The possibility of a total loss of about 16 billion yen of virtual currency, because access to Wallet became impossible due to the death of the exchange CEO

On January 31, 2019, Canada's largest bit-coin exchange "QuadrigaCX" which had stopped function due to maintenance reasons lost almost all of the virtual currency kept from the customer and protected the creditors by bankruptcy to the court It became clear that I applied for it. According to the report, the reason for losing the virtual currency is that "access to cold wallet became impossible due to the death of the CEO who managed the transaction by one person".

QuadrigaCX

https://www.quadrigacx.com/

QuadrigaCX Owes Customers $ 190 Million, Court Filing Shows - CoinDesk

https://www.coindesk.com/quadriga-creditor-protection-filing

$ 190 Million in Crypto Gone Forever, How Canada's Biggest Exchange Lost All of It

https://www.ccn.com/190m-gone-how-canada-biggest-bitcoin-exchange-lost-it

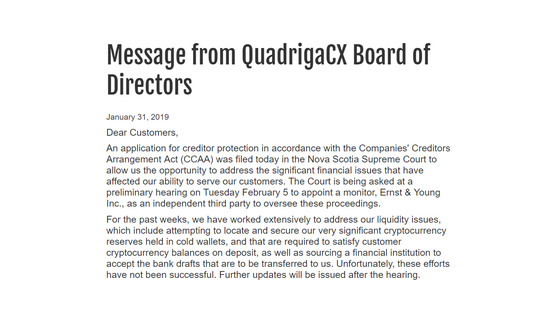

QuadrigaCX, the largest virtual currency exchange in Canada, was founded by Gerald Cotten in November 2013. QuadrigaCX was flooded with customer complaints "Delayed payment" from customers in December 2018, and was tried by Canadian Imperial Commercial Bank (CIBC). On January 28, 2019, access to QuadrigaCX portal became impossible, on 31st of the same month "Message from the board of the QuadrigaCX's board" was released on the official website's top page, application for creditor protection according to the creditor reorganization law Was submitted to the Supreme Court of Nova Scotia, Canada.

At the time of article creation, the virtual currency such as bit coin, light coin, and etheria, which QuadrigaCX had from customers, totaled about 147 million dollars (about 16 billion yen), QuadrigaCX can not access this virtual currency at all It is said that it is becoming. QuadrigaCX's debt to customers is expected to exceed 20 billion yen in total.

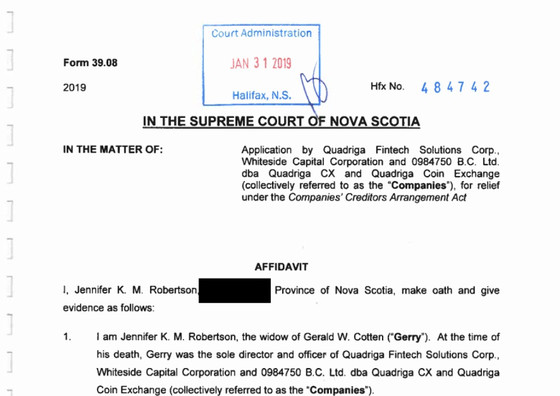

Coindesk of virtual currency related media got an affidavit submitted by Quadriga CX to the Supreme Court. According to Coindesk, the name of the filer of this affidavit was not the founder and CEO of QuadrigaCX, Gerald Cotten, but his wife Jennifer Robertson. The affidavit contained Mr. Cotten 's death certificate, according to which Cotten was suffering from a difficult cough disease called Crohn' s disease , proved to have died from India in the Indian state.

Normally, in exchange for a virtual currency, it is common to prepare a remittance infrastructure that adopts " multi signature " in which multiple people own secret keys in case of emergency. However, Mr. Robertson said in his affidavit "The virtual currency kept from QuadrigaCX is stored in cold wallet, all of its management was done by Mr. Cotten".

Cold wallets are those that store virtual currencies with physical devices that do not connect to the Internet. By using cold wallets, virtual currencies can be managed only by printers with offline devices, and there is little worry that they are threatened by hacking or security breaches. However, as Cotton's death, it seems that it did not understand what the cold wallet is, where it exists, and how much amount it keeps.

by Stickac

Cotton's notebook, the only clue about cold wallet, was locked with a password and could not be viewed by Mr. Robertson. Robertson seems to be trying to hire a consultant to cancel the password, but it seems that the release was not successful at the time of writing the article.

"There was only a minimum amount of coins kept in hot wallets that are on-line," Robertson stated in affidavits, but the details, including the amount, have not been revealed. In addition, Mr. Robertson stated that he is considering selling the business in order to repay the debt of 21 billion yen that he has against the user. According to CCN , there are several companies already handling the sale of QuadrigaCX's trading business.

The affidavit filed will require the court to stop the litigation that will occur in the future. Robertson stated that "If the exchange is sued, QuadrigaCX's trading platform value may decline." CCN says, "A loss of hundreds of millions of dollars has been incurred as a single officer of the exchange managed the user's funds.With an appropriate and continuous plan for the exchange of large disguised currencies It is important that it is important. "

Related Posts: