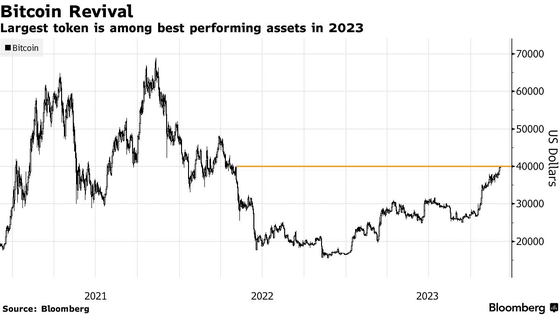

Bitcoin exceeds $40,000 (approximately 5.9 million yen) for the first time since May 2022, symbolizing that the digital asset is on track to extend its recovery into 2023 due to expectations for interest rate cuts and demand for ETFs

The virtual currency Bitcoin has exceeded the $40,000 (approximately 5.9 million yen) level per BTC for the first time since May 2022. It has been pointed out that this is due to expectations for interest rate cuts by

Bitcoin (XBT) Hits $40,000 Level for the First Time Since May 2022 - Bloomberg

https://www.bloomberg.com/news/articles/2023-12-03/bitcoin-hits-40-000-level-for-the-first-time-since-may-2022

Bitcoin Price Blasts Back Above $39K For First Time Since May 2022 | Bitcoinist.com

https://bitcoinist.com/bitcoin-price-back-above-39k/

Bitcoin highest hits level since May 2022 to kick off December: CNBC Crypto World

https://www.cnbc.com/video/2023/12/01/bitcoin-hits-highest-level-since-may-2022-to-kick-off-december-cnbc-crypto-world.html

Bitcoin has surpassed the $40,000 per BTC mark for the first time since May 2022.

Tony Sycamore, a market analyst at Australian financial service

Investors are increasingly believing that the Fed has stopped raising interest rates as inflation cools, and are focusing on a rate cut in 2024. Additionally, in the digital asset industry, BlackRock , one of the world's leading asset management companies, has filed an application with the U.S. Securities and Exchange Commission to develop America's first spot-based Bitcoin ETF. Although the spot Bitcoin ETF is still in the application stage, Bloomberg's research tool, Bloomberg Intelligence, predicts that it will receive approval from the Securities and Exchange Commission by January 2024.

Bloomberg reported, ``Optimists argue that the recent rise in Bitcoin prices shows that the digital asset market is maturing and that digital assets are spreading to the general investor base.''

On the other hand, virtual currency media Bitcoinist reports, ``The soaring price of Bitcoin is due to the fact that Ethereum, which also drives the virtual currency market , has updated its high price in 2023. ''

Since May 2022, the virtual currency market has been affected by the collapse of the virtual currency exchange FTX and the arrest of its founder Sam Bankman-Fried , and the failure of Binance, one of the world's largest virtual currency exchanges, to take anti-money laundering measures. The company has been embroiled in various scandals, including the resignation of Changpeng Zhao as CEO due to violations of the Bank Secrecy Act .

Furthermore, in April 2024, the amount of rewards (tokens) obtained from Bitcoin mining is scheduled to be halved. This is called a halving and happens once every four years, or every 210,000 blocks.

Related Posts:

in Note, Posted by logu_ii