App Annie is suspected of securities fraud by the Securities and Exchange Commission and pays 1 billion yen to settle

The U.S. Securities and Exchange Commission has

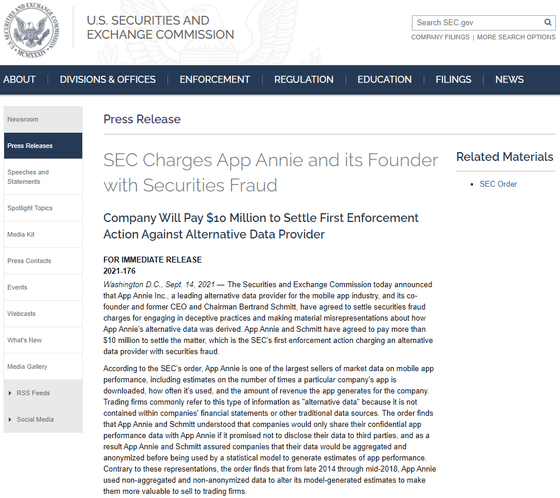

SEC.gov | SEC Charges App Annie and its Founder with Securities Fraud

https://www.sec.gov/news/press-release/2021-176

App Annie Issues Statement on SEC Settlement

https://www.appannie.com/en/about/press/releases/app-annie-issues-statement-on-sec-settlement/

SEC charges App Annie with securities fraud in $ 10 million settlement --Protocol — The people, power and politics of tech

https://www.protocol.com/bulletins/app-annie-sec-fraud

SEC Charges App Annie With Securities Fraud in $ 10 Million Settlement — Pixel Envy

https://pxlnv.com/linklog/app-annie-securities-fraud/

'Alternative data' is data collected from sources other than the financial statements and government-announced statistics that have traditionally been used as the basis for investment.

App Annie is a leading seller of market data such as mobile app downloads, frequency of use, and revenue generated by apps.

According to the Securities and Exchange Commission, App Annie and Schmidt understand that companies only share sensitive data with App Annie if they promise not to disclose the data to third parties. We have guaranteed companies to aggregate and anonymize their data before using it in statistical models to generate performance estimates. However, from late 2014 to mid-2018, it was found that it used unaggregated and unanonymized data to modify the estimates generated by the statistical model to increase its value for sale to trading customers. I am.

'Federal securities law prohibits fraudulent and material misconduct regarding the buying and selling of securities,' said Guruville S. Grewar, executive director of the Securities and Exchange Commission. App Annie and Schmidt said. It lied to the company about how its sensitive data was used, not only selling manipulated estimates to customers, but also encouraging transactions based on the estimates, with the company's actual performance and stock prices. Was showing off the correlation of. '

App Annie and Schmidt did not approve or deny the results of the Securities and Exchange Commission's findings, paying App Annie a $ 10 million fine and Schmidt a $ 300,000 fine. Was ordered. Schmidt also agreed to an order banning him from serving as an officer or director of a public company for three years.

Related Posts:

in Note, Posted by logc_nt