93% of stock market movements since 2008 are due to the government

ByShehan peruma

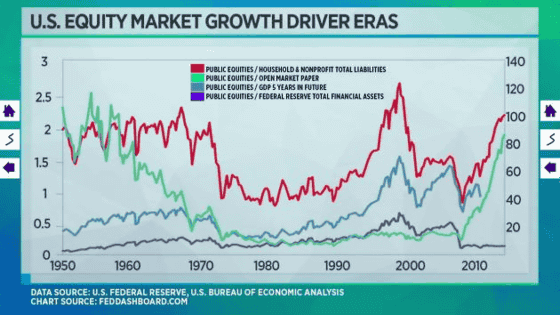

From 2008 to 2015, the stock market in the US is basically rising and it was a good market environment. But 93% of this cause is explained by the quantitative easing policy that has been done since 2008, economist, Brian Barnier explains in a graph.

The Fed caused 93% of the entire stock market's move since 2008: Analysis

https://beta.finance.yahoo.com/news/the-fed-caused-93--of-the-entire-stock-market-s-move-since-2008--analysis-194426366.html

When the Lehman shock occurred in 2008, the Federal Reserve Board (FRB), the central bank of the United States, said QE 1 (the first quantitative easing), QE 2 (the second quantitative easing), QE 3 (Quantitative easing third By implementing a massive monetary easing policy called bullets, the US has gone away from deflationary concerns. Especially at QE 3 announced in 2012,Federal Reserve BankHas purchased residential mortgage-backed securities on a monthly basis of $ 40 billion plus purchase US $ 45 billion monthly long-term government bonds as well.

At this time, it is a stock price indexS & P 500Looking at, the figures have jumped more than twice from November 2008 to October 2014, but at the same time the Fed's balance sheet size has expanded from 2.1 trillion dollars to 4.5 trillion dollars. According to economist Brian Barnier, the two are not in a pseudo-correlated relationship, but the rise in the stock price index is due to quantitative easing.

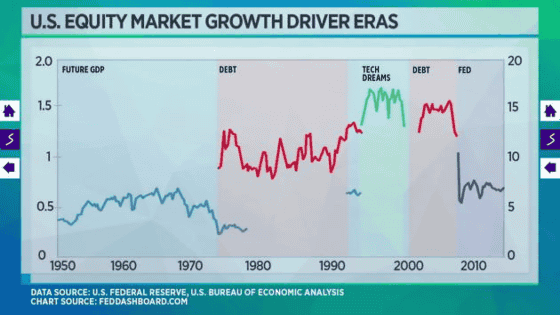

As a matter of fact, Mr Barnier publishes the chart, saying that the upward trend in the stock market in the past is influenced by "only one factor" that occurred at that time. Although there are many economic factors that are thought to affect the stock market from 1950 to the present, Mr Barnier chooses the one showing the same ratio as the increase / decrease of the stock value from among them. As a result, the four factors, mainly "expected data of GDP over the next five years", "debt of households / nonprofit organizations", "general market commercial bills" and "Federal Reserve's efforts" have influenced the movement of the stock market It is known.

Furthermore, Mr. Barnier charted each economic factor by "era" in the stock market, the following was found out.

(1) From the Second World War to the mid-1970s, Mr. Barnier said that the prospect of GDP in the coming five years explains the movement of the stock market by 90%.

(2) Sluggish growth in GDP growth can be seen in the early 1970s when the number of credit cards and consumer debt increased. Liabilities of general households were first brought about by the spread of credit cards, followed by debts by mortgage loans. This trend will continue until the early 1990s when the real estate bubble bursts. It is said that 95% of the market movement in this era can be explained by household debt.

(3) From the mid-1990s to the latter half to 2000, a technology bubble occurred, start-ups and young companies asked for funds. This era deals with short-term financial productsCP marketMr. Barnier thinks that this phenomenon is caused by a technology bubble.

(4) After the technology bubble, the housing bubble will come again with the housing loan background. Market movements in the early years of the century due to this phenomenon.

(5) When the financial crisis caused by the Lehman shock in 2008 occurs, the Fed invests dollars into the financial markets, such as by purchasing receivables. Mr Barnier explains that over 93% of market movements since the start of QE 1 are in the FRB, he said that in the first half of 2013 it is causing overall market growth. On the other hand, the characteristic of this era is that there is a tendency that yields of bonds begin to decline, contrary to the price of creditors themselves.

Since the FRB's purchase of bonds has been sluggish since the FBB stopped purchasing receivables in the latter half of 2014, the S & P 500's year-to-year rate of change has been sluggish, and as FB's purchase of bonds ceased, now that the next element to market leverage is needed, They are doubtful.

Related Posts:

in Note, Posted by darkhorse_log