Scammers are exploiting 'cryptocurrency ATMs' that allow users to exchange cash for cryptocurrency

Cryptocurrency ATMs are terminals that allow users to transfer cash to designated cryptocurrency accounts. They are installed in familiar locations such as gas stations and general stores in the United States and are advertised as a convenient tool for easily converting cash into cryptocurrency. However, experts are warning that these cryptocurrency ATMs are becoming a means of transferring funds for international criminal organizations.

Organized Crime and Corruption Reporting Project - OCCRP

According to FBI estimates, the total amount of damage caused by cryptocurrency ATM fraud in 2023 exceeded $120 million (about 19 billion yen), and there were more than 4,300 complaints of fraud. Many of the victims are elderly, and scammers are using a method of posing as fake government agency employees and having them deposit cash into designated accounts at cryptocurrency ATMs.

'Cryptocurrency ATM fraud is an organized crime ring, with fraudsters based in Southeast Asia, India and West Africa,' said Detective Matthew Hogan of the Connecticut State Police, who specializes in cryptocurrency cases.

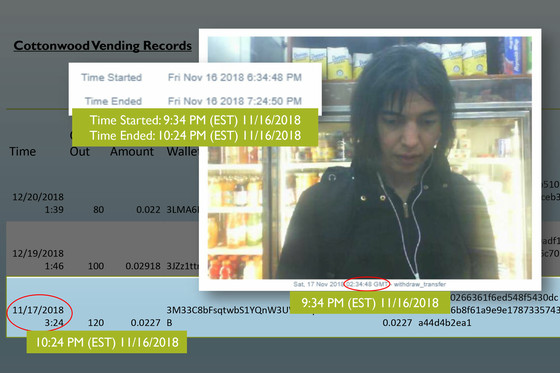

According to Hogan, cryptocurrency movements are easier to track than cash transfers because they use blockchain technology, but fraudsters are using tactics that make it harder for law enforcement to track them, such as transferring assets between different blockchain networks.

Additionally, U.S. Attorney Erin West, who specializes in cryptocurrency fraud, points out that the cryptocurrency exchanges where the fraudulent funds are deposited are located overseas, making the investigation difficult because they are uncooperative with U.S. authorities.

Crimes involving virtual currency ATMs are not limited to fraud. In April 2024, a man was indicted and sentenced to 18 years in prison for allegedly transferring $18,000 (approximately 2.8 million yen) to a group supporting a Syrian terrorist organization via a virtual currency ATM.

Additionally, a man was convicted of operating more than 40 unlicensed cryptocurrency ATMs at laundromats in New York City. The defendant testified that he took up to 20% or more of the transaction amount in commission and 'intentionally targeted criminal customers.'

The Organized Crime and Corruption Reporting Project (OCCRP), one of the world's largest investigative journalism organizations, argues that the lack of regulation and enforcement is making the situation even worse. While cryptocurrency ATMs must register with the U.S. Treasury Department's Financial Crimes Enforcement Network (FinCEN), other regulations vary by state and are inconsistent, the OCCRP noted.

Related Posts:

in Note, Posted by log1i_yk