asset strategy at market research firm Fundstrat, said: 'Following the weak CPI announcement, cryptocurrencies have performed well and the crypto-macro correlation is not going away any time soon. This week's price action was certainly encouraging, so unless problems such as DCG, a cryptocurrency company that is feared to go bankrupt, surface, it is highly likely that the cryptocurrency will be at an absolute bottom. I will,” he commented.

Katie Stockton, co-founder of market research firm Fairlead Strategies, said ``short-term overbought is not a positive move and should not be followed at this level.'' He warned against expectations that prices would continue to rise. Based on technical analysis , Stockton believes that bitcoin will temporarily plateau around $21,500.

Although it is a bit coin that has reached the 20,000 dollar level, it is more than 70% lower than the highest value of about 69,000 dollars (about 8.8 million yen).

Bitcoin & Ethereum have fallen by more than 70% since hitting all-time highs in November 2021-GIGAZINE

Related Posts:

in Software, Posted by log1l_ks