Can Boeing's state-of-the-art 787 aircraft recover huge development costs and make a final profit?

ByJetstar Airways

Boeing's state-of-the-art airliner that has already made the first service in Japan by ANA in 2011 and is already flying all over the worldBoeing · 787 type machine"Is an aircraft that pursues ride comfort by achieving high economic efficiency incorporating advanced design, realizing large windows and atmospheric pressure closer to the ground. Although 787 which included an electric system to many of the aircraft control etc. even though it is still 787, it is 787, but at the development stage many confusion arises due to its innovation and the delay of development and the cost of development accompanying it Increase became a problem. "AstronomicalSeattle Times has summarized the latest situation about the impact of huge development cost suitable for expressing.

Will 787 program ever show an overall profit? Analysts grow more skeptical | The Seattle Times

http://www.seattletimes.com/business/boeing-aerospace/will-787-program-ever-show-an-overall-profit-analysts-grow-more-skeptical/

◆ Development process of the Boeing 787 aircraft with extreme difficulty and huge development cost

Since its first inauguration in 2011, the Boeing 787 aircraft has been introduced to routes connecting airports around the world to transport people and goods. Using a wing with a gentle curve at the tip, an engine cover called "Chevron" molded into a jagged shape, and a lightweight body composed of composite materials of carbon fiber, etc., it improves fuel economy and achieves high economic efficiency and environmental friendliness As the state-of-the-art airframe that has been realized, airline companies around the world are introducing it.

It is a 787 aircraft with a feeling of being established in the sky of the world, but the way to its debut was a daunting difficulty to see an unprecedented example. Development started in 2004 and the schedule which was supposed to be able to reach the first test flight in 2007 was repeated many times due to repeated troubles many times and the customer scheduled for May 2008 In fact, it has shifted to September 2011 which was delayed more than three years from then. The biggest cause is the development of airframe with new material, air conditioning system not using pressurized air (bleed air) from engine, and trouble of lithium ion battery supporting unprecedented power dependence etc It is listed.

ByArtem Katranzhi

Along with the repeated extension of the schedule, development expenses have also increased steadily every time. It was a development cost that was originally said to be 10 billion dollars (about 1 trillion 200 billion yen), but in fact it has turned out that more expenses have been spent.

Although it is said that Boeing adopts an accounting method that deletes expenses invested in development in the future and records expenses every time the aircraft is sold, in calculation 787 is sold for each machine sold by 25 million The dollar (about 300 million yen) is in a deficit situation. Still, in Boeing it is said that this situation will improve by the end of the current fiscal year and it will reach the stage where the surplus will finally come to an end, and there will be settlement of huge development expenses, which is said to amount to as much as $ 32 billion (about 3.9 trillion yen) I will explain it.

The company says it is expected that huge development costs will be offset in about 6 years by strongly advancing sales of 787 in the future, but this prospect also raises questions of favorable analysts to Boeing I suspect it is. The development expenses published by Boeing two years ago were less than 10 billion dollars (about 1.2 trillion yen) from now, and it is uncertain how the numbers will change in the future It is continued. Do consulting business in aviation industryLeeham CompanyBjorn Fehrm evaluates this outlook as "impossible", "Boeing has to make more profits per machine, but it will be impossible to achieve it," and shows a tough view It is.

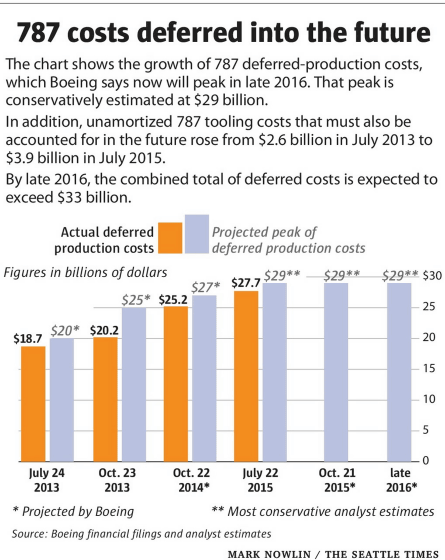

In the graph below, the change in deferred amount of debt per machine is shown. It is estimated that the deferred development cost from 2015 to 2016 is estimated at 29 million dollars (about 350 million yen), which is a conservatively estimated amount.

