Whether Bitcoin eventually disappeared from MtGox or was stolen, the findings showing the new situation clearly

ByCarsten ten Brink

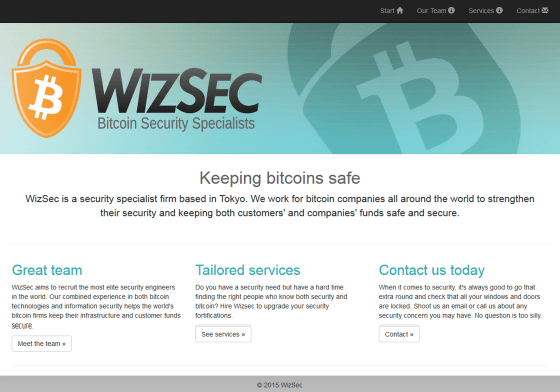

With a base in Tokyo, the Bitcoin exchanges, which once boasted a considerable transaction volumeMtGox(Mount Gox) on February 28, 2014Apply civil rehabilitation proceedings to Tokyo District CourtHaving done virtual currencyBitcoinThe world of (bit coin) got into big mess. After the incidentHacker unveils evidence that unveils Calpress CEO's cheatingAlthough it is the world surrounding the bit coin which still continues to be confused, specialize on bit coin related securityWIZSECIn its own research report, it seems that various facts are emphasizing.

WizSec: The missing MtGox bitcoins

http://blog.wizsec.jp/2015/04/the-missing-mtgox-bitcoins.html

WIZSEC, which announced this report, carried out its own investigation even after a series of riots over MtGox. There are still many unknown points at the time of publication of the report, and the investigation is continuing further. WIZSEC is a company based in Tokyo like MtGox.

WIZSEC - Wiz Security Consulting

One of the questions raised by many researchers in the verification concerning MtGox is the point that "MtGox really held bit coins?" From the conclusion, according to the analysis by WIZSEC, " The bit coin of MtGox which is said to have been stolen has actually been intermittently stolen from the hot wallet that Mt Gox had placed on the Internet from around 2011. In the survey, WIZSEC first analyzed the total amount of bit coins which MtGox thought possessed, based on multiple circumstantial evidences and created the following graph. Beginning in April 2011, the holdings until April 2014 when management collapses are shown in the blue graph.

Since the obtained data did not include all the transactions that MtGox did, WIZSEC said that we are creating a graph based on the change in holding volume. One point in creating the graph was the fact that MtGox, who had been questioned about its financial situation at the time, went on 23 June 2011 to prove his own sound, so422 42 42.4 42 42 42 42 Bit coin transactionAs performance, and at this point it is confirmed that we had assets of the scale corresponding to this fact.

Next, what WIZSEC did is to obtain specific supporting data indicating how much MtGox actually had assets at each point. Here, WIZSEC will attempt to obtain reliable data per source as follows.

· Obtain a list from the MtGox trustee (but that this was rejected)

Collation with cash deposit / withdrawal log data based on transaction data on leaked block chains

· Estimation of possession performance using cluster analysis

· Fill in the gap between data against internal information

Here is a graph showing actual holdings of MtGox derived by WIZSEC using such a method. The blue graph is the theoretical value, whereas the orange graph shows the numerical value derived through confirmation. As you can see clearly by comparing the two graphs, orange graphs show a big decline from July to November 2011, then suddenly the holdings jump up to the 600,000 bit coin level. After that, it is presumed that almost the same curve as the blue graph, which is the theoretical value estimated based on the volume of transactions, is drawn, and it is estimated that the assets owned are almost at the bottom of August 2013.

Also, the graph below plots the difference between the theoretical value and the actual value. As you can see from the fact that the memory on the vertical axis shows minus, the lower the graph, the larger the difference between the two data.

At first glance it means that the difference between the theoretical value and the actual value has been consistently increasing. And as the opening gradually became gone as time passed, it is presumed that as the real asset approaches depletion, it means that there was no room left for "cheating" as it were, so to speak It is.

In addition, WIZSEC analyzed the obtained data, which suggests that MtGox was manipulating incoming and outgoing money records of incorrect bit coins. It is speculated that someone in the interior was involved in the fact that the amount of the bit coin going out of MtGox was being manipulated.

It is thought that the following three methods were used for "internal treatment".

· Move the bit coin to "cold storage" not connected to the Internet

· Split or consolidate the withdrawal of bit coins to make the transaction appear smooth

· Dressing of financial situation by manual operation

Unlike bit coin transactions in the market, these internal processes are not recorded, so it is difficult to accurately grasp the actual situation, but WIZSEC has found out the following really interesting transactions. MtGox distributes some of the bit coins held in its account to several hundred bits of coins and moves it to a temporary account outside the company. The point is that this move is not logged. And then it seems that they gathered this distributed bit coin into an account of several thousand bits coin level and remittered from it to multiple accounts including outside the company. The account of the remittance destination is MtGox, BTC - e, Bitcoinica, and other unknown accounts.

Thus, from the analysis of WIZSEC, the contents indicating the possibility that illegal transaction operations were being carried out by clever means rather than mere "theft" have become clear. Specifically, it is necessary to investigate by a law enforcement agency with authority to confirm "who, when, what for" such operations, WIZSEC spare cooperation on the investigation .

Related Posts:

in Note, Posted by darkhorse_log