How is Japan supporting the semiconductor supply chain?

Japan, which was a 'semiconductor manufacturing powerhouse' in the 1980s, has since been overtaken by Taiwan and South Korea, and there are high expectations for

How Japanese Companies Are Benefiting From the Chips Battle - WSJ

https://www.wsj.com/tech/japan-chip-supply-chain-toppan-fujifilm-d5fff25b

When we look at the fab business of cutting-edge semiconductors such as 2nm semiconductors, TSMC has an overwhelming presence, being featured in the news every day. However, semiconductor manufacturing is not only carried out by fab companies, but the semiconductor supply chain is made up of a multitude of companies in various fields, such as 'companies that design semiconductors,' 'companies that produce semiconductor materials,' and 'companies that manufacture semiconductor manufacturing equipment.'

For example, the EUV exposure technology that is essential for manufacturing high-performance semiconductors is monopolized by ASML, a Dutch semiconductor exposure equipment manufacturer. The extent of ASML's dominance can be seen from the fact that videos of what the inside of an EUV exposure equipment looks like can be viewed on YouTube, meaning that they think it is okay to show it.

On the other hand, in the field of 'logic semiconductor' manufacturing, Taiwanese foundry TSMC has an overwhelming share, while in the field of 'memory', South Korea, with its Samsung and SK Hynix, has a nearly 50% share. There is a tendency for each field to be concentrated in one country or region.

Japan is said to be 10 years behind the world in the semiconductor industry , but Toppan Holdings and Dai Nippon Printing hold nearly 50% of the market share for photomasks, the original plates needed in the semiconductor manufacturing process.

Fujifilm also has a large share of the market for slurry used to polish the surface of semiconductors.

CMP Slurry | Fujifilm [Japan]

https://www.fujifilm.com/jp/ja/business/semiconductor-materials/cmp

Furthermore, Fujifilm, JSR , and other companies account for 90% of the market share for photoresists (photosensitive materials), which are essential for semiconductor exposure.

What is 'photoresist,' an essential ingredient in semiconductor manufacturing? / Reading keywords | Future CLIP/FUJIFILM

https://sp-jp.fujifilm.com/future-clip/reading_keywords/vol58.html

The Japanese government is also taking an active role in the semiconductor industry. For example

TOB for JSR completed: Government fund JIC to acquire all shares for 900 billion yen: Asahi Shimbun Digital

https://www.asahi.com/articles/ASS4K1TF7S4KULFA014M.html

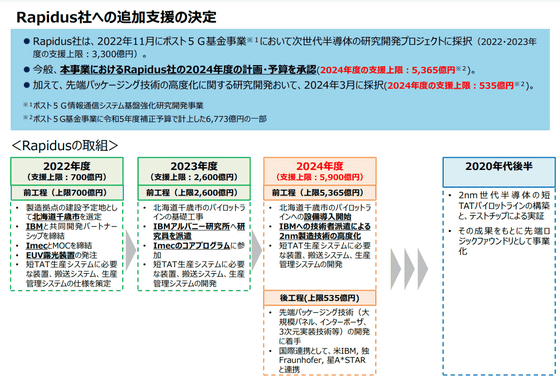

In addition, Rapidus, which is working on the development of design and manufacturing technologies for chiplet packages including 2nm generation semiconductors, has been selected to receive up to 590 billion yen in support. Rapidus will receive up to 330 billion yen in support in fiscal 2022 and 2023, for a total of up to 920 billion yen.

Decision to Provide Additional Support to Rapidus

(PDF file) https://www.meti.go.jp/policy/mono_info_service/joho/post5g/pdf/240402_theme_01.pdf

Related Posts: