'Silver Valley Godfather' points out that startup employees are not getting the right rewards

by

Steve Blank is also known as the Silicon Valley Godfather by high-tech companies and is a well-known entrepreneur in Silicon Valley. Mr. Blank pointed out that 'in the 21st century, employees working at startups are not getting the right rewards.'

Steve Blank Startup Stock Options-Why A Good Deal Has Gone Bad

https://steveblank.com/2019/04/10/startup-stock-options-why-a-good-deal-has-gone-bad/

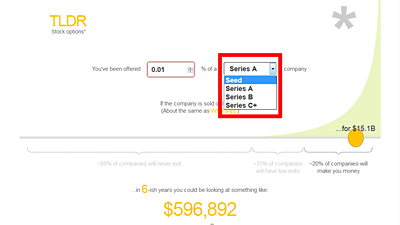

Until now, high-tech companies in the United States have given ' stock options ' as compensation to employees who have set up a company. The stock option is the right to buy the stock at a predetermined price when the company is listed on the stock in the future. The start-up companies that can not pay high salaries to employees have been used as a way to secure talented people because the company grows and the stock price is higher if the stock price is higher than a predetermined price. .

by

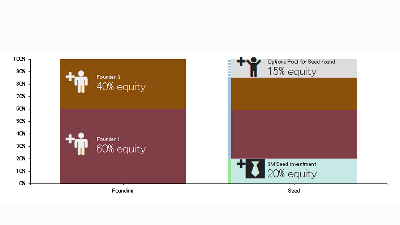

In the past, management teams of founders and other companies have received the same stock options as their employees, but at a different rate. For this reason, management and employees can sometimes stay together in the company, sometimes run around the trade fair with the first product in hand, and aim for the growth of the company together as they struggle. The Fairchild Semiconductor , one of the forerunners of Silicon Valley, is one of the companies that grew up in this way, with the world's first commercial production of semiconductor integrated circuits and the subsequent development of human resources to create global semiconductor manufacturers such as Intel.

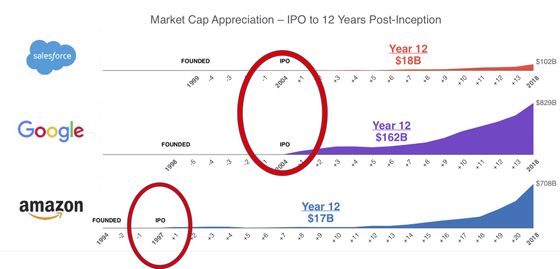

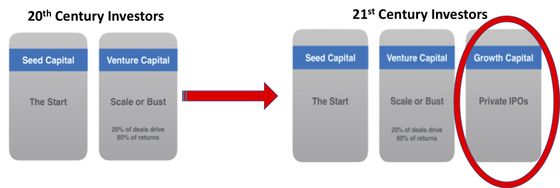

However, this relationship has begun to change since the beginning of the 21st century. The biggest factor is that startup companies have a long time to reach public offering ( IPO ). Formerly, the way start-up companies raise funds is 'seed capital' and 'venture capital' (funds received from investors as an adventurous investment destination). It was two of them. Under this framework, start-up companies may take up to several years to go public, for example, Amazon is listed in the third year of its establishment.

From the beginning of the 21st century, this will be followed by “seed capital” and “venture capital,” followed by a third step called “growth capital” and the period until the public offering Came to be turned behind.

Entrepreneur

In addition, the relationship between management and other employees is also changing. Over the past 50 years, the amount of compensation CEOs have received has grown from 20 to 300 times the average employee salary. Also, management has come to receive compensation as ' Restricted Stock ' rather than stock options. Restricted stock is a stock that has certain restrictions on trading. Unlike certain stock options, although they have certain restrictions such as years of service, they can be delivered as physical shares, and you can also receive dividends. As a result, the line of sight of managers changes from an employee's point of view to a capitalist's point of view, and the relationship between managers and employees, who were once said to have been on the same boat, has changed.

by vadymvdrobot

The background behind this has been the changing environment in which startups, especially technology start-up companies, are located. While 20th century venture companies were expected to achieve long-term growth with a single technology, as technological advances progressed more and more in the 21st century, it was necessary to repeat innovation in a short period of time. As a result, companies are forced to change management in a short period of time to avoid rigid management, and naturally, the rewards given by companies to management will increase and become of short-term nature. did. In response to these changes in the environment, the way in which start-up managers and investors earn returns has also changed, while the way in which employees receive compensation can not be reached, so start-up employees We were left behind in the reform.

Mr Blank said that this change 'detracts from the attractiveness of working in start-up companies and human resources are being drained to large companies,' and investors give incentives to employees participating in startup startups. He pointed out that it is necessary to introduce a new mechanism to give. He also advises that employees participating in startup startups should be rewarded not with stock options but with the same restricted stock as management.

Related Posts:

in Note, Posted by log1l_ks