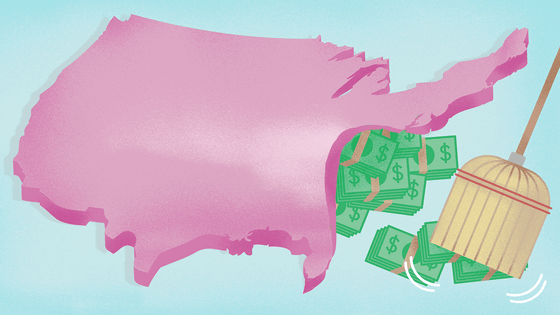

The tax haven companies use for 'tax escape', the world's most popular land is the United States

ByPictures of Money

In order to acquire foreign capital and foreign currency, intentionally set the corporate tax to zero or set an extremely low tax rate, and the country and region that is attracting companies and affluent assets are "Tax havenI call it. Tax havens exist all around the world including Monaco, Switzerland, Dubai, Cayman Islands, especially Cayman IslandsIt is famous enough to be treated in moviesis. However, in fact it is known that the No. 1 place popular as a tax haven is none of them either.

The World's Favorite New Tax Haven Is the United States - Bloomberg Business

http://www.bloomberg.com/news/articles/2016-01-27/the-world-s-favorite-new-tax-haven-is-the-united-states

Japanese big companies and wealthy people are tax havens and the second largest tax escape in the worldAlthough it has become a big topic to have done, it has been regarded as problematic in the United States that big companies and some affluent people are using tax havens to escape taxes for several years. Tax havens are gaining attention worldwide,Economic Cooperation and Development Organization(OECD) in multilateralAutomatic information exchangeIn the United States, it seems that there is a new bank appearing in the US to hide foreign investment by resisting this.

One of the world's leading investment banksRothschild"Opens a trust bank in Reno, Nevada, and transfers funds from overseas customers who have concealed funds to tax havens such as Bermuda to the bank. This is a measure to counter the new information exchange standards by OECD, but why is it safe to transfer funds to the trust bank of Reno, Nevada, USA is not applicable to new information exchange standards by OECD It is because it is an area to be.

Rothschild representative Andrew Penny says, "We only have to move the customer's funds to the US, which makes it tax free and can be hidden from the government," he says, I am talking about becoming a tax haven. Like Rothschild, it is the world's largest international mutual fundTrident TrustHave also moved many accounts from Switzerland and the Cayman Islands to America. Alice Rocaal, who is representative at the branch of Trident in South Dakota, said, "I was very surprised that funds were lost from many of the bank accounts in Switzerland," in preparation for the new OECD standards I am talking about the fact that many people are moving funds. In the United States, Switzerland, and other areas, secret accounts for hiding funds are expected to prevent injunction from home country, but now many Americans feel that American bank accounts are the most safe That is why.

Of course, no one thinks that all tax havens will go away. To show it, Swiss banks have retained 1.9 trillion dollars (about 230 trillion yen) in the secret accounts in Switzerland, Gabriel Zackman, a professor of economics at the University of California, Berkeley I guess. In addition to the United States, there are several countries and regions that do not agree with the OECD's standards for automatic information exchange.

ByThetaxhaven

In the past, in the United States a large tax escape using tax havens has been regarded as a problem. In 2007, UBS Group AG banker Bradley Birkenfeld announced that UBS Group AG was helping American customers to evade tax and more than 80 Swiss banks, including the company, We will pay about $ 5 billion (about 590 billion yen) of reparations to the government.

In order to prevent such a situation, in the United States as part of employment-related law in 2010 "FATCA"Was enforced. This is a law to prevent tax avoidance behavior using foreign financial institutions by Americans, and imposes tax obligation on customer accounts to foreign financial institutions. Inspired by this FATCA, the OECD has formulated a new information exchange standard that other countries are also likely to identify those who are performing tax avoidance acts. This agreed in a way that 97 member countries agreed in 2014, but among OECD member countries, only Bahrain Naur Republic, Vanuatu Republic, and the United States do not agree.

The US Treasury commented that it does not agree with the OECD's new standard, "America is leading with international tax evasion measures using offshore accounts" and the new OECD standards were based on FATCA There is (so there is no need to agree). But it is a financial advisorBolton Global Capital(A company that supports customers' tax evasion) CEO of Ray Grenier told their customers that "The fact that the US did not agree with the OECD's new standards will lead to strong support for our business It is clear "I am e-mailing. Bolton Global Capital has moved overseas accounts to the US, and Grenier CEO responds in an interview that OECD's new standard was "the start of foreign investment from Swiss banks" .

ByWest Midlands Police

Although the US Treasury has proposed criteria that closely resemble the information exchange standards of the OECD, these are rejected as opposed to Republicans who are deeply involved in the banking industry. The problem is not only that civilians outside the US can avoid taxes. The US Treasury Department seems to be worried about the large amount of funds flowing from criminal organizations into secret accounts made in the United States. According to the UN estimate, at least 1.6 trillion dollars (about 190 trillion yen) illegal funds are money-laundering each year, and the Ministry of Finance is afraid that these will flow into the United States in a stroke.

Related Posts:

in Note, Posted by logu_ii