Report analyzing the flow of start-up money '2018 State of Startup Spend Report'

by Annie Spratt

The success of startup is thought to work positively for future innovation and economic growth, but in order to tackle business as startup, various problems such as financing, securing of office space, CRM etc. are convinced. A report that summarizes information on expenditure of start-up in fiscal 2018, which is an indicator to know what kind of locus the startup is going through, is a corporate credit card without a personal guarantee or security deposit for start-up Brex that provides you the latest information.

2018 State of Startup Spend Report - Brex

https://brex.com/blog/state-of-spend

One of the big doubts for founding people who start startup is "How do big startups spend money?" However, there were no reports that summarized how startups are using the money so far. So Brex summarizes the rough outlay of the startup market as a whole "to create an environment in which the entire start-up market forms a highly transparent culture, learning from each other and growing and accelerating business" It seems he decided to create and publish a report.

Brex noted that he analyzed trends in the start-up market by utilizing its own data and the data of Y seed accelerator's Y combiner that invests in start-up.

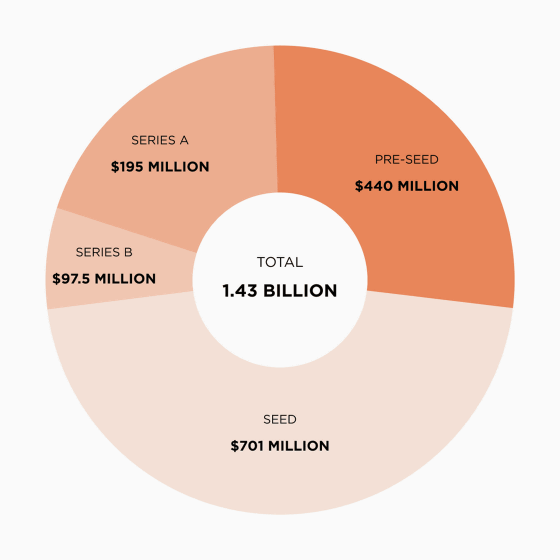

◆ Investment in startup In recent years, investment from venture capital to stealth mode startup that has not announced about fund procurement is expanding. According to a report on the stealth mode startup published by Brex, it is clear that the investment from venture capital is actually $ 1.43 billion (about 160 billion yen) investment in stealth mode startup I will.

The following graph shows what investment rounds of about 1.43 billion dollars invested in stealth mode startups were made. Approximately 75% of the huge sum of over 1.4 billion dollars has already gathered before the start-up.

Also, if you classify the startup in the stealth mode by industry and pick up only the industry that accounts for the top 30% of funds raised, it is likely to be financial services · healthcare · consumer · enterprise software · real estate · biotechnology · food & beverage . However, investment in the startup in stealth mode seems to be only 3-5% of the total investment by venture capital.

Investment in stealth mode was $ 1.43 billion, but according to The Q3 2018 Global VC Report , the investment from start-up capital to start-up is 8 billion dollars (about 900 billion yen) at the stage immediately after start-up, entrepreneurial It will rise to 70 billion dollars (about 8 trillion yen) in the second half.

Venture capital to invest in Brex IVP According to Somesh Dash, who work in, the trend of investment will not control the "machine learning and AI is a trend, FinTech and B2B, been carried out much of the investment in SaaS There is that.

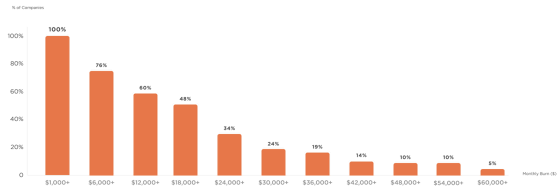

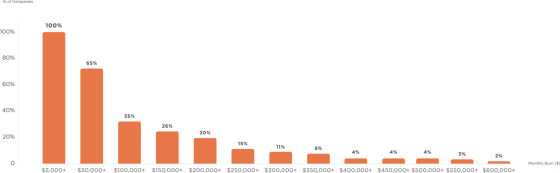

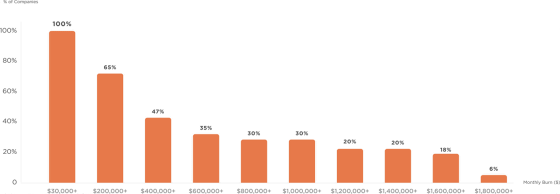

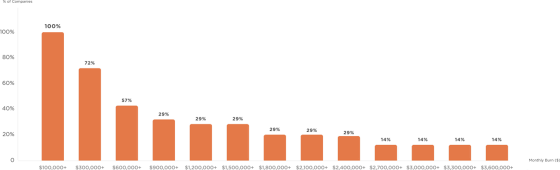

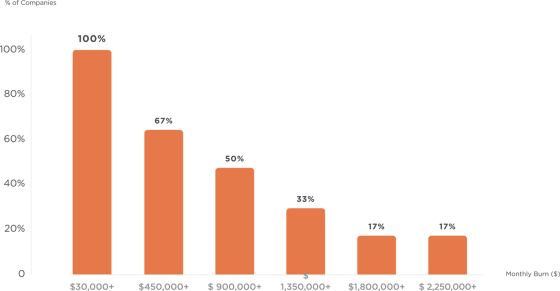

◆ Startup Burn Rate <br> on "What is the startup spending money on?" The graph below shows the fund "Burn Rate" required by the start-up for company management as a result of analysis according to fund raised amount. The graph is divided into stages of the investment round.

