What is the tax avoidance technology by Call of Duty's Activision Blizzard that has avoided taxes of nearly 600 billion yen?

World of Taxcraft-how Activision Blizzard moves billions to tax havens-Tax Watch UK

https://www.taxwatchuk.org/reports/world_of_taxcraft/

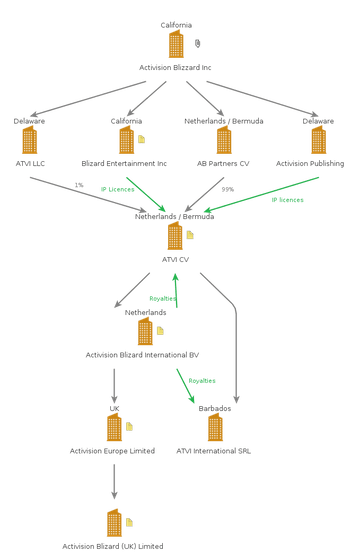

◆ America → Netherlands → Bermuda · Barbados

Although Activision Blizzard is headquartered in California, USA, most of Activision Blizzard's overseas operations are led by Activision Blizzard International BV in the Netherlands. The company's profit before tax in 2017 was € 556 million (about 65.5 billion yen), and the corporation tax paid was € 7.2 million (about ¥ 8.5 billion), which is a small amount for the world's largest game company .

by

Activision Blizzard International BV's profits are unusually small relative to its business size because of the zero-employment company ATVI CV, whose majority of profits are in Bermuda , and a royalty to ATVI International SRL, a similar company in Barbados. It is because it is gone to payment.

In fact, many of the intellectual property rights (IP) of Activision Blizzard are sold to ATVI CV, and Activision Blizzard International BV is licensed only through two companies. The royalty paid to ATVI CV and ATVI International SRL by Activision Blizzard International BV in the five years from 2013 to 2017 is estimated to total € 5 billion (approximately ¥ 589.7 billion).

However, the scheme has already been captured by the Internal Revenue Service (IRS) of the United States , and ATVI CV added to the two companies, 2009-2016, given that the payments to subsidiaries Activision Publishing and Blizzard Entertainment were underpaid. He was ordered to pay a total of $ 1.4 billion (approx. 148.3 billion) and an additional tax of $ 345 million (approx. 36.5 billion).

◆ Britain → Netherlands → Bermuda · Barbados

Activision Blizzard UK is primarily responsible for Activision Blizzard in the United Kingdom, whose income in 2017 was £ 75 million (approximately 9.6 billion yen) but its pre-tax profit was only £ 516,000 (approximately There was only 66.32 million yen).

Tax Watch UK pointed out that 'Activision Blizzard UK's revenue is a small fraction of the company's actual revenue.' In fact, Activision Blizzard has announced that 'the UK market accounts for about 12% of the company's total revenue,' which is applied to the company's earnings of about $ 4.8 billion (about 50.84 billion yen) in 2017 And, Tax Watch UK estimates that Activision Blizzard UK's income will be about $ 572 million.

The small profit from Activision Blizzard UK is due to the company being considered as a

And Activision Blizzard UK's parent company is Activision Blizzard International BV, which first appeared. As mentioned above, the profit of Activision Blizzard International BV is to disappear in royalty payment to ATVI CV etc. It is central to this method that the profit of Activision Blizzard UK is not taxed from anywhere.

Activision Blizzard UK is currently in dispute with the United Kingdom's HMRC regarding the flow of funds that it describes as an 'international business model.'

In addition, Activision Blizzard's French subsidiary is in dispute with the country's tax authorities, and is required to pay a total of € 571 million, including interest and penalties. Activision Blizzard is ready to challenge this order through the court.

Here's how you put together the complex and unusual organizational structure of the Activision Blizzard group into a single organizational chart.

◆ Smartphone game market

Activision Blizzard's tax avoidance technology is not the only one. Activision Blizzard acquired the Swedish game production company

by Nguyen Hung Vu

King's business is essentially conducted by Midasplayer.com Limited in the United Kingdom, which is said to provide 'management services' to the company, and the company will sell $ 283 million in 2017 (approximately ¥ 29,964 million yen) ) And paid a corporation tax of $ 17,700,000 (approximately 1,874,290,000 yen). However, according to Tax Watch UK, the sales amount does not reflect the revenue from consumers.

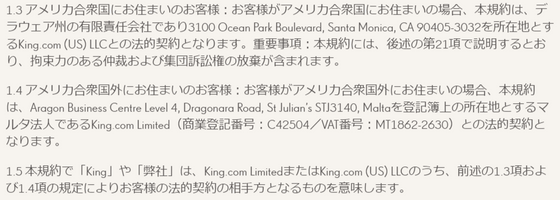

According to the terms and conditions of Candy Crush, users in the United States are contracting with King.com in Delaware and others are contracting with King.com Limited in the Republic of Malta , and the user is charged It can be seen that these two companies are earning money.

Tax Watch UK speculates that several companies in the group, including King's head office, are functioning as contractors of the two companies, and as if to support this, several tax including UK and Sweden Authorities are embarking on an investigation into King Group's transfer prices .

Transfer price is the price applied in intra-group transactions, Tax Watch UK says, “If King's group underestimated the transfer price of the service, the UK and Sweden's taxable profits would also fall. ', He mentions the possibility that King group floats profits in intra-group transactions.

In addition to the transfer price issue, there is also information that the Swedish tax authorities are claiming a tax of $ 400 million (about 42,354.6 million yen) for King's 'transfer of suspicious intercompany assets.' Tax Watch UK has said that 'This may be related to the deal when King was acquired by Activision Blizzard,' said Activision Blizzard's reviewing the payment order. And

◆ Summary

'It is clear that the complex corporate structure around Activision Blizzard is designed to minimize taxation on the company's profits,' Tax Watch UK said. It states that there will be billions of dollars in tax-exempt funds and argues that stronger policy responses are needed.

Related Posts:

in Game, Posted by log1l_ks