Why are economists concerned about President-elect Trump's tariff plans?

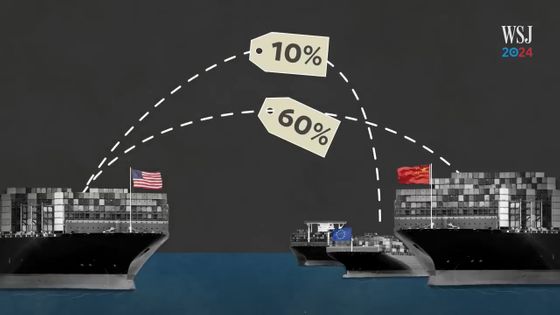

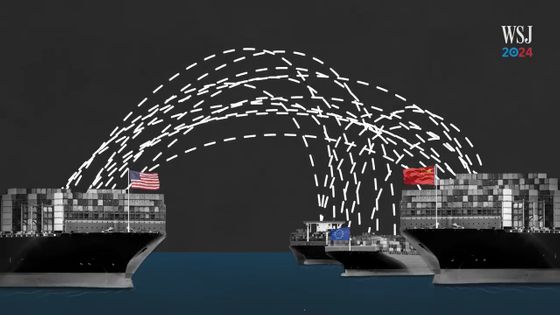

The next president of the United States, Donald Trump, plans to impose 10-20% tariffs on all imports and even higher tariffs on imports from China. The Wall Street Journal, an economic newspaper, explained on its official YouTube channel why economists are concerned about Trump's tariff hike plans.

Before discussing Trump's plan to raise tariffs, the Wall Street Journal explained the purpose and effects of tariffs by using the example of the ' Chicken Wars ' that broke out between the United States and European countries, including West Germany, in the 1960s.

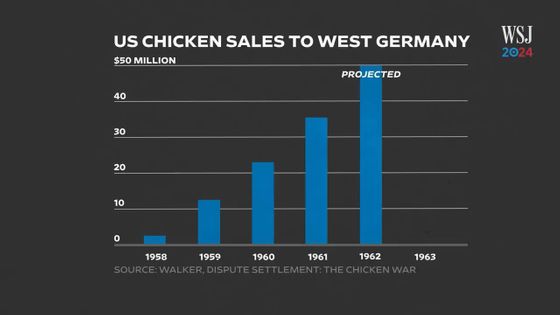

After World War II, consumption of American chicken increased in West Germany.

In 1962, American chicken farmers were expected to export more than $50 million worth of chicken to West Germany alone.

However, European farmers rebelled against this, so

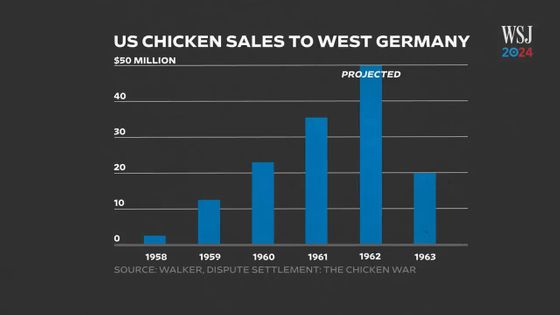

As a result, chicken exports to West Germany fell sharply.

Naturally, this infuriated American chicken farmers and politicians. 'The Chicken Wars is a fascinating story,' says

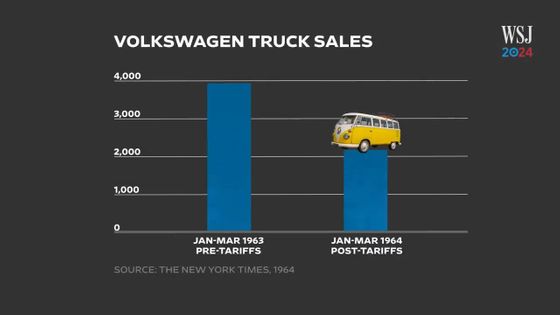

So in 1963, the United States targeted the automobile industry, which was a major industry in West Germany, by imposing a 25% tariff on small trucks and other items.

As a result, Volkswagen's truck sales in the U.S. fell in half and never recovered.

The war meant German consumers paid more for chicken and American consumers had fewer truck options.

This is a perfect example of the impact of tariffs, which the Wall Street Journal explains as 'designed to protect certain industries while hurting consumers and forcing countries to change their behavior.'

Over the past few decades, tariffs have not often been a major issue in trade policy, but Trump, who advocates an 'America First' policy, has called for the active use of tariffs.

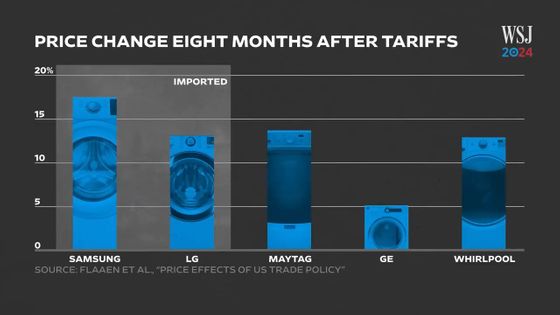

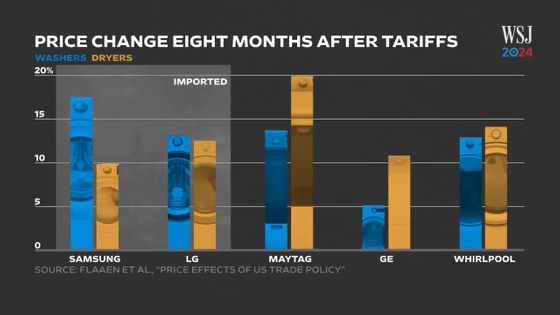

In fact, Trump imposed tariffs on 'washing machines' during his first term in office in 2018. This meant that trading companies importing washing machines were obligated to pay tariffs to the US government, and as a result, the tariffs were passed on to consumers as 'increased sales prices.'

'In a way, the purpose of the tariffs is to reduce demand for those goods to make room for domestic producers,' Irwin said.

After the tariffs were imposed, the prices of washing machines made in the U.S. rose, not just for foreign companies like Samsung and LG. This means that the demand for foreign washing machines fell due to the price increase, and the demand for domestic washing machines increased, creating room for American-made washing machines to be priced higher.

In addition, dryers, which are often purchased together with washing machines, were not directly subject to tariffs, but they did experience price increases just like washing machines. Tariffs have a knock-on effect not only on the products directly subject to tariffs, but also on other products.

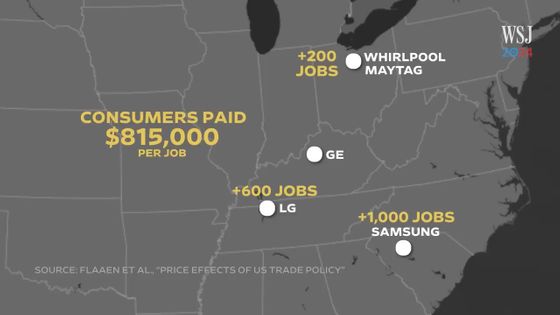

One of the goals of the tariffs on washing machines was to create jobs in the United States, and foreign companies such as Samsung and LG have opened factories in the United States, which has resulted in the creation of approximately 1,800 new jobs.

The tariffs on washing machines brought in $82 million in annual revenue for the US, but cost consumers an extra $1.5 billion. That means consumers paid $815,000 for every additional job created in the US. This makes it a very cost-ineffective way to create jobs, which is one of the reasons economists don't like tariffs.

Trump also imposed tariffs on steel and aluminum in 2018, intended to sanction China for violating international trade rules, as well as to strengthen national security.

But these materials are used not just in military products but also in cars and other everyday items, putting US companies that use steel or aluminum at a disadvantage against foreign competitors who don't have to pay the tariffs.

According to Irwin, research has shown that tariffs have caused more downstream jobs to be lost than upstream job creation. The impact of the tariffs introduced in 2018 has certainly encouraged manufacturing to move out of China, but they have also had many economic disadvantages, such as a decline in overall employment and an increase in the burden on consumers.

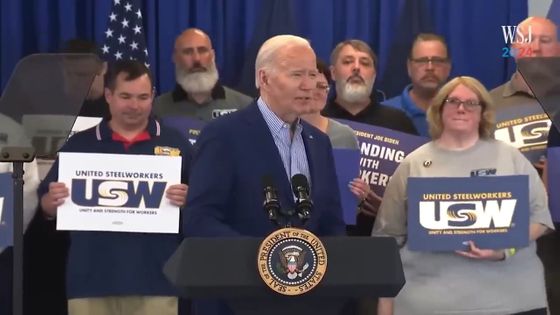

However, the subsequent Joe Biden administration maintained Trump's tariffs. Once tariffs are imposed, stakeholders who benefit from them lobby to maintain them, and the administration also wants to use the 'elimination of tariffs' as a trump card, so the reality is that they are difficult to eliminate.

In fact, American chicken farmers no longer care much about the European market, but as of the time of writing, 60 years later, the United States still imposes a 25% tariff on small trucks.

'We're still living with the legacy of the Chicken Wars. This is a history lesson,' Irwin said, noting that caution must be exercised when imposing tariffs to temporarily help an industry.

Trump has called for his next administration

According to some studies, the tariffs could force American households to spend an additional $1,700 a year and could result in the loss of more than 684,000 jobs. Furthermore, this estimate does not take into account the possibility of domestic manufacturers taking advantage of the tariffs or other countries imposing retaliatory tariffs. If a foreign country imposes tariffs on American products, there is a risk that American companies will lose revenue, resulting in job losses and reduced tax revenue for the United States.

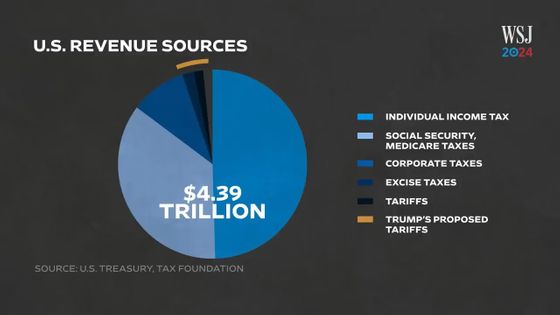

Trump plans to use the revenue from the tariffs to fund tax cuts at home. According to a study, the new tariffs could raise $270 billion in tax revenue, equivalent to about 5% of the U.S.'s annual tax revenue.

Trump's tariffs are expected to hurt the economy in the short term, but it's unclear what the long-term consequences will be. The Wall Street Journal said, 'Trump wants to play a game of chicken to find out.'

Related Posts:

in Video, Posted by log1h_ik