Russia can mitigate economic sanctions against Ukraine invasion with virtual currency, plunder by digital ruble and ransomware attacks, etc.

Following Russia's invasion of Ukraine, the United States has imposed widespread economic sanctions on Russia. However, experts warn that the impact on the Russian economy will be limited due to the existence of virtual currencies that are not regulated by the conventional financial system and the acquisition of foreign currency by ransomware attacks.

Russia Could Use Cryptocurrency to Mitigate US Sanctions --The New York Times

How Russia, Billionaires Could Use Crypto to Go Around'Severe' US Sanctions --Bloomberg

https://www.bloomberg.com/news/articles/2022-02-24/russia-billionaires-could-use-crypto-to-go-around-severe-us-sanctions

On February 24, 2022, the White House completely blocked Russia's invasion of Ukraine against five major banks, including Sberbank, Russia 's largest bank, and the assets of Russia's upper management. Announced widespread economic blockade, including freezing. Regarding the effect of this response, the U.S. government said, 'Before this additional sanctions were imposed, Russia's stock market hit a record low for the first time in four and a half years, and the Russian ruble also hit a record low. It was under intense pressure. This new and tough measure will build up more of this pressure, curbing Russia's economic growth, intensifying inflation, intensifying capital outflows and sinking its industrial base. ' I'm evaluating it.

Economic sanctions are one of the most powerful diplomatic cards that Western nations exercise against non-allied nations. In particular, if the US dollar, the world's key currency, is no longer supplied, the operation of the nation will be severely restricted, so the economic blockade of Western countries against the invasion of the Crimea Peninsula in 2014 will give Russia 50 billion dollars a year (about 50 billion dollars). It is estimated to have hit the scale of 5.7 trillion yen).

However, experts point out that the impact of economic sanctions is diminishing as cryptocurrencies, which were rarely used in 2014, are becoming mainstream. Mati Greenspan, founder and chief executive officer of investment company Quantum Economics, told Bloomberg, 'In modern times, you can use Bitcoin even if you can't use a bank. If your bank account is about to freeze, you can turn your property into Bitcoin. '

Russia has long rushed to introduce

Russia can also earn cryptocurrencies by making full use of ransomware. According to a survey by blockchain tracking company Chainalysis, about 74% of the funds collected by ransomware in 2021, a virtual currency of 400 million dollars (about 46.2 billion yen), will be involved in Russia in some way. Is being sent to a suspected organization.

It has been pointed out that money laundering is not always easy because blockchain technology can track transactions, but Matthew Sigel, who is in charge of digital assets at investment company VanEck, said, 'A dictator or a human rights activist. Well, we don't encounter censorship on the Bitcoin network, 'he said, saying that cryptocurrencies are an effective way to escape sanctions. In Russia, millions of Russians already have a total of 2 trillion rubles worth of cryptocurrencies, according to government statistics.

In this regard, Michael Parker, who is in charge of money laundering and sanctions at the Washington, DC law firm Ferrari & Associates, told The New York Times, 'Russia is a scenario like this economic sanctions. It would be a naive idea that I wouldn't have expected. '

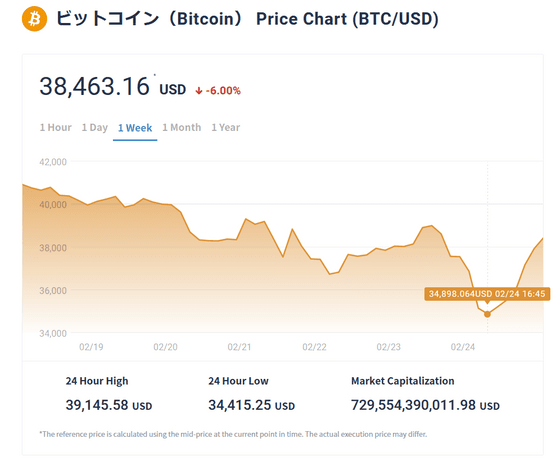

The cryptocurrency market is also showing signs of turmoil due to the unstable international situation. Bitcoin fell by nearly 10% on the 24th, when Russia began its invasion of Ukraine in earnest, temporarily breaking below $ 3,500.

Related Posts:

in Software, Posted by log1l_ks