How did the world's first "high-frequency trading" start?

ByFrancisco Gonzalez

Trading of stocks and foreign exchange transactions is already centered on electronic trading using the Internet, and there are techniques that human beings can no longer compare with. The topic among them is buying and selling at a high speed of less than milliseconds (1 / 1000th of a second) and getting a small interestHigh Frequency TransactionIt is called what is called raising a huge profit in a way that promised the same victory as "late janken" so to speak. Such high-frequency trading began not in the 2000s when the Internet trading became active, but actually it was an old era in which no element of the computer existed at allMediumIt is reported in.

The First High-Frequency Trader - Medium

https://medium.com/@SparkFin/what-high-frequency-trading-looked-like-in-the-1970-s-ed1674e704cd

◆ "High Frequency Trading"

By utilizing the high-speed processing capability of a computer, transactions performed at a speed much higher than human cognitive abilityHigh Frequency TransactionOrUltra-fast transactionIt is called. The feature of this transaction is not only that the trading span is extremely short, but also includes a magical way of ensuring 'winning percentage 100%' which was considered unlikely in the world of exchange trading There is it.

The outline of the mechanism is as follows. An investor puts an order online, trying to purchase stocks. Although orders placed by investors are processed in the system, there is a certain time lag here, with a very short blank period from order to actual settlement.

It was a dealer who conducts high-frequency trading that watched the time lag. This dealer has built a faster trading system with the securities company than the general investor, and when it knows that the investor's order has been entered, put an order on the same stock so that it will go ahead of it, We will close (promise). In this way, the high-frequency trading company gets the same stock first due to the touch difference while ordinary investor orders are being processed.

And this time, by putting a small profitable on the brand you got in that way and putting it for sale, you will surely get the profit. This methodA scalpingIt is a type of act called "high-speed trading", so it can be said that we are going to do so with so-called "late janken" quickly. The situation is to judge the other's hand with a high-speed camera and decide his hand"Penguin robot" with winning percentage of 100%Same asSometimes it is expressed.

ByCraig Sunter

The appearance of this high-frequency transaction has become a big shock even in the United States where computer-based algorithmic transactions are popular. Even though it is lawful, it is also unlimitedly close to black gray, even more closely related to securities exchanges and "guru" also high-frequency trading is done where securities transactions have exceeded human judgment no longer It can be said that it is a phenomenon that makes us realize things. The situation is described in detail in Michael Lewis' s book "Men in the 1 / 100th of a second flash boys".

Amazon.co.jp: Men with flash boys one billionth of a second: Michael Lewis, Michael Lewis, Keiko Watakui, Kazunori Torue: book

◆ Beginning of high-frequency trading

Although it is such a high-frequency deal, in fact, its origin existed far before the on-line trading by the computer began.

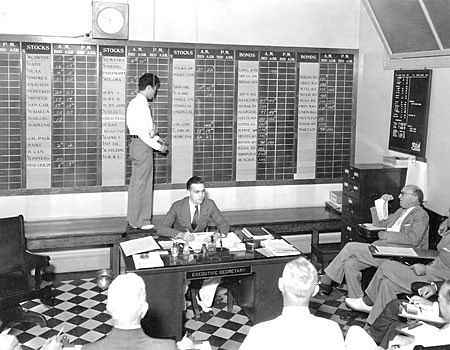

While the exchange of modern exchanges has progressed because securities transactions have been brought online, once it was common for exchanges to exist for each region and city. In modern America, Wall Street in New York is undergoing a lot of transactions as the center of finance, but in the past, in the United States, in addition to New York, big cities such as Chicago, Boston, Philadelphia, San Francisco,HartfordYaSpokaneTrading was active actively in cities such as Japan, the capital city of Hawaii, Honolulu, far away from the mainland of the United States like the following photographs.

It was common that there was a slight "gap" in the price of securities traded in various places, as it was the time before the on-line system that electronically connects the various areas was developed. It was Joe Richie who had a psychology degree in a former prison guard and launched a securities trading company "Commodity Research and Trading (CRT)". Mr. Richie was a person who was sometimes stuck with funds, but I was aware of the power of the "phone" that can exchange information in real time with remote places.

CRT was dealing in silver trading at exchanges in New York and Chicago. The company will make huge profits later in the deal, but making it possible was a way to utilize the phone that no one was watching at that time. CRT was the only dealer who brought in the phone within the exchange.

Through this call, Mr. Richie communicates the market prices of New York and Chicago one after another, and places orders in the cheaper market at the moment of "gap" and puts the settlement of sale on the higher market I repeat. The company will make a huge profit with a completely risk-free method, that is, to use the real price difference in front of us to make interesting parties. As the traders around him gradually began to recognize the real power of the method, they all started to draw a telephone line. Although each company adopted the same method, the superiority of CRT was lost, but Mr. Ritchie succeeded in building a huge wealth in a short period of time. In this way, Mr. Richie revolutionized options trading and at the same time became recognized as a creator of high-frequency trading.

With the development of computer algorithm technology and network technology, high-frequency trading that started from the telephone can be said to have reached the level where human ability no longer extends. High-frequency trading is expanding in Japan, and its appearance and structure can also be seen in the materials published by the Bank in 2013.

Impact of high-speed and high-frequency transactions on stock markets - rev13j02.pdf

Related Posts:

in Note, Posted by darkhorse_log