Cryptocurrency exchange 'FTX' succeeded in raising 100 billion yen, corporate value reached 2 trillion yen

FTX Trading Ltd. Closes $ 900M Series B Round --Largest Raise in Crypto Exchange History

https://www.prnewswire.co.uk/news-releases/ftx-trading-ltd-closes-900m-series-b-round-largest-raise-in-crypto-exchange-history-847881913.html

Crypto Exchange FTX Raises $ 900 Million, Valued at $ 18 Billion --Decrypt

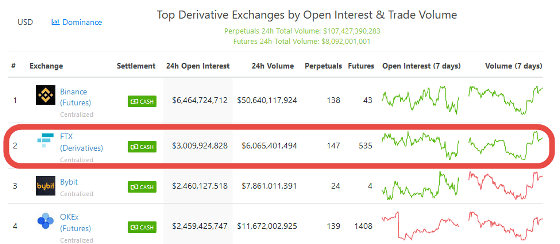

FTX is a cryptographic assets Exchange faced a million or more users, which was founded in 2019, CoinGecko per 24 hours has been aggregated open interest in the rankings Binance have been recorded in second place industry following the.

According to FTX, FTX succeeded in raising revenue in 2021 after successfully raising a

In addition to Softbank, major venture capital firms such as Sequoia Capital and Thomas Bravo are among the investment groups that have provided a total of 100 billion yen to FTX. FTX CEO Sam Bankman-Fried said, 'We are excited to work with our funding partners to make FTX the best company. FTX is a new derivatives exchange two years ago. This funding will help FTX continue to build a broader vision. '

According to crypto asset-related news media Decrypt , FTX will use the funds raised to acquire margin trading-related companies. In the past, CEO Fried said, 'If we can raise funds, we would like to acquire a major financial institution such as Goldman Sachs.' However, after the successful funding, Fried said, 'Goldman Sachs is too big a target for acquisition. Still, we are interested in major financial institutions.' It's premature.

Related Posts:

in Note, Posted by log1o_hf