Settlement amount of criminal transactions by virtual currency reached a record high, up 79% from the previous year

Chainalysis, a blockchain analytics firm, has announced that the 2021 crypto-based criminal transaction was the highest ever. The amount of money received by illegal cryptocurrency addresses amounted to 14 billion dollars (about 1.6 trillion yen) annually, a significant increase of 78% from 7.8 billion dollars (about 900 billion yen) in 2020. On the other hand, the total transaction value of virtual currencies has increased by 567% from 2020 to 15.8 trillion dollars (about 1830 trillion yen).

Crypto Crime Trends for 2022: Illicit Transaction Activity Reaches All-Time High in Value, All-Time Low in Share of All Cryptocurrency Activity --Chainalysis

Crypto scammers took a record $ 14 billion in 2021: Chainalysis

https://www.cnbc.com/2022/01/06/crypto-scammers-took-a-record-14-billion-in-2021-chainalysis.html

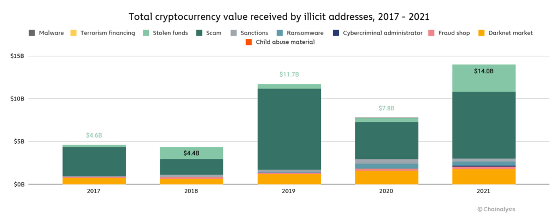

The graph below shows how the amount received by illegal addresses changed from 2017 to 2021. The classification of illegal addresses is as follows: dark gray is malware, yellow is terrorist funds, light green is stolen funds, dark green is scam , light gray is sanctions, green is ransomware, dark blue is cybercrime administrator, pink is fraud shop, Orange is the dark net market and red is the content of sexual exploitation of children. As of 2021, the three most common are fund theft, scam, and darknet market.

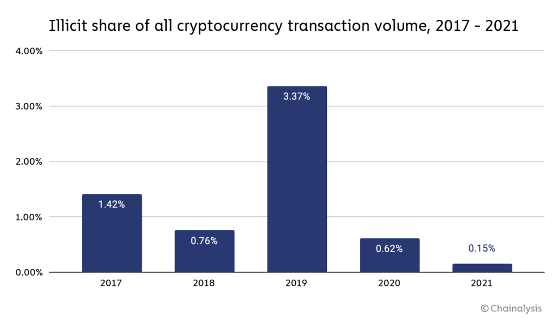

With the highest ever illegal transaction value of $ 14 billion, it seems that many cryptocurrencies are being used for crime. However, this is not always the case when we see that the total transaction value of cryptocurrencies reached $ 15.8 trillion in 2021 and increased by 567% from 2020. It is a surprising fact that the increase in criminal transactions was an order of magnitude less than the increase in overall transactions, and in fact, the proportion of criminal transactions in total transactions has reached the lowest level in recent years.

Below is a graph showing how the proportion of criminal transactions in total transactions changed from 2017 to 2021. It decreased to 3.37% in 2019 and 0.62% in 2020, but it decreased further to 0.15% in 2021. In addition, Chainalysis says that it is an outlier

However, this number is tentative. The figure for 2020 was also initially 0.34%, but later an illegal address was discovered and corrected to 0.62%. On the other hand, the capabilities of law enforcement agencies are increasing year by year, and as a whole, criminal transactions tend to be a very small part of the virtual currency ecosystem.

Of course, it's true that $ 14 billion of illegal transactions have taken place and should be taken seriously. For this reason, it is important to find out how illegal transactions were carried out, but it seems that

For example, in 2021, the transaction value of Scam increased by 82% from the previous year to 7.8 billion dollars (about 900 billion yen). Of this amount, more than $ 2.8 billion (about 324 billion yen) is due to a method called 'rug pull (pool escape)' that forges 'a virtual currency project legally constructed by developers' and steals funds from investors. .. All rug pulls tracked by Chainalysis in 2021 included the DeFi project.

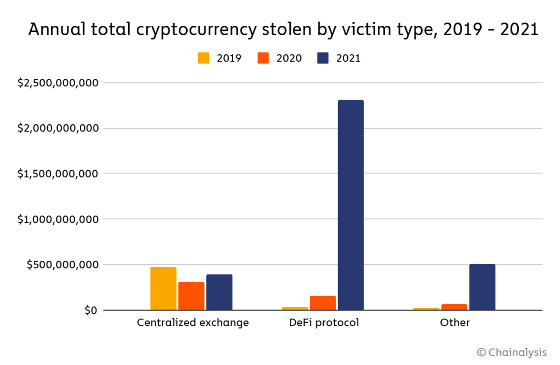

Regarding theft, in 2021, a virtual currency worth 3.2 billion dollars (about 370 billion yen) was stolen, an increase of 516% from the previous year. Of this, 72%, or $ 2.2 billion, has been found stolen from the DeFi protocol.

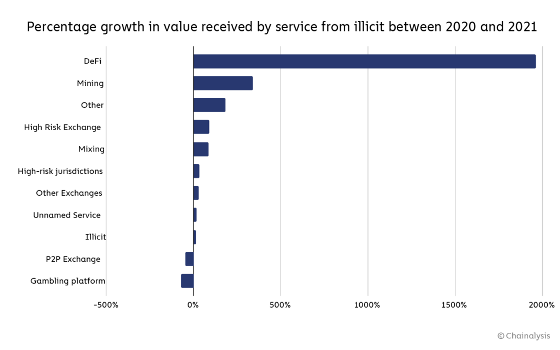

There are also increasing opportunities for the DeFi protocol to be used for money laundering. Below is a chart showing the growth rate of the amount of money received by illegal funds from each service between 2020 and 2021. You can see that DiFi is growing by nearly 2000% and is by far the best.

DeFi is one of the hottest areas of the crypto ecosystem, but if it's a hotbed for theft and scams, it's less likely to be useful in the future. In addition to learning how to avoid suspicious projects, Chainalysis said investors may need to take more drastic steps.

Related Posts:

in Note, Posted by darkhorse_log