Boeing sells more than 900 aircraft including the 787 developed machine "787-10" which is scheduled to come in the future, and by raising the profit of 35 million dollars (about 425 million yen) per machine He said he is planning to collect development costs. We already have orders for more than 1100 farm orders (fixed orders) on 787, and we are also getting orders for hundreds of machines. The company says that 1,300 aircraft are one profitable line. However, it is common sense that the catalog price of the aircraft and the actual contract price are different, and it is impossible to obtain the profit as calculated. Economic analyst David Strauss said, "It will be difficult to realize, we need to sell even more than 1300 aircraft," he said.

Furthermore, it is also partnered with MITInstitute for Strategic LeadershipHe is a senior fellow (senior research fellow)Ted PiepenbrockDr. tried calculating how many 787 will be sold at the time of selling. Then it says that the answer was what it was "impossible to realize". Mr. Piepenbrock used to participate in the executive team assessing the schedule of 787 in Boeing and analyzes it based on Boeing's report released every quarter. Piepenbrock says that Boeing will leave a deficit of $ 5 billion (about 600 billion yen) as a result of selling 787 of 2000 machines even in the best result.

◆ Boeing to "Collect is possible"

On the other hand, Boeing spokesperson said that it could be realized, recovering the development cost of $ 33 billion (about 4 trillion yen), and finally the "one-digit net profit" It is said that it is necessary to make a profit of 50 million dollars (about 6 billion yen) per aircraft to be sold in the future. However, this means that it is necessary to secure a profit rate of 30% per machine, but even for the 737 aircraft and 777 aircraft that the company has been supplying over the years, the average profit margin is 20 to 25 Considering that it is percentage, it is expected that it will not be easy to realize even considering the advanced nature (= high added value) possessed by 787 and derived models that will be coming in the future.

Also, the presence of competing machines such as A330neo, the newest competitor from Airbus, and A350, which has already been handed over, is also a matter of concern. Especially A330neo is equipped with the same type of jet engine as the 787, it is an airframe that realizes high economy by using many composite materials and it is expected to become a great pressure in terms of price against 787.

In addition, there are voices showing skeptical views on the improvement of profitability from the viewpoint of manufacturing cost of the aircraft. Adam Pilarski, an aviation industry analyst, points out that two Boeing assembly factories exist in the east and west of the Americas (Everett South Charleston). We point out the difficulties that Boeing needs to reduce the production cost, listing the disadvantages of improving production skills and improving production efficiency into two places. In addition, we are also concerned about expanding consignment to external suppliers.

ByWoodys Aeroimages

◆ The impact of the development cost problem of 787 is

It is rich that it is very difficult to recover the huge development expenses spent on 787 in this way. The fact that the cost required for development is not recovered is a very serious problem, but the analyst mentioned above unexpectedly derives the answer of "there is not much problem" about the influence of this fact.

Economic analyst Strauss said: "These costs have already been paidThunk cost(Burial cost). What is important is the contents of improvements that Boeing can proceed from here ", he says that the" development cost difficult to collect "previously mentioned is not really a big problem in the future. In addition, he said that Boeing is planning to purchase a large amount of cash from the sale of the 787 aircraft in the next 2020, and "Neutral" (= does not need to sell) to Boeing shares, It shows a viewpoint.

Myles Walton of the Deutsche Bank also evaluates the sales of 787 plus. Until 2020, Boeing analyzes that it will have cash of 5 billion dollars (about 600 billion yen) annually, evaluating the company's stock as "buying".

ByDave Sizer

Nonetheless, it seems that the future situation is not in a state of mercy for Boeing. The largest successful work among the company's lineup is the presence of 737 and 777 aircraft, which is compensating for the large development expenditure spent by 787. In particular, the long-selling machine that debuted about 40 years ago, 737 is said to be a success example that is unprecedented in history, which has accumulated total sales of 10,000 aircraft,Bombardier C SeriesYaEmbraer E-Jet, And the first flight is expected also in November 2015Mitsubishi MRJWe are receiving pressure from competing machines that show their appearances one by one, and the likelihood of getting involved in price competition is also increasing. Furthermore, there is a possibility that the amount of sales will decrease as 777 will also be declining in production.

It was a development cost problem of the Boeing 787, which has been supported by the strong performance so far, but the environment is changing as the situation changes. Future situation is considered to be largely dependent on how much the profitability of 787 improves, and Fehrm judges that "It will be a difficult period for Boeing for the coming 5 years".

Related Posts: