The currency value of Bitcoin is 1 BTC = 130,000 yen reasonable and Bank of America announced

ByAdam Fagen

On November 27, 2013, the virtual currency on the net that the exchange rate of the dollar broke through the mark of 1,000 dollars (about 100,000 yen)Bit coin"Has continued to raise the value even after that,In the first half of December, it temporarily exceeds 1,200 dollars (about 12,200 yen)Transactions on the line are taking place. The value as a currency of a bit coin showing such overheating is the largest private financial institution in the United StatesBank of America Merrill Lynch(BofA) is$ 1,300(About 133,000 yen) was calculated as appropriate.

BofA: Bitcoin Has 'Clear Potential' But Limited Upside - Fair Value Seen as $ 1,300 - Focus on Funds - Barrons.com

http://blogs.barrons.com/focusonfunds/2013/12/05/bofa-bitcoin-has-clear-potential-but-limited-upside-fair-value-seen-as-1300/

Bank's Research Report on Bitcoin

https://www.documentcloud.org/documents/885843-banks-research-report-on-bitcoin.html

Alan Greenspan, former chairman of the Federal Reserve Board of Federal Reserve "It's a bubble.Although it is a bit coin that declined it, BofA seems to have recognized certain value as a currency. At the same time, it will exceed 1,300 dollars in the futureBeyond fundamentalsIt is suggesting that you are at risk.

The total value of the bit coin which is currently being distributed is$ 1.2 billion(About 122.3 billion yen), this amount is one of the American financial institutions "Western Union"It is above the value of $ 900 million (about 91.8 billion yen), which is a new competitor for existing financial institutions.

ByLaura Gilmore

BofA also compares bit coins with gold (gold), indicating that the bit coin is more tolerant of risk factors, indicating that the benefits of asset distribution are higher than gold.

ByEpSos .de

On the other hand, we have received the following huge comments on very high volatility (intensity of price fluctuation).

It is a situation that gives investors the opportunity to obtain very high profits, because the quantity of circulation is small and the liquidity is poor, the property of highly speculative market is emerging

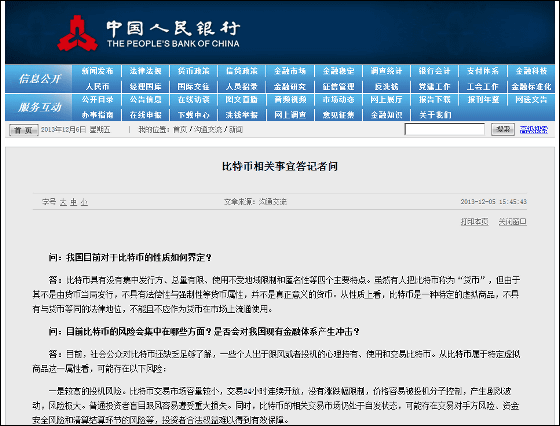

There is also an analysis that trends in China have an influence on bit movements of bit coins.

In China, on December 5, a ban on bit coin transactions against banks was informed. Although it is said that there is no impact on China's financial system at the present time, it was judged that it will include future risks. The use of individual bit coins is not restricted.

China bars banks from bitcoin transactions | Technology | Reuters

http://ca.reuters.com/article/technologyNews/idCABRE9B407L20131205

This is a statement in Q & amp; A format with reporters posted on the website of the People's Bank of China. Here, bit coins (in Chinese, "relative characteristic money") are classified as "not real" and "not supported by law, value as money", "Do not use it as currency circulating in the market It should not be. " In addition, risks due to high volatility and abuse such as money laundering are cited as concerns.

Specific Quota Phone Country Officer Questioner - China People's Bank

http://www.pbc.gov.cn/publish/goutongjiaoliu/524/2013/20131205153950799182785/20131205153950799182785_.html

Related Posts:

in Note, Web Service, Posted by darkhorse_log