Validate the virtual currency mining front line from the viewpoint of ASIC developer for mining

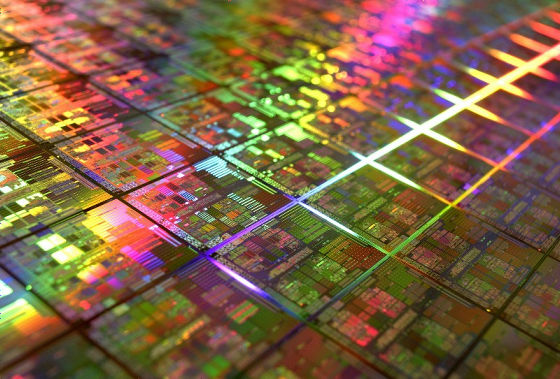

A free currency storage type virtual currency "Siacoin"Engineer for miningASICWe report on the blog the findings on the current state of virtual currency mining obtained from the experience of developing and manufacturing machines. It describes the strength of Bitmain as a mining ASIC manufacturer and minor in China who dominates the world of virtual currency mining.

The State of Cryptocurrency Mining - Sia Blog

https://blog.sia.tech/the-state-of-cryptocurrency-mining-538004a37f9b

Mr. David Bolick, Sia's leading engineer, has published insights on the current state of virtual currency mining, which he gained by launching the virtual currency mining ASIC manufacturing company Obelisk. For many virtual currency developers, the movement of the virtual currency mining industry seems to be confusing, so Mr. Bolik thought that the best way to understand would actually be to develop ASICs and provide them minor, In parallel with the development of currency Siacoin, it seems that we started the ASIC development project. From that experience, we have summarized what we should understand with virtual currency mining with several keywords.

◆ ASIC tolerance

In order to efficiently mining virtual currencies, ASICs that perform operations specialized for mining are indispensable. However, minor monopolizing mining revenues by some minorists with only large-scale ASIC systems has resulted in centralization by minor, which is a distributed system released from centralized organization, which is one of the features of virtual currency I lose the idea of. Therefore, in order to prevent efficient and exclusive mining by ASIC, the virtual currency developer may have "ASIC tolerance" by introducing a mechanism that is difficult to mining with ASIC in virtual currency system. For example, since the virtual currency Ethereum (ASIC) is ASIC tolerant, mining using graphic boards rather than ASIC tools is common.

However, Mr. Bolic says that ASIC resistance should not be expected excessively. Customized hardware specialized for usage that is superior to general-purpose hardware such as CPU and GPU always breaks down the constraints of the algorithm. Mr. Boric said that Bitmain was not surprised that Bitmain released ASIC for mining algorithm "Equihash" known for having ASIC tolerance. Rather, Bitmain said ASIC for Equihash might appear more powerful in the coming months as ASIC is 5 to 10 times less performant than Sia assumed.

Hard fork resistance

Many think that computing can be divided into three types of "CPU", "GPU" and "ASIC", but if you tell Mr. Bolik this is a mistake. To be correct, it is said that there is only one "ASIC", it only makes a difference in its flexibility. If the CPU with the highest versatility is "1" and the ASIC considered by the general public is "10", the GPU will be at most "2". The reason why few products between the GPU and the ASIC are seen is because it is almost impossible to design ASIC with inflexibility.

The strategy of hard forking the virtual currency to make the specific mining ASIC practically meaningless is also a good strategy, as it can not avoid avoiding the ASIC that overcomes quickly from the viewpoint of flexibility It does not seem.

◆ Secret ASIC for Monero

A few months ago, the existence of a dedicated ASIC for mining the virtual currency Monero became clear. This Monero ASIC is minely quietly mining Monero for about a year without being aware of its existence, and it is possible to approve even illegal transactions due to the existence of a minor who monopolizes more than 50% of mining ability, so called "51% AttackThere was information that it was a situation where it could happen.

After that, MoneroPoWMr. Bolik points out the possibility that the existence of "secret ASIC" will be brought out again in the near future because we are doing a hard fork and planning hard fork in the future.

◆ ASIC developed to confidentiality

According to Mr. Bolik, there are many minorities that develop sensitive ASICs for specific virtual currencies. It seems unlikely that millions of dollars (hundreds of millions of dollars) will be invested to monopolize certain virtual currencies, and the total amount of mining fee for one year will exceed $ 20 million (about 2.2 billion yen) All the virtual currencies are said to have expected that at least one secret ASIC group is mining.

◆ Superior position of developers of ASIC tools for mining

Halong sold ASIC to mining the virtual currency Decred, but ASIC batches of unknown performance with a value of $ 10,000 ($ 1.1 million) are always "sold out". After that, according to the follow-up survey of Decred mining, it was found that more than 50% of the mining fee was sent to the address attached to Halong. In other words, Halong owned high-performance ASIC machines and sold a lot of mining while selling poorly performing ASIC machines to other virtual currency minor. There is an information gap between the ASIC manufacturer and the minor purchasing ASIC, and the minor has to trust the ASIC manufacturer. However, it is obvious that it is disadvantageous in mining competition, as it is not possible to limit the mining activities by ASIC manufacturers themselves.

Immediately after Bitmain of Bitcoin mining ASIC released Bitmain "Antminer A3", only a small lot of A3 was able to choose a very short delivery date "within 10 days", so a large amount of A3 was shipped for individuals . A little while ago, the personal virtual currency minor's YouTube movie of "earning $ 800 per day (about 88,000 yen)" overflowed, As a result, A3 showed a good start, It was able to lead to the preparation of batch 2 ".

Mr. Borgg points out that the profit rate gained by selling batch 2 should be higher than the profit rate that would have been obtained in A3, although Bitmain does not know exactly because it does not clarify the sales number of A3 doing. In other words, even if supposing that the electricity charge was free, he sold more than 100 million dollars (about 11 billion yen) of mining machines, knowing that A3 did not reach minor revenue on improved version batch 2, Mr. Borgg He thought he was thinking. This kind of example seems to have been doing the same thing with the mining machine for the virtual currency Dash, not the first time, and in the industry it is called "flooding" and between the ASIC manufacturer and the virtual currency minor who buys the ASIC machine Mr. Borgg says that it is a disadvantage created by "information asymmetry".

There is an anecdote that it was a businessman aimed at a minor, such as a tool dealer who sold instruments such as Zurhashi, rather than gold mined gold miner, who made a profit in the American gold rush, but in digital gold In the mining of a virtual currency, there is a difference that the tool trader himself also serves as a super powerful miner. It may be better for the minor to examine again something about Bitmain, one of the world's leading bit coin miners, to sell mining tools along with mining acts.

◆ economies of scale

In the business, "scale merit" obtained by mass production is acceptable, but it is the same with virtual currency mining. Very roughly, Mr. Borgg says that virtual currency mining can cut costs by about 30% for every 10 times the cost. For example, if you are investing 100 million dollars (about 11 billion yen) in a mining machine, the cost of 500 dollars a day (about 55,000 yen) per unit is 1 billion dollars (about 110 billion yen) It is a feeling that it can cut down to $ 350 (about 38,000 yen) if you throw it, and $ 245 (about 27,000 yen) if you can invest $ 10 billion (about 1.100 billion yen).

And Bitmain is a representative who is doing a big business by investing huge amounts in virtual currency mining, and Bitmain has dominance that there is a bad reputation that it can even interfere with entry of other ASIC developers in China It is a tough fact to have one. Mr. Borgg thinks that in a virtual currency mining system that a person who throws a huge amount of money will be more advantageous it will be in a centralized form that a small number of major players share the market.

Related Posts: