The reason why the "black market" of currency exists in Buenos Aires, Argentina

When you go abroad you will definitely exchange money at a foreign exchange counter, but the exchange rate is often surprisingly different depending on the place. Argentina's city of Buenos Aires has quite a large and illegal foreign currency exchange area, many Argentinian citizens gather and exchange pesos, which is a local currency, for dollars.

The How and Why of Argentina's Currency Black Market

https://flightfox.com/tradecraft/argentina-black-market

Argentina's capital where the word "good wind" in Spanish, that is, "forward wind" that the sailor wants is the originBuenos AiresThere is a black market town in the currency called "cuevas (cave)" on Florida Street in one corner of the city.

As of October 30, 2013, the exchange rate from the US dollar to the Argentine peso is approximately 5.9, which can be exchanged for one dollar to approximately 5.9 pesos. Conversely, if you bring 100 pesos to the bank, you should be able to get about $ 17, but the Argentinans came to this much black market, where the rate is 100 pesos We will convert it to a much less eleven dollar. There are reasons for people to be forced to convert at a bad rate, but the problems of the economy that Argentina had are lying there.

◆ Economic crisis

The origin began to appear from 2001 to 2002Argentine crisisIt was a currency crisis called. Ten years have passed since then, the influence has remained, and the president's wife at that time served as the current president as its successorChristina Fernández de KirchnerCoupled with Mr. Default's concern under the regime, creditworthiness of the Argentine peso has fallen rapidly. The government set limits on the withdrawal of bank deposits during the turmoil in 2002, but since the number of people who withdraw deposits to protect assets has remained unchanged, the amount of $ 16 billion (about 15 trillion yen) A considerable deposit flowed out to the town.

ByBernardo Londoy

◆ Inflation

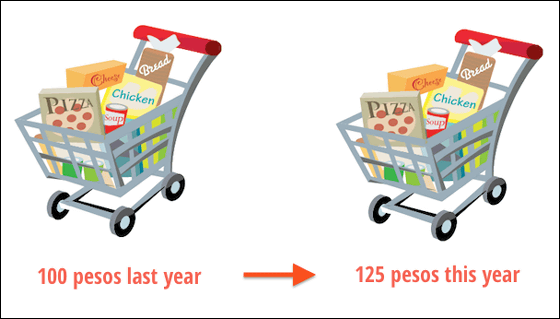

The Argentine government has announced last year's inflation rate of about 10%, but this is suspected of numerical manipulation. A number of surveys by private and lawmakers have announced that the inflation rate is about 18% to about 25%, Prime Minister Abe has set a 2% inflation targetInflation rate in JapanConsidering that it is wandering around 0%, Argentina's inflation rate of around 25% at the maximum is abnormal.

As we can not buy things we could buy at a price of 100 pesos a year ago by 125 pesos, citizens would like to exchange for "US dollar" which is a stable currency to protect their own assets more It will look like. However, as the Argentine government took measures to set strict restrictions on the exchange of funds into the US dollar at banks, it became a situation where people gathered in the black market where credit can be reliably converted even if the rate is bad.

◆ Dollar supply

So, who is the source of US dollars for exchange markets that should have restrictions on transactions? It is a "tourist" coming from overseas. For banks and ATMs, from 1 US dollar to about 6 pesos can be exchanged, whereas in the black market it can be exchanged at a very high rate of about 9.5 pesos, so tourists come to the black market and "supply" US dollars It is.

ByLaura

So, is there no problem with this exchange at illegal exchange office? There are three perspectives, and each legitimate allegiance is also part of complicating the situation.

·government

Exchange under the black market will result in "underground money" which the government can not grasp, to circulate, which may be diverted to fraudulent money laundering and funds for crime. Also, keeping currency outflows from banks means that resources will continue to decline as the government rebuilds its financial base and strengthens its structure.

· Argentinian people

Even illegal money exchange is a way for Argentinian citizens to stabilize their assets. Under circumstances in which the economy and currencies are unstable, the right to possess a highly safe currency and avoid risks should be guaranteed. In addition, it is important to protect assets with more stable currency in a situation where inflation has progressed and the peso reduction can not be avoided.

·tourist

Exchangeing US dollars at a black market with a better rate than the official rate can be said to be a way to obtain pesos under the original value standard. In fact, Argentina has received disgrace from the IMF (International Monetary Fund) as the first country to be warned about inflation policy. In situations where the inflation rate of the government is deliberately low, the official rate does not indicate the value of the right peso.

In 2011, President Kirchner took measures to prohibit purchasing US dollars for deposits against both corporations and individuals, but in the end this attempt has failed. The real inflation rate in Argentina is very high and the creditworthiness of the peso has been completely lost coupled with the failure of these economic measures. Unless economic and political issues are resolved, the double market exchange rate by the black market is unlikely to disappear.

Related Posts:

in Note, Posted by darkhorse_log