'The next recession is within a year'

by

On August 14, 2019 is long and short interest rates in government bonds of the United States and the United Kingdom reversed about what was, economy paper Bloomberg is 'the most remarkable in the world financial crisis and subsequent recession and (recession) containing It has been suggested that' the press was . However, there was an economist who had predicted this situation about six months before the Bloomberg report.

The Fourth Horseman of the Next Recession Approaches | Duke's Fuqua School of Business

https://www.fuqua.duke.edu/duke-fuqua-insights/harvey-yield-curve-2019

Campbell Harvey, a professor of finance at Duke University , one of the world's most prestigious universities, said in a column published on March 12, 2019, `` Yields on 5-year US government bonds since March 7, 2019 Is lower than 3 months. ' Counting from March 2019, the world economy is expected to enter into a recession within 12-14 months.

Harvey cited the following four factors as a risk factor for recession, similar to the four knights of Revelation, which is supposed to come to an end in Christianity.

by

◆ 1: Yield curve reversal

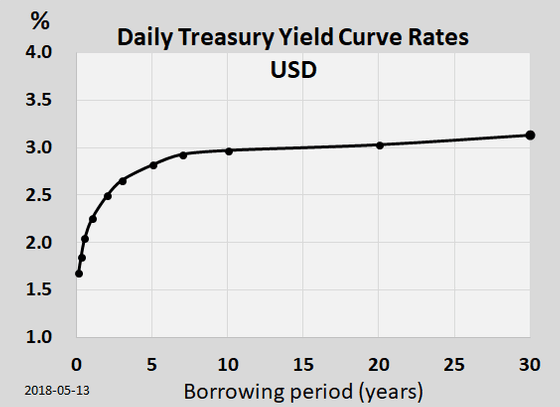

Yield curve is a line graph of changes in bond yields. Similar to bank time deposits, investors usually show a moderate upward trend because the longer the maturity of a bond, the more demanding the yield is.

The following image is the yield curve of US government bonds as of May 13, 2018. The vertical axis of the graph shows the interest rate, the horizontal axis shows the length of the redemption period, and the line graph shows an upward trend, so you can see that the yield is higher for long-term bonds.

by Ldecola

In March 2019, as described above, a phenomenon called “reverse yield” occurred in which the long-term interest rate fell below the short-term interest rate. Reverse yield at the timing that is expected and investors in the future economic downturn occurs have been because, as an important indicator in terms of forecast the future of the economy. Harvey says, “If the reverse yield lasts longer than 3 months, the recession will be clearer.”

◆ 2: CFO survey

According to a survey conducted by Duke University on CFOs, half of CFOs expect a recession to occur at the end of 2019 or early 2020. In addition, 82% of the total CFOs who said they will enter a recession by the end of 2020 at the latest can be seen that corporate management is surely looking into entering a recession in the near future.

◆ 3: The rise of protectionism

As a result of the US government's record-high tariffs on imported goods under the Smoot-Horley Customs Law enacted in 1930, the US economy fell into a major recession rather than being protected, triggering a later global depression. It was. Harvey expects the same thing to happen in this case, but Harvey says that the biggest threat is not the US-China trade friction but Britain's withdrawal from the EU (Brexit).

◆ 4: High financial market volatility

Volatility is a numerical value that represents the “magnitude of asset price fluctuations”. The higher the volatility, the more the price fluctuates. The volatility of “ S & P 500 ”, a representative stock index in the United States, is also called the fear index, and is an important point in determining the stability of the US economy that leads the world economy.

However, if the volatility is high, it is not necessarily the case that the recession is near. For example, Black Monday in 1987 saw a global stock price crash and volatility soared, but the global economy did not actually go into recession. However, Harvey says, “That's why the fourth horse could be a dark horse.”

“In general, the average period between the end of a recession and the arrival of the next recession is 58 months,” Harvey said, but the National Institute of Economic Research announced the end of the recession in June 2009 and has already been 120 months. 'It's too close,' suggesting that the long-term boom of the economy will be significant.

Related Posts:

in Note, Posted by log1l_ks