Experience the plummeting stock price that Facebook loses market capitalization over 13 trillion yen, the decrease in one day is the maximum in American history

by William Iven

Facebook announced its second-quarter earnings results, revealed that synchronized sales increased by 42% to more than $ 13 billion (about 1.4 trillion yen). Nevertheless Facebook's stock price plummeted by as much as 23%, and market capitalization dropped by about 120 billion dollars (about 13 trillion yen). This is the biggest record in American history as the stock price decline rate in just one day.

Facebook's stock market decline is the largest one-day drop in US history - The Verge

https://www.theverge.com/2018/7/26/17619424/facebook-stock-market-decline-largest-ever

Facebook loses $ 120 billion in market cap after awful Q2 earnings | TechCrunch

https://techcrunch.com/2018/07/25/fallbook/

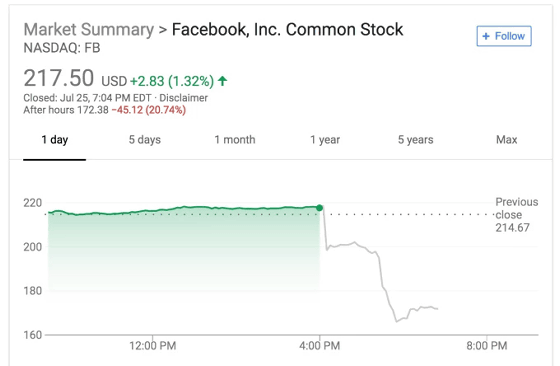

The chart at the moment when Facebook's stock price plummets will be as follows. It has come down to around 90 degrees from 4 pm. The highest value on that day is 217.5 dollars (about 24,000 yen), and it plummeted to about 172 dollars (about 19,000 yen) after announcing the settlement of accounts. "With just over two hours Facebook has lost more value than the market capitalization of most startups," TechCrunch writes overseas media.

TechCrunch lists the following four reasons for Facebook stock price plunge:

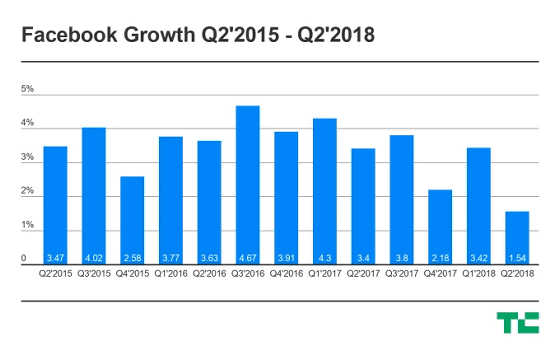

The first reason is "slow user growth rate". While the user growth rate in the previous quarter was 3.14%, the figure for this term is only 1.54%. The increase rate of active users increased from 1.42% in the previous quarter to 1.44% in the current term, it is obvious that growth is slowing down. The number of users is flat or decreasing in regions such as Europe and the United States and Canada, and the fact that the number of users is stagnating in these "most profitable markets for Facebook" is a possibility that many shareholders disappointed That is why.

The graph below shows Facebook's quarterly user growth rate. It is clear that the growth rate in the second quarter of 2018 is considerably lower than before.

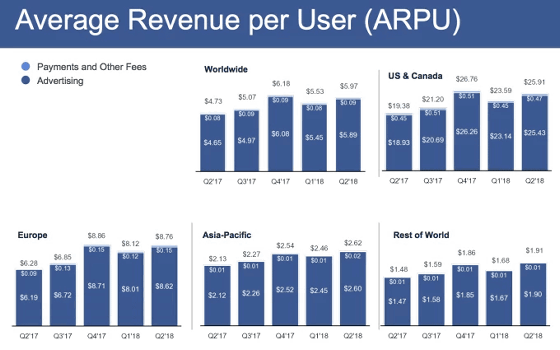

The second reason is "slowing profit growth". Facebook is a 42 percent increase in sales in the second quarter of 2018, but David Wenner CFO of the company warned that revenue growth could slow down in the coming quarterly results It is clear that this has influenced the plummet of stock price.

The graph below shows sales per user.

The third reason is "privacy and happiness." The first quarterly settlement of accounts for the second quarter of 2018 was the first time the privacy policy was changed in accordance with the " EU general data protection rule (GDPR)". Not only is GDPR one of the reasons Facebook needs to improve its privacy management as a result of the Cambridge Analytica problem, according to Werner CFO "GDPR is also contributing to Facebook user loss There is that.

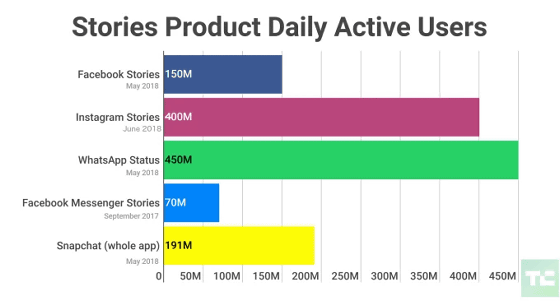

The fourth reason is "Transition to Stories". Although Facebook is introducing the slide function "b> Stories " displayed in portrait view, the sharing of feeds by users is expected to increase, but it is pointed out that the advertiser is not missed, affecting the slowdown of profitability It is thought that it is doing. In fact, Facebook Cheryl Sandberg COO also commented that "I do not know honestly that Stories are profitable just like regular news feeds."

Related Posts:

in Web Service, Posted by logu_ii