'Quit cost' that allows you to quickly calculate the amount of money you need during the unemployed period after you quit your job

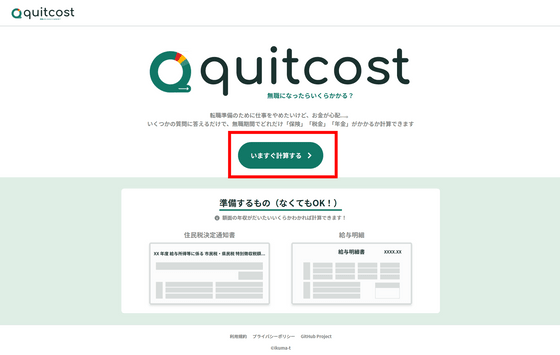

When you quit your job, you will have to manage and pay the national health insurance premiums and other money that you had left to the company. ' Quitcost ' is a service that allows you to easily know the three amounts of 'national health insurance,' 'national pension,' and 'resident tax' for such 'money required when you become unemployed.'

quitcost

We have released a service to calculate 'How much will it cost if you get unemployed?'!

https://zenn.dev/ikuma/articles/release-quitcost

The top page of quitcost looks like this. It is best to have a 'resident tax decision notice' and a 'salary statement' for calculation, but it is OK without it. Click 'Calculate Now' to calculate.

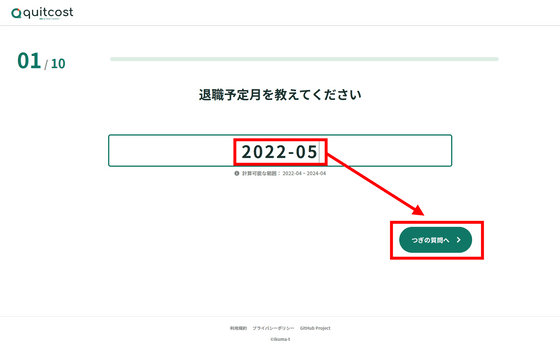

First, enter the expected retirement month. The computable range is from April 2022 to April 2024. This time, enter May 2022 as a trial and click 'Next question'.

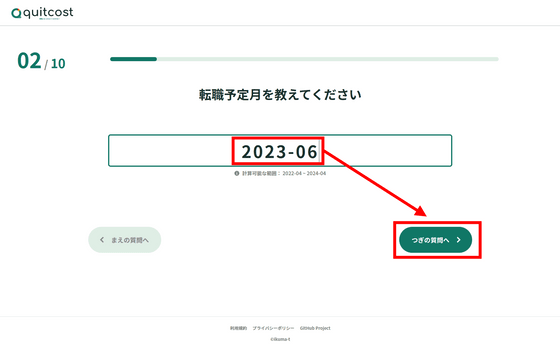

Then enter the month you plan to change jobs. This can also be calculated from April 2022 to April 2024. This time, it was June 2023, one year after retirement.

Enter the age further.

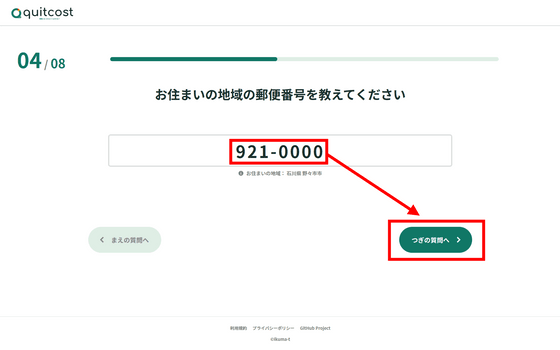

Next, enter the zip code of your area. This time, as a sample, I will enter the postal code of Nonoichi City, Ishikawa Prefecture, which ranked first in the overall evaluation in the livability ranking 2021 calculated by Toyo Keizai. In quitcost, the national health insurance rate for each municipality is used for calculation.

Next, enter the amount of income for the last year (January 1st to December 31st). Roughly enter '300,000 yen' this time.

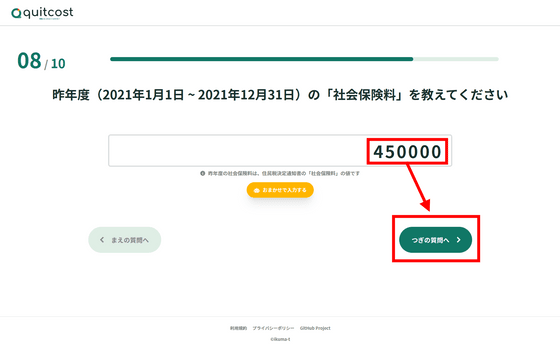

Then, enter the social insurance premium for the last year (January 1st to December 31st) (displayed last year). If you don't know, click 'Random input' and the sample value will be input automatically.

Next, enter the amount of income for the last year (January 1st to December 31st).

Similarly, enter the social insurance premium for the last year (January 1st to December 31st).

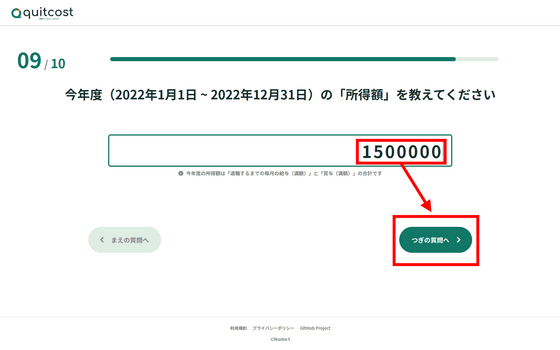

Then enter the amount of income for this year. Enter the total amount of 'Monthly salary (full amount)' and 'Bonus (full amount)' until you retire.

Finally, enter the social insurance premium for this year and click 'Calculate' to complete.

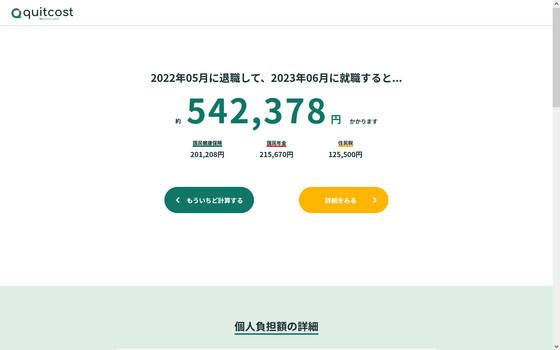

The total amount of national health insurance premium, national pension and residence tax is displayed as shown below. In the case of this estimation, the amount required for a one-year unemployed period was 'about 542,378 yen'.

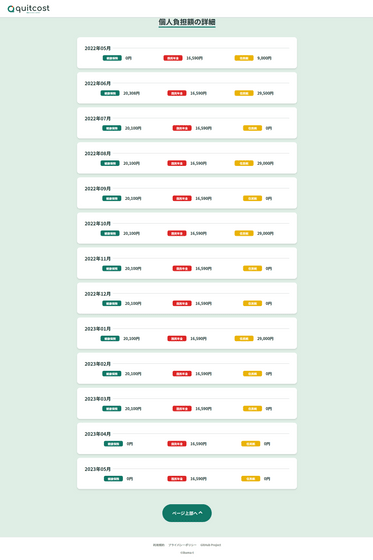

You can see the details of your monthly contribution by clicking 'View Details' or scrolling down the page.

Related Posts:

in Review, Web Service, Posted by log1p_kr