In the Amazon market world where AI is moving the price of products up and down, the price is changing like the stock market

ByRafael Matsunaga

Some of those who use Amazon may have noticed that the price of the same item varies finely by day, in some cases even within one day. In addition to Amazon main body, in the market of online market where many retail shops are entering, the price of the item sold there is like a stock market change according to the situation.

The High-Speed Trading Behind Your Amazon Purchase

http://news.morningstar.com/all/dow-jones/us-markets/20170326515/the-high-speed-trading-behind-your-amazon-purchase.aspx

Technology columnistChristopher MimsOne day, I visited Amazon to buy a marshmallow. There, products of non-brand name are sold cheaply, but when it comes to the name of the brand that passed the name, its price is twice as much as that sold at retail stores, and a change in price for a while It seems that as soon as I tracked up, it soared soaringly.

According to Mr. Mims, the price fluctuates depending on the product because each store sets a price, which is because the system of pricing using the algorithm and AI is working in the background. Amazon has made it possible for third parties to sell merchandise on Amazon since 2000 and in the marketplace there are many items that Amazon has sold independently and by third parties. There, it is said that dynamics that determines the strongest price at that time is working so that the price of the stock can be decided by exchange of the exchange.

Price movement is relatively gentle on actual Amazon, and there are not so many sharp fluctuations in prices like the stock market seems to be seen, but even as long as the price is finely up and down in a short period of time You can see it. Chrome extension that graphs price transition at AmazonKeepa", You can see the price movements of various products at a glance. For example, put a marshmallow and fire like a rifleMarshmallow ShooterThe price of the article was 5378 yen at the time of article creation, but the lowest price is around 3500 yen, you can see that the maximum value has reached approximately 13,000 yen.

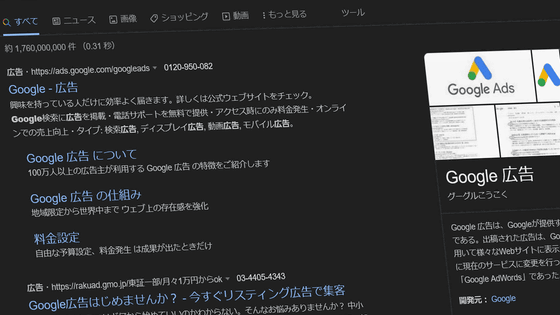

The driving force for such price movements is a dispute over the high exposure in Amazon. This is the same idea as SEO measures to be displayed as high as possible by Google search results, and it is highly likely that the page first displayed when searching for items on Amazon is most likely to be purchased, so especially aggressive The stores that priced at the store keep checking the prices of rival stores and trends in inventory in detail and keep track of the most favorable price and profit balance at that time.

Follow up on market price trends using AI and advise selling priceFeedvisorIs one of the tools used in such a case. Barry Rampart, who entered the top 500 of Amazon and used Feedviser, said that it is possible to use this service as "set and leave it behind." Feedviser is a service that uses AI to pricing to maximize sales and minimize loss by checking the trend of rivals by moving commodity prices finely.

In this way, the item price at Amazon is in a state to be determined, but the more complicated thing is that Amazon itself sells those items. Amazon grasping the detailed sales data of the market will target products by introducing products themselves into areas where profits can be expected. At this time, it is obvious that Amazon, which has only the detailed data of the market, is in a favorable position. For example, in the field of dry batteries where stable consumption can be expected, while dry batteries sold by third parties are going through detailed price movements, products sold by Amazon by their own brands are more stable in price, It is said that it is sold at about half the price.

ByRaymondclarkeimages

In the field of retailing as well as in general, in the online retail world like Amazon where information is exchanged online in real time, the price of the goods is changing dynamically just like the stock market, financial engineering The term "VolatilityIt is also a matter of time. While this can be said to be an opportunity for retailers, it also means that if you missed the waves sales will fall into a devastating state. Therefore, it is said that it is important to adopt risk hedging measures that do not depend entirely on Amazon when selling online, but also open up on other platforms at the same time.

Related Posts:

in Software, Web Service, Posted by darkhorse_log