What is an example of 'price fixing of virtual currency'?

Data scientist Matt Ranger explains on his blog 'Examples of price-fixing of cryptocurrencies' about the suspicion that 'cryptocurrencies are price-fixed', which is often talked about.

An Anatomy of Bitcoin Price Manipulation – Single Lunch

Concerns that virtual currencies such as Bitcoin are 'price-fixed' are often reported, and in fact, the US Securities and Exchange Association is price-fixing applications for exchange-traded funds (ETFs) linked to Bitcoin. Is rejected as a factor.

US SEC rejects two Bitcoin spot ETF applications | Reuters

https://jp.reuters.com/article/sec-bitcoin-idJPKBN2J306E

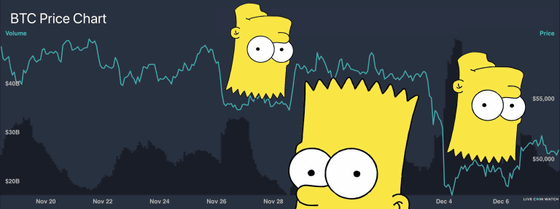

Mr. Ranger is explaining this time about 'Price transition of Bitcoin on July 26, 2021' that he judged to be price-fixing. Before explaining the price movements on the day, Mr. Ranger cites the fluctuation of the chart called 'Bart pattern' as a prerequisite knowledge. The Bitcoin chart is said to have the characteristic of 'suddenly falling / soaring after moving up and down in small steps', and if you draw this series of movements on the chart, Bart, who is a character in the popular American animation 'The Simpsons' It is named because it resembles the hair of.

The bart pattern is said to be a phenomenon that uses

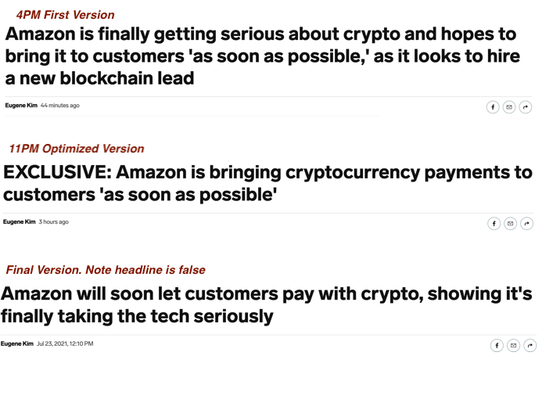

First, at 16:00 on July 23, 2021, Business Insider, an American business news site, said, 'Amazon is finally serious about cryptocurrencies, aiming to hire new blockchain leaders to provide crypto assets as soon as possible.' I posted an article. However, when you actually look at the jobs posted by Amazon , it is a fact that you want to hire a person who has a proven track record in cryptocurrencies and blockchain, but in short, the content is 'I want to hire such a person and find out what new things can be done'. .. The title of this article was revised over time , at 23:00 'Exclusive information: Amazon plans to implement cryptocurrency payment as soon as possible', the next day 'Amazon will start cryptocurrency payment soon, finally serious about technology development We will work on it with a new title. '

Then, at 9 o'clock on July 25, the British business newspaper City AM

And about 36 hours after City AM's coverage, an Amazon spokeswoman reportedly said, 'We have no plans to implement Bitcoin payments.'

Amazon: No, We Have No Plans to Accept Bitcoin Payments --CoinDesk

https://www.coindesk.com/business/2021/07/26/amazon-no-we-have-no-plans-to-accept-bitcoin-payments/

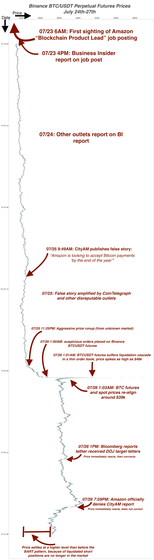

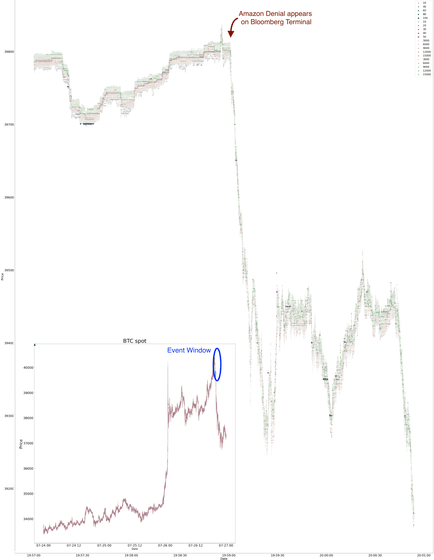

Please note that the figure below incorporates the movements so far in the Bitcoin chart, and unlike the general chart, it is 'Price (price) on the X-axis side and Date (time) on the Y-axis side'. give me. Looking at the chart from top to bottom in chronological order, the price of Bitcoin soared a few hours after the coverage of CityAM, and 1 bitcoin = 39,000 dollars (about 4.5 million yen) at one time. Stagnation. And when Amazon issued an announcement denying the coverage of City AM, it turned to a plunge, and you can see that it is exactly a 'bart chart'.

The series of price movements seems to be a pure reflection of the rise and fall of expectations for Bitcoin, which was fueled by the press, but according to Ranger, there are also technical aspects.

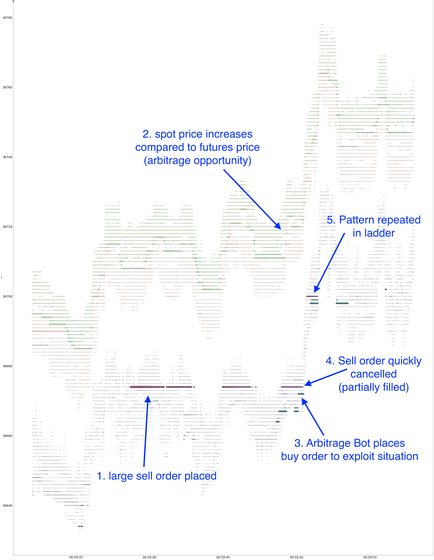

In the midst of this turmoil, Ranger claims that it happened around midnight on July 26th, the ' wash trade .' Wash trade is a method of manipulating the market by making other investors misunderstand that trading is active by performing the act of 'buying the stock / virtual currency sold by yourself'. Immediately before 1:00 on July 26, when the price soars, a mysterious transaction has been confirmed that 'a large number of sell orders are placed, and buy orders are placed for some reason but are canceled later'.

According to Ranger, this mysterious deal will allow spot prices to be derived. Regarding the mastermind behind the 'bitcoin price transition on July 26, 2021' that was the subject of this explanation, Ranger mentioned 'probably Alameda Research or DRW Cumberland .' 'The reason is that these companies have been sued by the Commodity Futures Trading Commission on suspicion of price manipulation due to algorithmic trading,' he said.

Related Posts:

in Note, Posted by darkhorse_log