China's chip self-sufficiency is expected to rise from about 14% in 2014 to 23% in 2023 and reach 27% in 2027.

According to research by semiconductor information platform TechInsights and others, China's semiconductor industry is growing rapidly and its self-sufficiency rate is increasing. The market value of China-based SMIC, the world's second largest foundry, has doubled in the past two months.

China's Semiconductor Production Capacity to Grow by 40% in Five Years | TechInsights

China's chipmaking champion soars amid country's push for self-reliance — SMIC's stock jumps 120% as semiconductor trade war intensifies | Tom's Hardware

https://www.tomshardware.com/tech-industry/chinas-chipmaking-champion-soars-amid-chinas-push-for-self-reliance-smics-stock-jumps-120-percent-as-semiconductor-trade-war-intensifies

SMIC's Nvidia-Beating 120% Stock Rally Faces Chip War Threats - Bloomberg

https://www.bloomberg.com/news/articles/2024-11-20/china-tech-stock-s-nvidia-beating-rally-faces-chip-war-threats

China's semiconductor self-sufficiency rate was only about 14% in 2014, but is expected to rise to about 23% by 2023 and reach 27% by 2027.

China has worked to expand semiconductor production amid its rivalry with the US

— Nikkei Asia (@NikkeiAsia) November 20, 2024

The Chinese self-sufficiency rate in semiconductors rose from around 14% in 2014 to 23% in 2023 and is expected to reach 27% in 2027. https://t.co/AqLnifHjch pic.twitter.com/df6P71bdD1

According to TechInsights, China's semiconductor industry is expected to grow significantly, with production capacity expected to increase by 40% over the five years after 2024. TechInsights points out that the driving force behind this rapid growth is rapid strategic investment in semiconductor manufacturing facilities.

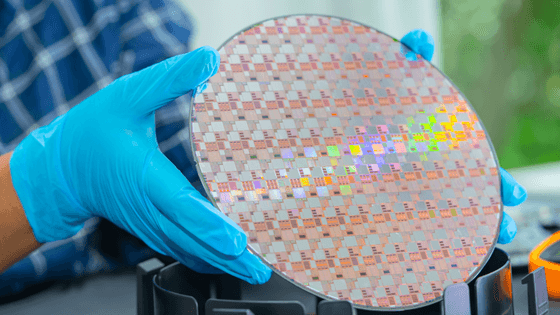

According to TechInsights, China's production capacity of silicon, which is essential for semiconductor manufacturing, is expected to grow from 310 million square inches in 2018 to 631 million square inches in 2024 and further to 875 million square inches in 2029.

In China, with the support of the government's semiconductor self-reliance promotion program, the world's second largest foundry, SMIC, has grown rapidly, and its market value has nearly doubled in two months. However, due to restrictions imposed by the United States, China is unable to access EUV exposure equipment, which is only handled by ASML in the Netherlands, and is therefore lagging behind Western countries in the development of cutting-edge chips. As a result, China is shifting its focus away from areas that require high-performance products such as AI and toward the manufacture of 'legacy chips' used in refrigerators and automobiles.

China's integrated circuit production is increasing 40% year-on-year to 98.1 billion units, and it is becoming a legacy chip production powerhouse due to US sanctions - GIGAZINE

Domestic demand and production in China continues to rise, and TechInsights predicts that demand will swell to $2 million (approximately 310 million yen) by 2027.

China's public and private sectors are accelerating efforts to boost domestic production of semiconductors, including cutting-edge devices, with the US only expected to dial up pressure on Beijing in the second Trump administration. https://t.co/2hxrDPdM4P pic.twitter.com/4ZJJX3xEi8

— Nikkei Asia (@NikkeiAsia) November 19, 2024

TechInsights said, 'Historically, the majority of China's semiconductors were exported, but now most are consumed domestically. A key question is whether the expanding manufacturing facilities with government investment will be used for domestic purposes or whether they will re-enter the global market and potentially drive down prices. Due to this concern, the Biden administration has also decided to increase tariffs on Chinese-made semiconductors from 25% to 50% to protect Western chipmakers such as Texas Instruments and Globalfoundries. This could raise costs for electronics and automotive OEMs that rely on Chinese suppliers and affect consumer prices. China's semiconductor production capacity is set to grow significantly due to large-scale investments in manufacturing equipment and focused investment in 12-inch fabs. This growth will have a significant impact on the global semiconductor market and have important implications for pricing and trade policy.'

Related Posts:

in Posted by log1p_kr