What is the domestic situation in China that is contributing to the soaring price of gold?

In recent years, the price of gold, a stable asset, has been on the rise due to political instability in the international community, and at the time of writing, it is

What Gold's Crazy Run Says About China - YouTube

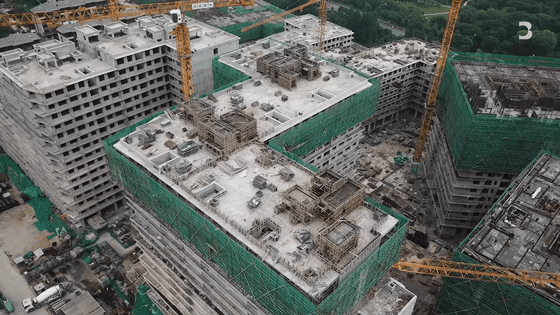

The recent rise in gold prices is due to the worsening economic situation in China. The most serious of these is the collapse of the real estate market. In China, where housing is considered an important asset, many people have concentrated their assets in housing. However, in recent years, the collapse of the real estate bubble has caused housing prices to plummet, resulting in a significant decline in the asset value of many Chinese citizens.

In response, the government introduced large-scale measures aimed at reducing borrowing costs, but the effect was limited, and the real estate market slump continues at the time of writing.

Additionally, within China, there is widespread concern about employment, which is leading to rising unemployment and falling wages, wage increases that are not keeping up with rising prices and the cost of living, and a future slowdown in the growth of the Chinese economy.

These economic instabilities have led Chinese people to turn to gold, a stable asset, to protect their assets. Chinese consumers in particular have traditionally viewed gold jewellery as a store of value and have purchased gold as an 'asset to be passed down across generations'.

China, the world's largest retail gold market, is set to purchase more than 1,000 tonnes of gold in 2023, primarily for jewellery.

However, in October 2024, the price of gold hit an all-time high, and Chinese jewelry buyers began to refrain from purchasing due to the price. Meanwhile, wealthy Chinese people, due to persistent concerns about the global economy, have begun to purchase

In addition, the international situation surrounding China is also affecting the rise in gold prices. When Russia began its invasion of Ukraine in 2022, Western countries such as the United States and the EU imposed sanctions to freeze Russian financial assets. This measure froze bank deposits, securities, real estate, etc. held overseas by the Russian government, companies, and some wealthy individuals, making it impossible to freely use or sell them.

As a result, many emerging countries, including China, which has close ties with Russia, will begin to consider reducing their reliance on the dollar as a reserve currency out of concern that they may be subject to similar sanctions. China's central bank, the People's Bank of China, aggressively increased its gold reserves over an 18-month period from 2023 to 2024, in an attempt to diversify away from the dollar.

In addition, President-elect Donald Trump has hinted at imposing additional tariffs on imports from China , raising concerns that trade friction between the United States and China could escalate further.

The combination of these economic and political factors has led to increased demand for gold in China, ultimately contributing to the soaring price of gold.

Related Posts: