A list of investment destinations of 110 billion yen funds led by Bill Gates was found, and where was it chosen as 'Innovative Venture Company'?

by PIRO 4D

Bill Gates , a founder of Microsoft who is engaged in various philanthropic projects, has established a fund that invests in companies that address the energy problem " Breakthrough Energy Ventures (BEV)." BEV, a huge fund with a billion dollar (about 110 billion yen), has a policy of "investing in innovative venture companies dealing with global climate change" and receives investment from such a huge fund The news media " Quartz " reported the breakdown of the first venture team.

Bill Gates-led $ 1 billion energy fund makes first investments - Quartz

https://qz.com/1402301/bill-gatess-1-billion-energy-fund-is-expanding-its-portfolio-of-startups-fighting-climate-change/

In addition to Bill Gates, Mr. Mukesh Ambany , an Indian businessman, Mr. Jeff Bezos of Amazon founder, Michael Bloomberg , former New York Mayor, Richard Branson , a British businessman, Mr. Jack Ma, founder of Alibaba , Mr. Masayoshi Son, the founder of the Softbank Group, is funded by worldwide millionaires.

In June 2018, Quartz reported that BEV decided to invest in two companies " Form Energy " and " Quidnet Energy ". And this time, seven new companies are revealed as BEV's investment destination, and a breakdown list of the first investment destination of enormous energy funds has been released. The breakdown of the list is as follows.

◆ 1: QuantumScape

A startup that develops " all solid state batteries " that many researchers think is indispensable for the evolution of electric vehicles, having output characteristics that are higher than the lithium ion batteries currently mainstreamed in electric vehicles.

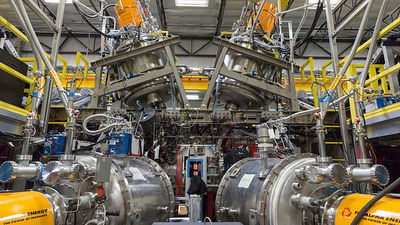

◆ 2: Commonwealth Fusion Systems

Start-up to conduct research on a nuclear fusion reactor utilizing high-temperature superconductivity .

◆ 3: Pivot Bio

A biotechnology company that develops microbial fertilizer instead of traditional nitrogen fertilizer and reduces the amount of nitrogen outflow and the amount of nitrous oxide that has the effect of destroying the ozone layer.

◆ 4: CarbonCure

A company that produces concrete with higher strength than conventional concrete by injecting carbon dioxide into concrete.

◆ 5: Fervo Energy

A startup tackling cost reduction of geothermal power generation by making full use of computer model and horizontal drilling technology.

◆ 6: DMC Biotechnologies

A company that produces chemicals with high added value such as biofuels from microorganisms.

◆ 7: Zero Mass Water

A company that sells panels that take out water from the air using the power of sunlight and batteries.

◆ 8: Form Energy

A startup that develops two types of batteries that can store energy over a long period of several weeks or months.

◆ 9: Quidnet Energy

A company aiming for innovation of hydroelectric power generation, developing technology to hydropower using water pumped from underground.

Mr. Gates has invested in energy-related startups that deal with many environmental problems before, but in the process he noticed that "investment in energy related venture is different from investment in software venture" It was. We need a big breakthrough to make innovation related to energy, we have invested enormously for a long time and finally we can get "tough technology". In addition, it is necessary to have a viewpoint of raising from researchers to entrepreneurs by providing support to researchers who have important technologies.

BEV executive director Roddy Guidelo says, "Our fund is a very unique fund with patient and flexible thought." BEV has built a network with 140 academic institutions, large companies, scientists and engineers to find ventures worth investing and gathers huge expertise on important technologies. Companies that are invested from BEV must disclose technologies that are considered scientifically feasible to BEV and show potential to reduce 500 million tons of global warming gas for at least one year.

The amount invested in the venture changes depending on the development stage and needs, and it seems that it is between about 200,000 dollars (about 22 million yen) and 20 million dollars (about 2.2 billion yen) per company. Although BEV does not clarify how much investment was made to each company, the total amount so far is about 100 million dollars (about 11 billion yen), and it is from the scale of the whole fund of 1 billion dollars If I do, I still have places like that. It is predicted that BEV will not invest all the necessary amount of venture, but by reporting that "investment was received from BEV", a chain of investments will be gathered in the venture.

by junaidrao

The BEV is expected to invest in a wide range of energy related fields in the future, but at the time of the investment destination of the first team, the fact that start-ups who received investment are based in North America and white men are the top is common It is said that it is. BEV said the investment destination will increase its diversity over time and become internationalized.

The companies that BEV invested are not all listed on the list, and it seems that there are also private companies because they do not want to disclose their names. Companies that are closed at this stage are expected to release their names in response to a later step-up.

Related Posts:

in Note, Posted by log1h_ik