Authorities announce results of an investigation into 'Does Apple Card set unreasonably low limits for women?'

The Apple Card, a credit card issued by Apple, was suspected of 'maybe women have unreasonably low limits.' In this regard, we report the results of a data analysis conducted by the New York State Department of Financial Services for more than a year on 400,000 people and a survey of thousands of pages of written responses from Apple.

Report on Apple Card Investigation

(PDF file)

Press Release --March 23, 2021: DFS Issues Findings on the Apple Card and Its Underwriter Goldman Sachs Bank | Department of Financial Services

https://www.dfs.ny.gov/reports_and_publications/press_releases/pr202103231

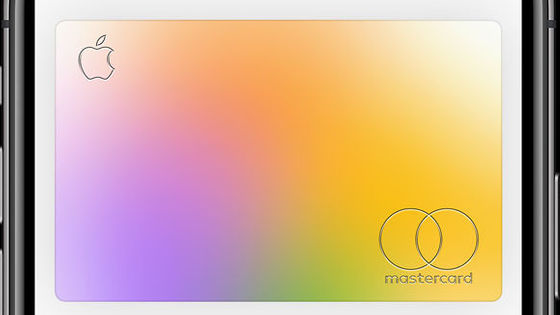

The service of Apple Card started in the summer of 2019, but in November of the same year, the theory that 'Apple Card is sexist?' Emerged. This theory was based on a programmer's claim that 'my wife had a higher credit score than me, but my limit was 10 times higher than my wife.' Steve Wozniak , one of Apple's co-founders, reported that he had experienced a similar situation, which is another reason why this theory attracted attention.

Many have pointed out that Apple's original credit card 'Apple Card' is sexist-GIGAZINE

On the other hand, Goldman Sachs, which provides Apple Card jointly with Apple, said about the algorithm, 'There is no gender entry field in the application for Apple Card in the first place, and it is possible to discriminate based on gender. I don't. ' However, experts pointed out that the lack of a gender entry field does not mean that gender discrimination does not occur.

A survey by the New York State Department of Financial Services, which began in 2019, was published on March 23, 2021 and concluded that 'there is no evidence of a bias towards women.'

The survey included thousands of pages of written responses and records from Goldman Sachs and Apple, interviewing Apple Card users and analyzing data from 400,000 New Yorkers who applied for Apple Card. It was done.

Data analysis also showed that the Apple Card application draws similar conclusions for men and women with similar credit information. An analysis of users claiming that Apple Card is discriminating also showed evidence that the application's conclusions were explainable, legal, and consistent with banking policies. .. The Department of Financial Services also states that flaws in customer service and lack of transparency have resulted in consumer distrust.

'We found no evidence of a breach of the legal system that provided for fair lending, but the study accessed credit nearly 50 years after the Equal Credit Opportunity Act (ECOA) was enacted. It reminded us that there was discrimination to do, 'said Linda Racewell, who represents the study. ECOA is a law enacted in 1975 aimed at prohibiting gender and racial discrimination in consumer finance.

'This report also touches on modern practices, laws and discriminatory restrictions on lenders that should be modernized and strengthened to improve access to credit,' Racewell said. In the above, to those who feel that Apple Card does not properly judge the user regarding credit, 'A user who relies on spouse's credit information or is allowed to use a credit card by spouse, You may have misunderstood that you have the same credit information as your spouse. '

“Access to equal credit requires extensive debate, and that's part of it,” says Racewell.

Related Posts:

in Web Service, Posted by darkhorse_log