Nigeria officially introduces Africa's first central bank digital currency, eNaira

by

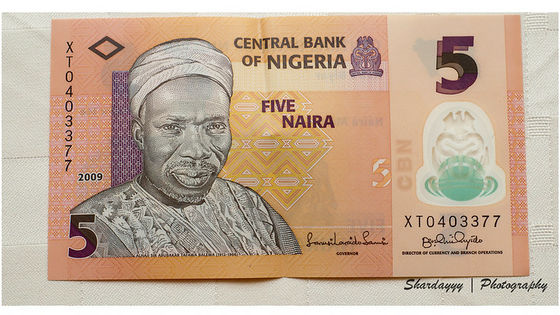

In the Federal Republic of Nigeria, which boasts the largest GDP in Africa, the official introduction of the Central Bank Digital Currency (CBDC) eNaira has been decided. The CBDC is the world's first case of the 'Sand Dollar' introduced in the Bahamas in October 2020, and the eNaira is the first CBDC in Africa.

Bitt Develops Africa's First CBDC

https://www.prnewswire.com/news-releases/bitt-develops-africas-first-cbdc-301406975.html

Nigeria to launch digital currency on Monday, central bank says | Reuters

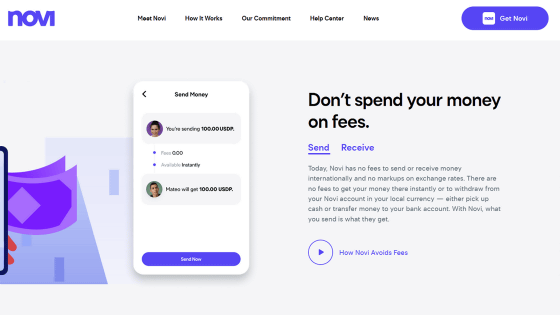

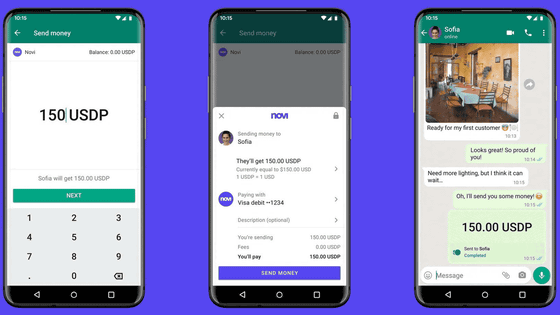

'Central bank digital currency' is a digitized version of banknotes issued by central banks in each country. eNaira is a digitized version of the Nigerian currency, Naira, and was developed by Bitt, a licensed digital currency management system at national financial institutions in six Central American countries.

With the official introduction of eNaira, Nigeria will be able to use digital currencies in everyday financial transactions.

'We are very pleased to be able to develop, test and deploy eNaira's currency infrastructure in record time,' said Brian Popelka, CEO of Bitt. Today's launch is very exciting for both the Central Bank of Nigeria and Bitt. We look forward to continuing our partnership in deploying the CBDC and providing all Nigerians with additional capabilities to extend the value of eNaira. '

Nigeria is the country with the largest population in Africa and has the highest GDP in Africa, but the poverty rate of young people is also one of the highest in the world. For this reason, cryptocurrencies are so popular among young people that the central bank has banned cryptocurrency transactions.

Why is crypto assets growing in popularity in Nigeria, where trading should have been banned? --GIGAZINE

However, the ban does not mean that transactions can be stopped, and the government has changed its perception that it is not realistic to stop transactions of virtual currencies, but rather used the popularity of virtual currencies to introduce digital currencies.

It is said that this is the sixth country to introduce CBDC, and it is also being considered for introduction in Ghana, West Africa.

Related Posts:

in Note, Posted by logc_nt