Binance, a virtual currency exchange, is sued by the Securities and Exchange Commission, suspicion of `` selling virtual currency without registration ''

by

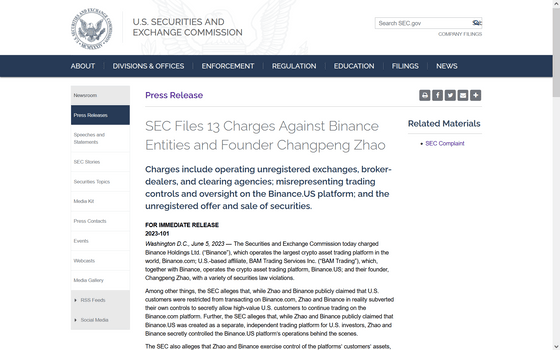

The U.S. Securities and Exchange Commission (SEC) has indicted Binance, the world's largest cryptocurrency exchange, and its founder, Changpong Zhao. The SEC alleges that Binance has profited unfairly by evading U.S. regulations.

comp-pr2023-101.pdf

(PDF file) https://www.sec.gov/files/litigation/complaints/2023/comp-pr2023-101.pdf

SEC.gov | SEC Files 13 Charges Against Binance Entities and Founder Changpeng Zhao

https://www.sec.gov/news/press-release/2023-101

SEC sues Binance and CEO Changpeng Zhao for US securities violations

SEC Complaint Aims to Unilaterally Define Crypto Market Structure | Binance Blog

https://www.binance.com/en/blog/ecosystem/sec-complaint-aims-to-unilaterally-define-crypto-market-structure-8707489117122437402

Binance has multiple affiliates, but the lawsuit targets its parent company Binance Holdings (Binance) , Binance.com , a virtual currency exchange operated by Binance Holdings, and a US-based affiliate. Company BAM Trading Services , Binance.US , an American cryptocurrency exchange jointly operated by Binance Holdings and BAM Trading Services.

Binance.com publicly claims that it does not trade with users residing in the United States, but according to investigations by the SEC and others, Binance is doing its part to accommodate some American users and Binance.com. It was said that he was inducing to be able to trade on com.

The US Commodity Futures Trading Commission (CFTC) and others have expressed the same view on this issue, and in March 2023 the CFTC filed a complaint with the federal court.

Binance and Changpong Zhao CEO are indicted by US regulators for alleged illegal trading - GIGAZINE

by Web Summit

The SEC has filed a total of 13 complaints in this lawsuit, but the main issues that the SEC asserts are the following four points.

◆ 1: Binance was not registered as an exchange in the United States

According to the SEC, although Binance has been active as a cryptocurrency exchange, broker, or dealer since at least July 2017, it has not been officially registered. The SEC argued that among affiliates, Binance.com should have been registered as an exchange/broker or dealer/clearing institution, and Binance.US should have been registered as an exchange/clearing institution. It is believed that Binance fraudulently earned $11.6 billion (approximately ¥1.62 trillion) between June 2018 and July 2021.

◆ 2: Providing and selling virtual currency without registration

The SEC has accused Binance of “offering and selling unregistered cryptocurrencies such as Binance Coin (BNB). In addition, BAM Trading is staking as a service through Binance.US. In addition to selling the program without registration, it also points out that Binance secretly manages the assets staked by American users in this program.

◆ 3: Did not restrict American investors from accessing Binance.com

Binance claims that ``Binance.US operates independently in the United States,'' and claims that American users can only access Binance.US and not Binance.com. By doing this, the scope of application of the US federal securities law was limited to Binance.US, but according to the SEC's claims, many American users actually access Binance.com, and Binance It is said that he was helping

According to the SEC, CEO Zhao had planned a plan for wealthy Americans to evade regulations, and had created a document that included action guidelines to hide the user's identity using a VPN service. Regarding similar issues, Reuters previously reported that “Binance hides financial information and headquarters,” and CNBC reported that “Binance employees were telling Chinese users how to bypass Binance’s KYC .” and regulators have expressed strong concerns about Binance.

◆ 4: Misunderstanding by investors

According to the SEC complaint, BAM Trading set up a monitoring system to detect and prevent fraud in cryptocurrency trading on Binance.US, but users misunderstood the existence of the system and whether the system was appropriate. It was said that he was giving

Following the lawsuit, Binance released a statement saying it was “sadly”. “From the beginning, we have actively cooperated with the SEC's investigation, and have worked hard to answer their questions and address their concerns. With today's complaint, we have abandoned that process and have instead chosen to act unilaterally and file a lawsuit. I strongly protested that I was ready to fight.

Related Posts:

in Posted by log1p_kr