Why is the payment form for net payment so many input items so much?

ByFosforix

When shopping at various sites and paying money, I have to enter various information on the form, but why do I have to fill so many items? The fundamental question "Sift Science Blog" is summarized.

Why are payment forms so complicated? | Sift Science Blog

http://blog.siftscience.com/why-are-payment-forms-so-complicated-2/

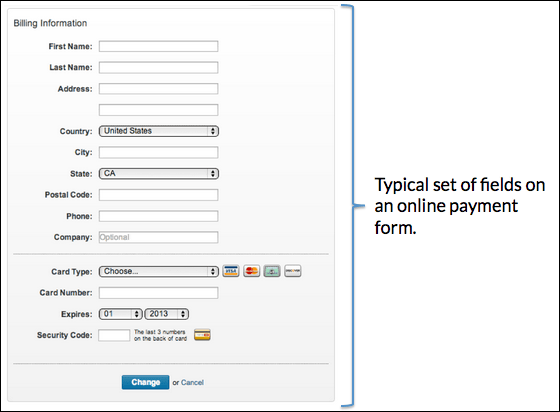

This should be a minimal form. In the case of credit card payment, it should be the end simply by entering the card number / deadline. Three fields, if you enter a total of 20 letters OK.

But actually it is like this. 14 fields, 131 characters are also required.

Surname, name, address, country, city (municipality), state (prefecture), postal code, telephone number, company name, security code, card type, etc. are required, and on the net payment form on average 12 Field · 70 characters are required.

The reasons why this is necessary are as follows.

◆ Credit card fraud and black market

ByElliot Moore

All sites accepting payment online and paying are facing the problem of credit card fraud and in the black market criminal buy about 100 stolen credit card numbers for $ 40 (about 3800 yen) I use it to purchase expensive goods from the website I trusted the stolen illegal number (to resell later and convert it to money).

People who use their credit card number illegally will notice the fact by looking at monthly invoices and reports,ChargebackI will call the bank to do (remand charge request) ". In the case of online shopping, the obligation and responsibility for charging back by this fraudulent fraud is imposed on the side that sold the item, not the bank, which is very costly to do this response processing. Around 3.4 billion US dollars (about 325.9 billion yen) has been lost in the domestic market alone in the United States, major credit card companies introduced two fraud prevention systems at the end of the 1990s in order to suppress these losses .

· First: "AVS (Address Verification Service)"

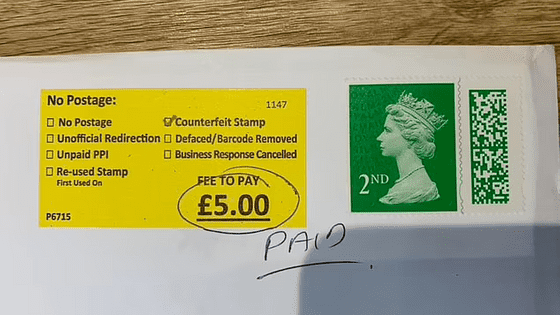

ByBitzcelt

It is a system that checks whether the billing address of the person holding the card matches the address registered in the bank. However, because fraudsters also purchase address information, it is not very effective now, but this AVS still allows us to find 28% of online fraud, while ordinary users who are not fraudsters are also about 8% I will get caught. In the case of the payment form and field earlier, 50 letters out of the 131 letters are spent on checking this address.

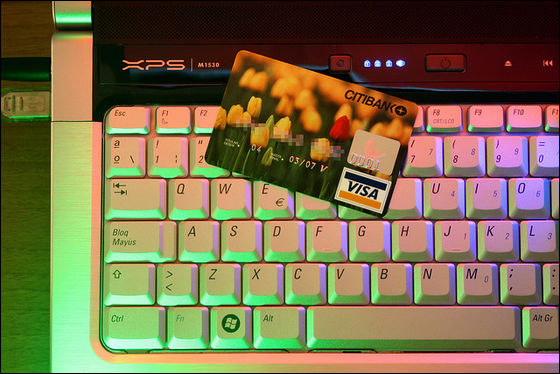

· Second: "CVV (Card Verification Value: Card number confirmation)"

ByDphiffer

This is a master card started in 1997 and prints a 3-digit PIN on the back of the card. VISA cards etc are also following immediately after. In theory, this CVV is prohibited from being stored as data in PCI - DSS (PCI data security standard: five security standards decided by credit card giants), so the criminal will never get it . In fact it is a tatemae, in fact the credit card number with the CVV code is distributed in the black market, of course. Depending on the country or seller, similar CSC · CVV 2 · CVVC · CVC · CCV · SPC etc.security codeIt is the present condition that we are also using.

AVS and CVV, these two systems started with good faith to protect consumers, purchasers, customers and users from online fraud, but in reality it costs as much as the operation of this system, It is also a factor that interferes with final conversions, in other words whether or not you can buy it properly without problems.

The reason is that if there are too many fields to enter, the user stops typing and leaves, enters the billing address, wrongs it, or when the data is reflected on the bank when moving to a new address It is because it refuses or does not know the security code on the back of the card. According to certain research data, if input of security code is omitted,The conversion rate (the rate of success, shopping success) was 40% higherThat's right.

◆ Whether to allow fraudulent behavior or make cumbersome input

ByJorge Franganillo

In order to combat online fraud, there is only one way to lower the convenience of the user so as not to do illegal acts, or to omit tedious input to improve user's convenience Although it looks like, in fact there is no need to choose either, and both are possible.

Fortunately, on the Internet, "which IP address was the user?" "Whether it is via a proxy server?" "Whether it is via a Tor node?" "How you came around the site "How many accounts were created from this physical device?" "Have you sent mail from the correct domain?" Hundreds of information are gathered, and using the mechanical learning algorithm in advance It is now possible to sense danger signals, and development and introduction of such systems are proceeding.

· Two important warnings to publishers offering online payment

By401 (K) 2013

Considering the above facts, "Although it does not mean that CVV does not mean anything, is not it better to have less input form?" But in practice the following important hazards are 2 One out comes out.

First, how does it affect transaction fees when you remove "AVS" and "CVV" from online payment provider (payment processor) you are using now? The point. Even if you delete an address or zip code, the transaction fee will not change, but if you are a clearing company that is strictly managing CVV, you should increase the commission by 0.1% if you do not have CVV. In other words, it is unnecessarily expensive.

Secondly, if you omit or omit the input form or confirmation process, you will need to measure and record the ratio of earnings and misconduct strictly. In conclusion, we should judge whether the increase or decrease of profit or the increase or decrease of fraudulent behavior will be decided.

Related Posts:

in Note, Web Service, Posted by darkhorse