It is revealed that Intel's semiconductor manufacturing division suffered an operating loss of over 1 trillion yen

Intel has revealed that its foundry (semiconductor manufacturing) division's operating loss for 2023 was $6.955 billion (approximately 1.5 trillion yen). The foundry division's deficit has ballooned from the previous year, a major blow to Intel as it tries to regain its technological lead.

Date of Report (Date of earliest event reported): April 2, 2024

- Intel Corporation

(PDF file)

Intel discloses $7 billion operating loss for chip-making unit | Reuters

https://www.reuters.com/technology/intel-discloses-financials-foundry-business-2024-04-02/

Intel shares fall on $7 billion operating loss in foundry business

https://www.cnbc.com/2024/04/02/intel-shares-fall-after-company-reveals-7-billion-operating-loss-in-foundry-business.html

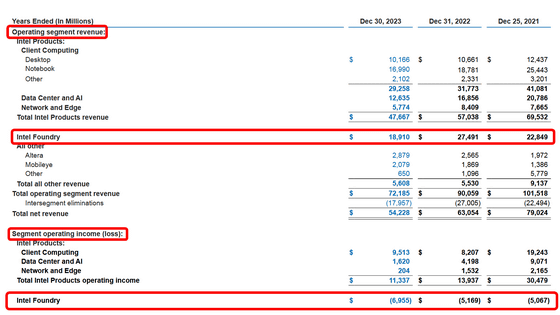

In documents filed with the U.S. Securities and Exchange Commission (SEC), Intel reported that it had operating segment revenue of $18.91 billion in 2023, on an operating loss of $6.955 billion.

Considering that the foundry business's revenue in 2022 was $27.491 billion (approximately 4.16 trillion yen) and the operating loss was $5.169 billion (approximately 780 billion yen), Intel's foundry business is facing an increasingly difficult battle in 2023.

In a presentation to investors, Intel CEO Pat Gelsinger said he expects 2024 to be the worst year for the company's chip manufacturing business, with the company expected to break even around 2027.

Gelsinger also said poor decisions, such as not upgrading EUV lithography equipment made by Dutch company ASML, had hurt the foundry business.

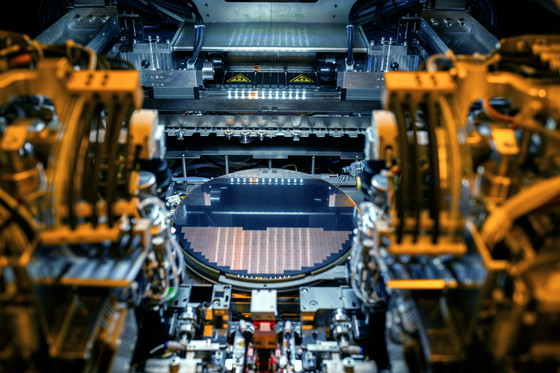

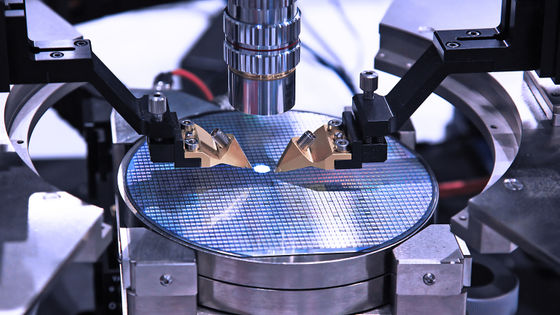

ASML holds a near monopoly on the manufacturing market for EUV lithography equipment, which prints integrated circuit patterns on silicon wafers and is essential for miniaturizing processors.

What kind of company is ASML, the exposure equipment manufacturer that semiconductor manufacturers around the world rely on?

However, there were concerns that EUV lithography equipment, which costs more than $150 million per unit, would increase the cost of manufacturing chips. Gelsinger said that Intel's reluctance to introduce EUV lithography equipment had forced it to outsource about 30% of its silicon wafers to outsourced manufacturers such as TSMC, and that the company aims to reduce its dependence on outsourced manufacturers to about 20% in the future.

'Before EUV, Intel had to bear a lot of costs and was not competitive,' Gelsinger said. 'Since EUV, I believe Intel is very competitive in terms of price, performance and leadership.'

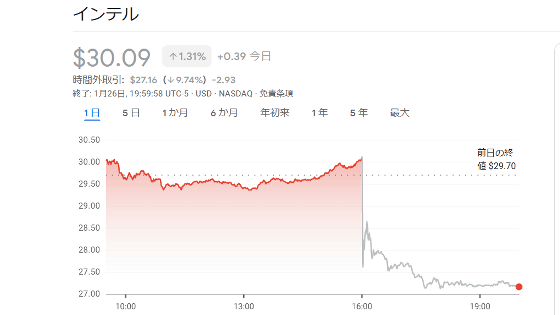

According to Reuters, Intel's shares fell 4.3% after the company filed the documents with the SEC.

Related Posts:

in Hardware, Posted by log1i_yk