For example, the graph below shows the burn rate of the pre-seed (stage before the seed round). If the amount of funds is in the range of $ 1000 (about 110,000 yen) to 5,999 dollars (about 680,000 yen), the burning rate is 100%, that is, the expenditure required for monthly company management ranges from $ 1,000 to 5,999 It will be about dollars.

The seed round burning rate is less than $ 5,000 (about 570,000 yen) or more than $ 50,000 (about 5.7 million yen)

The series A burning rate is 30,000 dollars (about 3.4 million yen) or more and less than 200,000 dollars (about 23 million yen)

Series B 's burn rate is 100 thousand dollars (about 11 million yen) or more and less than 300 thousand dollars (about 34 million yen)

In addition, the burning rate of "Successful startup" that has been from the pre-seed to the series A is less than $ 30,000 to $ 450,000 (about 51 million yen)

Analysis shows that the burning rate is particularly high in the Internet service, transportation and data analytics industry. Conversely, the low burning rate is consumer electronics, design, operating system, clothing / apparel industry.

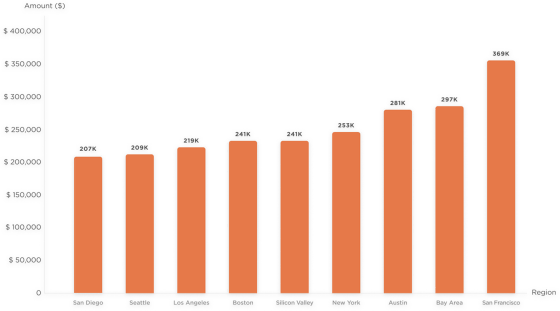

Also, the graph below compares the startup burn rates by region. The area with the highest burn rate, that is, the area where the start-up monthly expenditure is the largest is San Francisco, not the Bay Area or Silicon Valley. In addition, although San Francisco is the region where the high growth rate startup is most concentrated, monthly expenditure is about 370,000 dollars (about 42 million yen) even at the startup of the seed round, and this figure shows that the burn rate is Even compared to the second highest region, it means "monthly expenditure is as high as $ 70,000 (about 8 million yen)".

Breakdown of Technology Used by Startup <br> Monthly spend for startup includes usage fee for management tools and services used for work. Therefore, from expenditure information, Brex summarizes the services and software used by many startups.

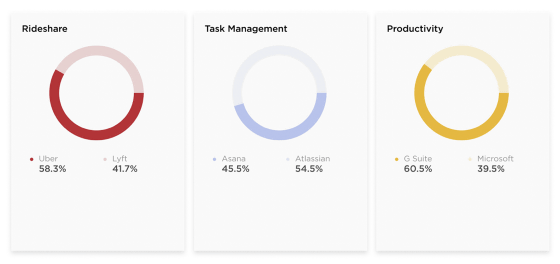

Uber's ride-sharing service used by startup is 58.3%, more than Lyft's 41.7%. Atlassian (54.5%) is used for task management rather than Asana (45.5%), and Google's G Suite (60.5%) is preferred as a collaboration and productivity tool than Microsoft (39.5%).

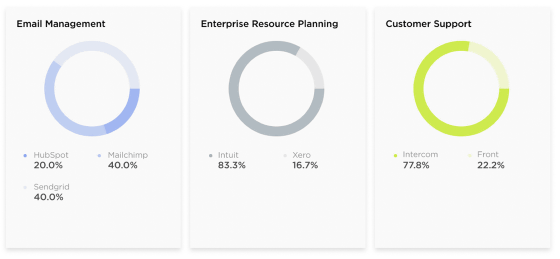

For mail marketing, HubSpot (20%), Mailchimp (40%), SendGrid (40%). For ERP , Intuit (83.3%) and Xero (16.7%). Intercom (77.8%) and Front (22.2%) are included as customer support.

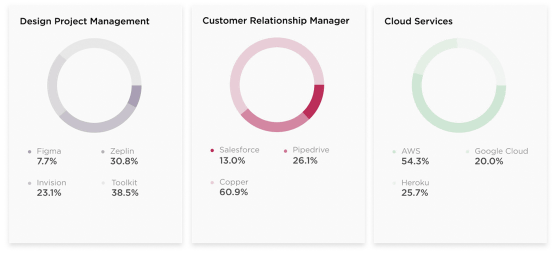

Figma (7.7%), Zeplin (30.8%), InVision (23.1%), Toolkit (38.5%) are included for design project management. Salesforce (13%), Pipedrive (26.1%), Copper (60.9%) are included in CRM. Cloud services are AWS (54.3%), Google Cloud (20%), Heroku (25.7%).

Brex states that "startup is investing in other startups to bring innovative solutions that are user friendly and affordable to the market," and that startups are creating their own ecosystem.

Related Posts:

in Note, Posted by logu_ii