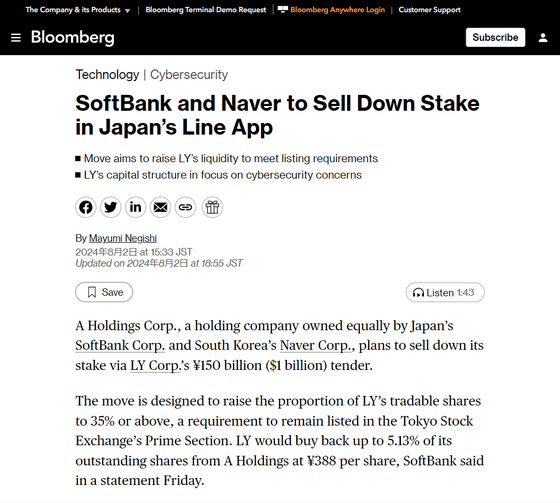

LINE Yahoo, which operates LINE, announces that it will conduct a tender offer with a maximum amount of 150 billion yen; SoftBank and Naver will sell up to 5.13% of their outstanding shares

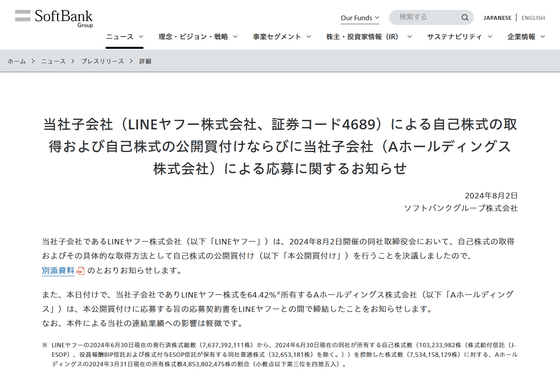

Notice regarding the repurchase and tender offer of treasury stock by our subsidiary (LINE Yahoo Japan Corporation, stock code 4689) and the tender offer by our subsidiary (A Holdings Corporation) | SoftBank Group Corp.

https://group.softbank/news/press/20240802

SoftBank and Naver to Sell Down Stake in Japan's Line App - Bloomberg

https://www.bloomberg.com/news/articles/2024-08-02/softbank-and-naver-to-sell-down-stake-in-ly-s-1-billion-tender

Line app operator announces buyback, SoftBank, Naver voting rights to fall | Reuters

https://www.reuters.com/technology/softbank-naver-jv-tender-minor-stake-line-operators-1-bln-buyback-2024-08-02/

On August 2, 2024, SoftBank announced that its subsidiary LINE Yahoo! would be making a tender offer for its own shares. This is aimed at increasing LINE Yahoo!'s outstanding share ratio to '35% or more,' which is necessary to maintain its listing on the Tokyo Stock Exchange Prime. As of March 2024, LINE Yahoo!'s outstanding share ratio was 34%, which did not meet the listing criteria of the Tokyo Stock Exchange Prime.

LINE Yahoo! plans to buy back up to 5.13% of the outstanding shares from A Holdings , a joint venture between Japan's SoftBank and South Korea's Naver, at 388 yen per share. This will reduce A Holdings' voting rights ratio to a maximum of 62.50%, but A Holdings will remain the parent company of LINE Yahoo! after the TOB.

LINE uses NAVER's cloud service to manage user information, so in 2023, NAVER's cloud service was attacked by a cyberattack, resulting in a large-scale leak of personal information of LINE users. In response to this, the Ministry of Internal Affairs and Communications issued administrative guidance to LINE and Yahoo. It pointed out that the investment ratio in LINE and Yahoo, which is 50/50 between SoftBank and NAVER, makes LINE vulnerable to cyberattacks.

However, due to public backlash within South Korea, it was expected that the investment would remain on a 50/50 basis for the time being.

LINE Yahoo!'s capital review abandoned for the time being, South Korea's Naver to continue investment: Asahi Shimbun Digital

https://www.asahi.com/articles/ASS7J2PBZS7JULFA00QM.html

LINE Yahoo 'Reviewing capital relations with Korean companies is difficult in the short term' | NHK | Communications

https://www3.nhk.or.jp/news/html/20240701/k10014498521000.html

The background behind the government's unusual intervention in 'control' of LINE creator Naver | Mainichi Shimbun

https://mainichi.jp/articles/20240701/k00/00m/020/251000c

Although LINE Yahoo! has been viewed with skepticism due to its capital structure review, it announced its financial results for the first quarter of fiscal year 2024 (April to June) on August 2, 2024, showing a 7.6% increase in sales to 463 billion yen and a 21.7% increase in adjusted EBITDA to 121.7 billion yen. This was due to the success of its payment service PayPay, online shopping site ZOZO, office supplies mail order company ASKUL, and Yahoo! Shopping.

Related Posts:

in Software, Web Service, Posted by logu_ii