Research results show that there is no trickle-down and 'supporting the rich does not make the poor rich'

The economic consequences of major tax cuts for the rich --LSE Research Online

http://eprints.lse.ac.uk/107919/

Footing the COVID-19 bill: economic case for tax hike on wealthy

https://theconversation.com/footing-the-covid-19-bill-economic-case-for-tax-hike-on-wealthy-151945

50 years of tax cuts for the rich failed to trickle down, economics study says --CBS News

https://www.cbsnews.com/news/tax-cuts-rich-50-years-no-trickle-down/

A new treatise published by David Hope and Julian Limberg of the London School of Economics is published by 18 member countries of the Organization for Economic Co-operation and Development (OECD), including the United States and Japan, for 50 years from 1965 to 2015. This is an analysis of tax cut policies for the wealthy people that have been implemented in Japan.

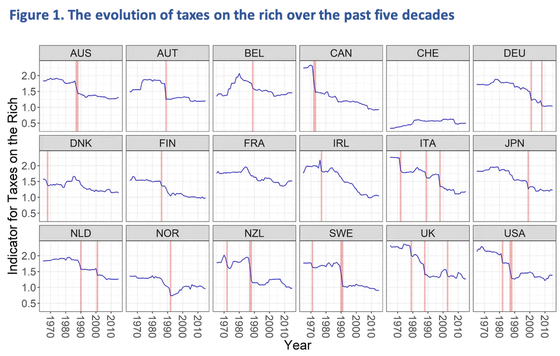

Hope et al. Calculated 'a comprehensive index of taxation on the wealthy' from income tax, wealth tax , inheritance tax, etc. in order to consider the transition of taxation on the wealthy. We have created a graph that visualizes the transition of this comprehensive index for each country. The red line in this graph indicates the 'year when the significant tax cuts were implemented for the wealthy' implemented by the administrations of each country, and in the USA (USA), the Ronald Reagan administration implemented it as part of Reaganomics 1982. The year and 1987 tax cuts are listed, and in the UK (UK) the 1979 and 1988 tax cuts implemented by the Thatcher administration.

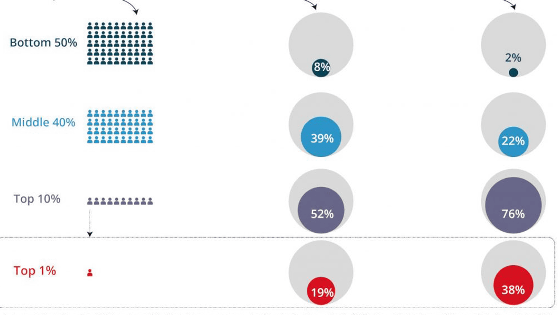

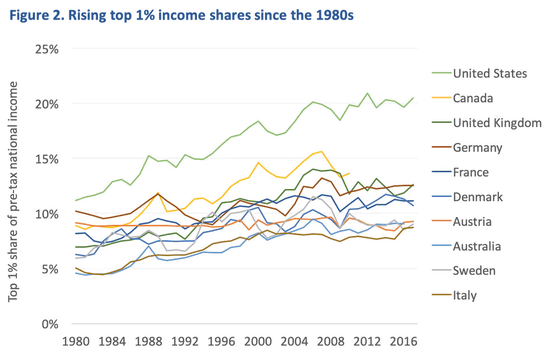

On the other hand, the graph below shows 'the ratio of assets held by the top 1% of all assets'. According to Hope et al., Comparing the two graphs, the time when the proportion of assets held by the top 1% of income increased particularly coincided with the time when the tax on the wealthy was reduced.

Hope et al. Investigate the countries that have implemented significant tax cuts for the wealthy and compare the economic conditions of those countries with those of other countries when the tax cuts are implemented. As a result, it was found that in countries that implemented significant tax cuts, the top 1% of incomes increased their income share by 0.8% or more in the five years since the tax cut policy was implemented, while economic growth and unemployment rate were almost flat. did. In other words, even if a large tax cut policy is implemented for the wealthy, economic growth and the unemployment rate will not change, and 'only the wealth of the wealthy will increase.'

Hope and colleagues say many governments are considering raising taxes with the new coronavirus pandemic, and tax increases for the wealthy could be the answer to the increase in government spending and social security spending under the pandemic. Claimed. He pointed out that historically, tax increases were implemented for the wealthy during the war and the Great Depression, and encouraged them to take into account the findings of this study that tax cuts for the wealthy do not produce economic benefits. It was.

Related Posts:

in Note, Posted by darkhorse_log