``FedNow'', a payment system that eliminates remittance time lag between different banks in the United States, started

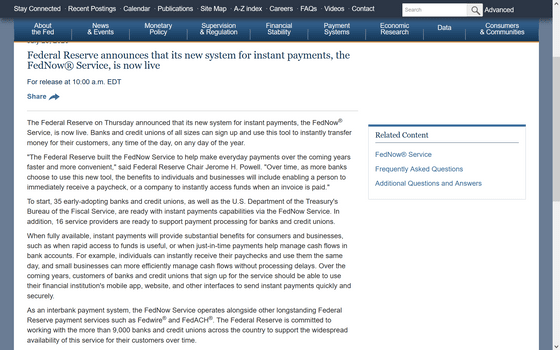

The US Federal Reserve Board (FRB) has launched the real-time payment system 'FedNow'. By using this tool, banks and credit unions will be able to instantly send money 24 hours a day, eliminating the time lag between different banks.

Federal Reserve Board - Federal Reserve announces that its new system for instant payments, the FedNow® Service, is now live

FedNow Dramatically Speeds Up US Payments, but Federal Reserve Downplays Any Tie to Digital Dollar

FedNow goes live for banks, credit unions | Payments Dive

https://www.paymentsdive.com/news/fednow-instant-payments-realtime-banks-credit-unions-transactions-FIS-Fiserv-JPMorgan/688455/

FedNow, which the Federal Reserve began developing in 2019, is a payment system that enables real-time remittances and payments 24 hours a day, 365 days a year by individuals and businesses. The launch of FedNow is expected to help the U.S. catch up with other countries such as India and Brazil that have already implemented similar instant payment systems.

Early certification participants include 52 banks and service providers such as JPMorgan Chase, the largest bank in the United States, the Treasury Department, Star One Credit Union and Bridge Community Bank.

Service providers such as ACI Worldwide, major processors FIS and Fiserv are also early adopters, and early participants include companies based outside the US, such as Dutch payment processor Adyen and Swiss financial services company Temenos.

When instant payments are fully available, employees can receive their paychecks instantly and use them on the same day, and small businesses can manage their cash flow more efficiently without delays. Over the next few years, bank and credit union customers enrolled in the service are expected to be able to make instant payments quickly and securely using the financial institution's mobile apps, websites and other interfaces.

Fed Chairman Jerome H. Powell said, ``Persons and businesses will benefit as more banks use FedNow.''

FedNow has faced criticism as a potential bridge to future digital U.S. dollars, but the Fed has denied any connection with digital currencies, stating that ``FedNow is neither a form of currency nor a step towards eliminating all forms of payment, including cash.”

Related Posts:

in Posted by log1p_kr