Are works of art excellent for investment?

by

Even if it looks like a graffiti at first glance, the value of the work of art is difficult to understand for amateurs, for example , the price is less than 100 million yen . Then, when thinking about the value of works of art in terms of 'money', is it an ant to invest in works? Is it a pear? Where it feels like to be described in the art-related media The Easel .

The Easel | Art journalism

http://the-easel.com/essays/for-love-or-money-the-merits-of-investing-in-art/

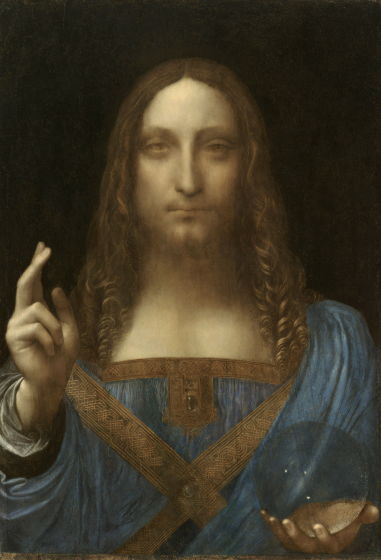

In 2017, the painting ' Salvator Mundi ' drawn by Leonardo da Vinci was made a successful bid for $ 450.12 million (approximately 50.8 billion yen at the time rate), including the commission, and the topic was said to be the highest bid ever. became. This news is good news for art proponents, given that the argument 'Can art be an asset?' Has been raised over the years. 'Assets' refers to the economic value that is expected to be profitable in the future, but in the light of this definition, the paintings of Da Vinci are indeed 'assets.'

The size of the art market has grown by a factor of 6.7 between 1990 and 2019, reaching $ 67 billion according to

On the other hand, looking at the market growth from 2008 to 2019, the growth rate is only 9%. It is believed that this is because the prices of works that are selling are falling, and the majority of the transactions are low-end works that are less than $ 5,000 (approximately 550 thousand yen), and the intermediate market of ¥ 550,000 to ¥ 1,100,000 is About a quarter of the whole, because it reflects the situation that less than 1 million yen transactions are less than 1%. However, it is said that less than 1% of the transaction accounts for 60% of the total sales, and is increasing the value of the art market.

Under such circumstances, it is impossible to estimate the price fluctuation of works of art like stocks and bonds. Art has no 'standard' works, trading is difficult and expensive, and market information is always poor.

One of the great things about art as an asset is that it has strong capital gains, such as a 600% increase in sales since 1990. These returns are also unrelated to other asset classes, which is an advantage when investing in that they can create diverse portfolios. It is also a merit that people who want to evade tax use art often because it is a merit that it is strong and has high mobility and it is unlikely that someone will know it even if the owner changes secretly.

On the other hand, the Achilles tendon of art is very difficult to buy and sell. It is difficult to find out the possibility of the origin, successive owners, and forgery of works as well as finding out artists who are highly reputed in the present age and knowing 'fair prices' and who pays for them. There is also the problem of ' information asymmetry ' in the art trade. The asymmetry of information means that the information held by the seller and the buyer is different, and only the seller has expertise and information that the buyer does not know. And there is also the risk that the brokerage fees will be high, as art market transactions rely on galleries and auction houses.

by

What this means is that, for example, the gallery sells the works of the artists they own, but since the artists do not have their own networks, their works, that is, the primary market, has great risks. . To guarantee this risk, the gallery requires a 50% margin from the artist. The gallery is sometimes criticized as 'exploiting an artist,' as the 50% margin is an impracticably high number from other industries.

However, the gallery not only exhibits the work and creates a network of potential customers, but also provides a lot of support for the artist. As all the artists do not succeed, these supports are very expensive and the risk is high, so the above critiques are irrelevant. The artist, Paul Durand Lüel, who supported the Impressionist painters, is known for his huge wealth, but he has been helping the painters for up to 20 years without demand. There was a struggle that created demand. Some say that the 50% margin is not enough to guarantee the risks that the gallery has.

On the other hand, the auction house supports the market separately from the gallery. The auction house receives a buyer premium of around 22% per artwork sold. There are less risks than in the gallery because it is already a well-known artist to be auctioned, so the share of the share is also less.

by QuinceMedia

Because of the asymmetry of the information, galleries and auction houses are an integral part of the art market, but commissions will reduce investment returns sharply. Although the Easel claims that 'selected' artworks are not recommended to buy because they have high commissions, in general, intermediaries are likely to offer buyers a comprehensive plan. The plan is: 'If the artist is at high risk, the price is low and the reward is high. If the artist is famous, the price is high and the reward is low.'

Financial economist Robert Schiller, who wrote about the 'baseless enthusiasm,' said: 'Swise investors get poor information and involve other investors when the state of mind shifts, markets such as real estate and arts Prices will go up. ' In light of Schiller's claims, works of art are easy to mistake in value and price. Salvator Mundi, who was awarded for ¥ 50.8 billion, also contains a mistake in terms of a sharp rise in prices, and on the other side, the low price of female artist works may also be wrong. Considering all these things together, works of art can be said to be an inefficient asset for investment.

Related Posts:

in Art, Posted by darkhorse_log