There are a series of horrifying crimes of 'personal information theft x usury' where you can get an exorbitant loan with an annual interest rate of over 900% without permission.

Krebson Security, a security blog, has released a story about 'a crime of making an exorbitant loan with an annual interest rate of 500 to 900% using stolen personal information' that was sent by a reader. Behind this crime is the 'loophole' that exists in American financial law.

Scary Fraud Ensues When ID Theft & Usury Collide – Krebs on Security

According to a person called 'Jim' in the article about his desire to remain anonymous, he noticed a series of crimes in May 2021. At the time, Jim received dozens of emails and phone calls from financial institutions saying, 'I want to approve the loan you applied for,' even though I don't remember.

These confirmation emails and phone calls came to Jim because he happened to take steps to freeze the credit information owned by the credit bureau as a countermeasure against spoofing crimes. The financial institution could not obtain Mr. Jim's credit information and could not check whether Mr. Jim had a history of debt delinquency, so he sent a notice asking him to send his credit information.

Jim replied, 'I'm not going to take out a loan,' to the financial institution that sent the notice. I have been informed that the personal information existing in the database has been stolen and should be deleted.

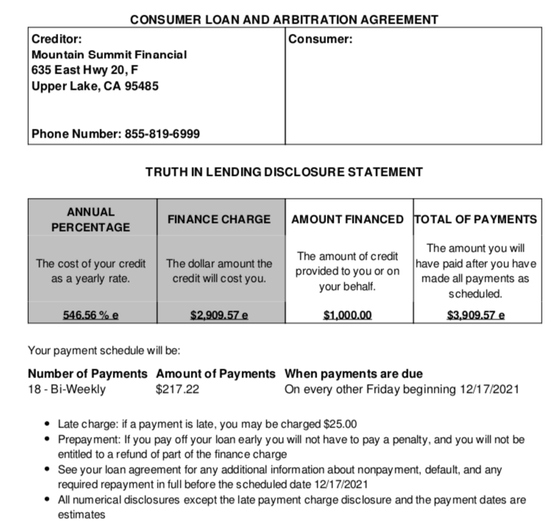

Among the financial institutions that interacted with Jim was the Upper Lake Havematrel Pomo , a financial institution specializing in lending called Mountain Summit Financial (MSF), run by a part of Native Americans. The MSF assured Jim that he would not accept loan applications and would remove personal information from the database. However, about four months after this exchange, on November 27, MSF sent an email saying, 'We have accepted your loan application and transferred your desired loan to your designated account.'

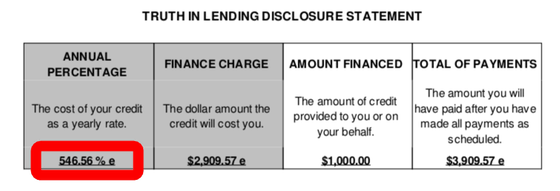

If you look at this notice, you can see that the loan is being taken at a terrifying interest rate of '546.56% per annum'.

The week after receiving the above email, Jim contacted MSF, but said that it had already been transferred to an account he didn't know about. MSF initially ignored Jim's request for withdrawal, but Jim took steps such as writing an affidavit that the loan in question was due to theft of personal information and reporting to local police. Agrees that the loan in question was not signed in a legitimate procedure. Then, in mid-January of the following year, I sent a notice to Mr. Jim saying, 'There is a possibility that a loan was made with personal information leaked from our company.'

According to Krebson Security, there is a 'tribal law' issue with Native Americans behind the case of such interest rate loans. Almost every state in the United States has a law called Usury Laws that limits the maximum interest on a loan, but the United States federal government has made itself a 'tribal sovereignty' over Native Americans and Alaska indigenous peoples. It recognizes the right to govern and, with a few exceptions, has the same authority as the federal and state governments. For this reason, loans operated by some Native American tribes are not subject to state law, and only tribal law with looser regulations on loans is applied. This loan, which was made without permission by a crime, is subject to the usury law under state law, but it is legal under tribal law.

The same crimes as Mr. Jim's case are occurring one after another in the United States, and as of January 2022, Native Americans said that 'the 544-922% annual interest rate loan made by the crime is a violation of RICO law and state law in the first place'. A (PDF file) lawsuit against four financial institutions run by the tribe is underway.

Jim, who played the leading role in this story, said, 'I'm still angry with MSF,' but also said, 'I'm also worried.' 'These financial institutions are personal as of May. Even though I requested the deletion of the information, I made a loan in my name without checking the credit information or confirming the consent, so one day I can pay the loan in installments that I have not contracted from the collector. I feel like I'm getting a call. '

Related Posts:

in Note, Posted by darkhorse_log