What is the 'private equity' that is dominating the UK economy?

Investors and investment funds that invest in unlisted companies' stocks and real estate are called

How Private Equity Ate Britain - YouTube

According to Bloomberg, since Brexit , when the UK left the EU in 2020, private equity has been flowing into the UK at an unprecedented pace, acquiring many well-known stores.

As the UK adjusts to new economic conditions, the surge in private equity has the potential to pose major problems for the UK economy, because most private equity is dependent on debt.

For example, you could buy a store for 500,000 pounds (approximately 95 million yen) by paying 100,000 pounds (approximately 19 million yen) as a down payment and borrowing the remaining 400,000 pounds (approximately 76 million yen) from a bank. You would then spend another 50,000 pounds (approximately 9.5 million yen) to renovate the store.

Then, three years later, if you sell it for £800,000 (about 152 million yen), your profit will be the amount you incurred up to that point, minus the costs you incurred up to that point and any repayments you make to the bank.

However, there are cases where the store itself, rather than the buyer, is responsible for repaying the loan. This is called a leveraged buyout , and is used when acquiring large companies. The acquisition funds are raised through debt, and even if the company goes bankrupt, the loss is smaller than if the entire purchase was paid in cash.

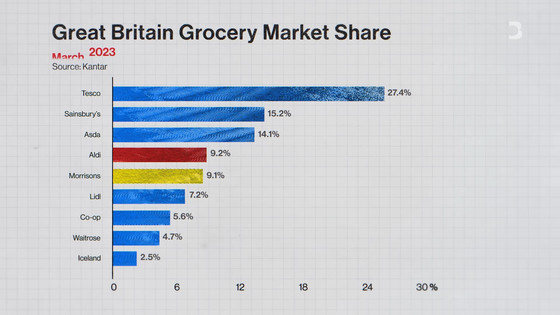

For example, Morrison, a British supermarket chain, has been family-owned for many years and was one of the four largest supermarket chains in the UK. Immediately after Brexit, Morrison's enterprise value was comparable to its US peers, but the COVID-19 pandemic changed the situation. After the pandemic, the enterprise value of US supermarket chains recovered, but Morrison's did not.

The company's low valuation made it attractive to outside acquirers. Shortly after the UK lockdown was declared in 2021, a bidding war for Morrison broke out among private equity firms. Ultimately, American investment firm Clayton Dubilier & Rice (CD&R) won, acquiring Morrison for approximately £7 billion (approximately 1.33 trillion yen). Morrison was valued at £4.5 billion (approximately 855 billion yen) in the first half of 2021, and CD&R's proposed acquisition price was significantly higher than that, but low interest rates made it easy to

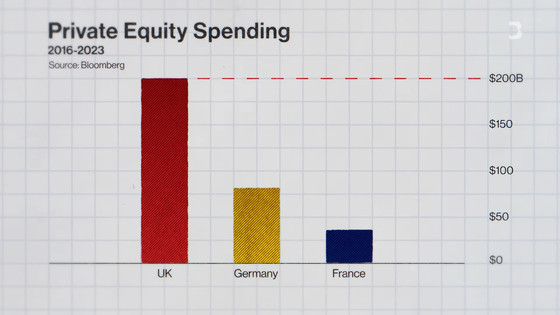

As in the case of Morrison, private equity has seen a massive influx into the UK since Brexit. Between 2016 and 2023, private equity is expected to spend a total of about $200 billion on the acquisition of UK companies, far more than German and French companies.

Since Brexit, British companies have generally become cheaper: they are valued at an average of just $11 for every $1 in profits, compared with $20 for American companies.

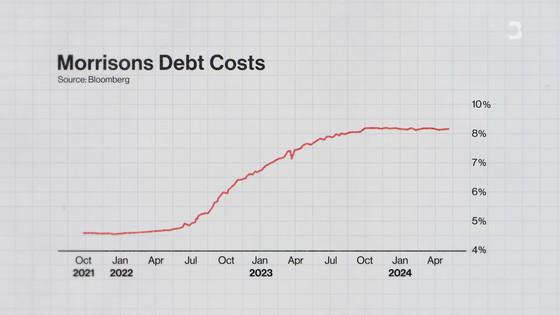

In the case of Morrison, the debt used in the acquisition amounted to about 6.6 billion pounds (about 1.25 trillion yen). However, interest rates were low when CD&R acquired Morrison, but interest rates have risen since then. About half of Morrison's debt, about 3 billion pounds (about 570 billion yen), was affected by the rise in interest rates, making the repayment of the debt more expensive.

At the time, Morrison was competing with its competitors on price, but rising interest rates meant it was having to pay hundreds of millions of pounds in additional interest each year, which Morrison was unable to do.

As a result, Morrison has fallen from fourth place in the industry.

Bloomberg points out that the issue is affecting many private equity-owned companies. In the UK, private equity-backed companies employ 1.9 million people, and their suppliers employ a further 1.3 million. If these deals fail, there will be real consequences for consumers, including higher commodity prices and job losses.

The Bank of England is concerned about the increase in private equity-owned British companies and rising debt levels. However, Britain needs outside investment after Brexit, and politicians are finding it difficult to tighten regulations on private equity. Therefore, Bloomberg said that even if

Related Posts: