India's Adani Group, owned by the world's third richest man, plunged in stock price due to accusation of ``the biggest fraud in corporate history'', 1.5 trillion yen blown away in one day

American Hindenburg Research, an investment research firm that specializes in short selling and is also known as a

Adani Group: How The World's 3rd Richest Man Is Pulling The Largest Con In Corporate History – Hindenburg Research

https://hindenburgresearch.com/adani/

Hindenburg's Short Sell Call Shaves $12 Billion Off Adani Stocks - Bloomberg

https://www.bloomberg.com/news/articles/2023-01-25/adani-group-stocks-drop-after-hindenburg-takes-short-position

Gautam Adani Accused of 'Largest Con in Corporate History' | Time

https://time.com/6250052/adani-hindenburg-fraud/

Adani Group, based in Ahmedabad, Gujarat, India, is a multinational conglomerate with a wide range of businesses including port management, energy industry, mining, airport management, infrastructure development and food processing. Gautham Adani, chairman and founder of Adani Group, holds the world's third-largest wealth as of January 2023, and was once ranked second in the world's richest list . Asia's richest billionaire.

On January 24, 2023, Hindenburg Research released a report that a two-year investigation into the Adani Group found evidence that the company was involved in decades of stock manipulation and accounting fraud schemes. bottom.

According to the announcement, the Adani Group has been investigated by authorities for alleged money laundering, tax evasion and corruption, estimated at $ 17 billion (about 2.2 trillion yen). Also, members of the Adani family, including Mr. Adani's brother Vinod Adani, conspired to forge documents to set up offshore entities in

From these findings, Hindenburg Research concludes that ``the seven Adani Group companies are overvalued by 85% even if we turn a blind eye to our findings that they are financially unstable''. In addition, it revealed that it had taken a short position against Adani Group through bonds traded in the United States and derivatives products outside India.

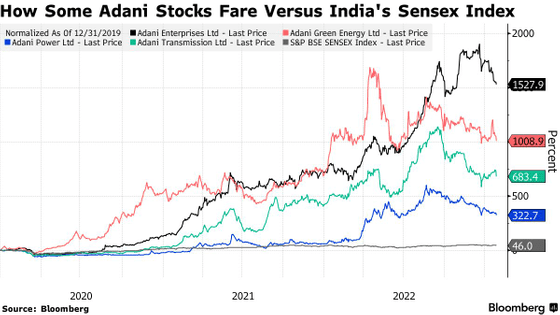

As a result, the stock prices of companies affiliated with the Adani Group have fallen sharply. According to overseas media Bloomberg, the market capitalization of 10 brands owned by the Adani Group, such as cement manufacturers and broadcasting stations, has decreased by a total of $ 12 billion. However, even after a $12 billion drop, companies controlled by the Adani Group remain up more than $50 billion in the past year.

In response to Hindenburg Research's announcement, the Adani Group said, ``This report is a malicious combination of selective misinformation and outdated and unreliable claims dismissed by the Supreme Court of India. , it is clear that the purpose of this report is to damage the Adani Group's reputation and damage the financing of Adani Enterprises , India's largest follow-up public offering (FPO) ever.' Did.

Media statement on a report published by Hindenburg Research.pic.twitter.com/ZdIcZhpAQT

— Adani Group (@AdaniOnline) January 25, 2023

Related Posts:

in Note, Posted by log1l_ks