Why do well-known companies such as Apple and Google choose 'Delaware'?

Delaware, USA, is the second smallest state in the United States and the sixth smallest in population. There is a loophole in the law behind the fact that Delaware is registered with more than 285,000 international companies, including large companies such as Google's parent company Alphabet, Apple, and Amazon. The state's tax system problem, known as the 'loophole in Delaware,' was explained by the business magazine The Hustle.

Why do so many companies incorporate in Delaware?

Located at the address '1209 North Orange Street ' in Wilmington, Delaware, the Corporation Trust Center is the home of 'Registered Agent Services' operated by CT Corporation , a subsidiary of the Dutch multinational Wolters Kluwer. In 2012, at least 285,000 companies registered this address.

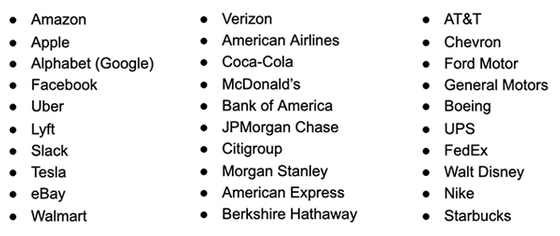

Below is a list of some of the largest international companies registered in Delaware. According to The Hustle, 68% of the Fortune 500 companies on the list of the top 500 companies in the United States are in Delaware.

Delaware became a registered land for many businesses because of the tax reforms that took place in New Jersey, USA, in the early 19th century. At that time, all businesses were registered as legal entities in the states in which they did business and had to comply with the tax regimes of their respective states. The U.S. states, which saw the issue of giant companies gaining control over the market during the Industrial Revolution, tried to impose heavy taxes on companies to regulate market monopolies, but New Jersey did. It was different.

New Jersey, which saw many states increasing corporate taxes as an opportunity to bring industry into the state, enacted a very loose corporate tax law in 1891 to attract companies. It was. In response, large corporations flocked to New Jersey, which earned enough tax revenue to pay off its debt in a matter of seconds.

Delaware followed suit and enacted a new corporate law in 1899. In addition to corporate tax, we have introduced full-scale incentives to free companies from all kinds of troubles such as bureaucratic crackdowns and shareholder proceedings.

After that, many states, including New Jersey, reflected on the loose regulatory system and revised or abolished the incentives, but only Delaware continued to give preferential treatment to businesses. This remains a legal loophole today, which is why Delaware continues to be the company of choice.

For example, a California company must pay a US government 21% federal corporate tax, as well as a state income tax of 8.84% of net income and an

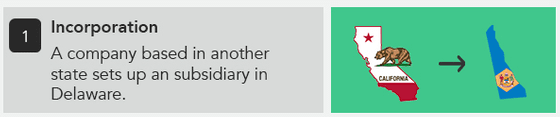

The following is a simplified method for companies to save taxes using this system. The company first establishes a subsidiary in Delaware.

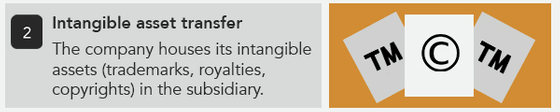

It then transfers to its subsidiaries intangible assets that are not taxable in Delaware, such as trademarks and copyrights.

After that, we will pay the 'royalties for intangible assets' to the subsidiary.

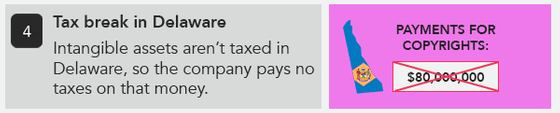

Since the profits earned from intangible assets are not taxable, the royalties on intangible assets paid by the subsidiary from the head office are also tax exempt.

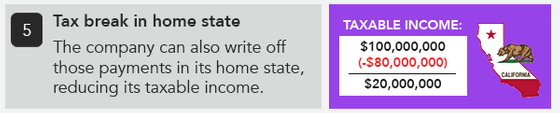

What's more, the expense of royalties also reduces the apparent profits of the head office, which makes it possible to reduce corporate income tax. This double savings is what the so-called 'Delaware loophole' is all about.

In addition, Delaware does not require disclosure of the names of officers or directors, so the personnel affairs of subsidiaries are anonymous. In addition, the registration of a subsidiary is very simple, so it is possible to set up a company in Delaware in less than an hour.

What makes Delaware even more attractive to businesses is the Equity Court in the state. In this court, corporate proceedings are considered by a judge who specializes in corporate law, not by a jury appointed from among the citizens. For this reason, equity courts often give very favorable judgments to companies, and it has been pointed out that this tendency is particularly noticeable in shareholder proceedings.

According to the Tax Justice Network , which is investigating tax avoidance issues by companies, the United States is the second largest tax haven in the world after the Cayman Islands . To overcome this situation, the US Congress passed a law in 2020 prohibiting the establishment of an anonymous paper company, but it is unknown whether this will correct the 'loophole in Delaware', The Hustle said. Said.

Related Posts:

in Note, Posted by log1l_ks