Softbank makes strategic alliance with PayPal, "Establish a new company that changes the settlement in Japan" Established

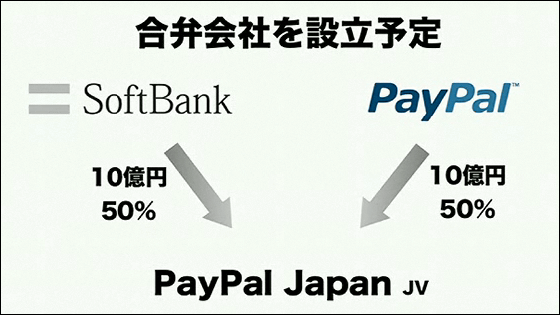

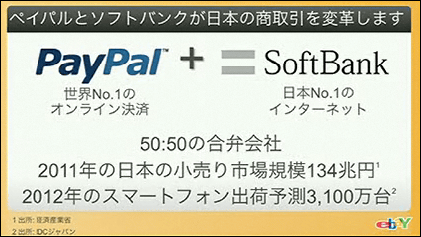

SOFTBANK Today hosted a new business strategy presentation, announced that it will establish a 50% joint venture company "PayPal Japan (PayPal Japan)" with a strategic alliance with PayPal. By doing this, we aim to become the No. 1 online payment and offline settlement,Change the settlement in JapanAnd that.

SOFTBANK and PayPal Establish a Joint Venture - Announcing Global Mobile Settlement Solution "PayPal Here" Small Businesses Enable Settlement by Credit / Debit Card / PayPal - | SOFTBANK CORP.

Press briefing | SOFTBANK CORP.

In addition to Softbank's President Masayoshi Son, President and CEO John Donahoe of eBay Inc., Representative of David Marcus of PayPal, and Managing Director of Softbank Mobile, Softbank Mobile, attended the meeting.

President Son told that this establishment of PayPal Japan is a company to change the settlement market in Japan.

Masayoshi Son:

We will announce the strategic alliance of SoftBank and PayPal and the new joint venture. Today's announcement is to make SoftBank and PayPal's 50-50 joint venture "PayPal Japan".

This is a company made for the purpose of changing the settlement market in Japan. Shopping on the Internet is settled on-line for e-commerce payments or for content, music and game purchases. On the other hand, doing payments at ordinary shops in an offline world has not been directly related to the internet industry. However, the times are going to change dramatically. The fusion of online and offline brings the world where both sides lead customers and payment is united. I would like to take any No. 1 in this payment market.

Ebay has been widely deployed in the United States and Europe, has a track record as No.1 in the Internet auction and e-commerce world, but since PayPal is used as a payment method, PayPal is now the number one in the world. I think that the strongest union was born by the partnership between SOFTBANK Group and eBay Group's PayPal.

As you probably know, PayPal has an account of 1.1 billion accounts on online payment, and it is still growing rapidly. PayPal is No. 1 in the world in this field and has already corresponded to 190 countries and regions, 25 currencies.

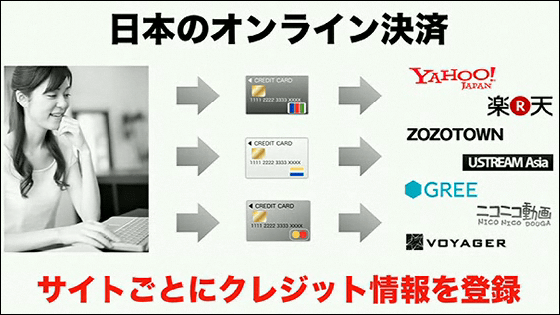

For online payment, customers are Yahoo! When shopping by shopping or shopping on Amazon.co.jp, it was necessary to make different accounts respectively.

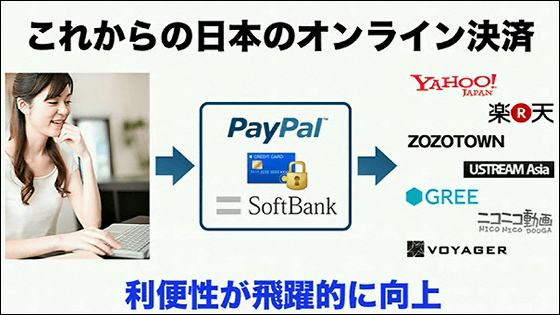

There are various kinds of things such as net games and music, but in Europe and the US it is convenient, like paying everywhere if you already have one PayPal account. It is finished that you do not have to enter credit card information many times. Even in Japan, if you open an account with PayPal Japan in a form like a one-time account of payment, you can pay for everything and dramatically improve customer convenience.

The de facto standard of Japan online settlement is completed. In addition to this, opening an account of PayPal Japan makes it possible to settle not only in the online world but also in general coffee shops, restaurants and boutiques.

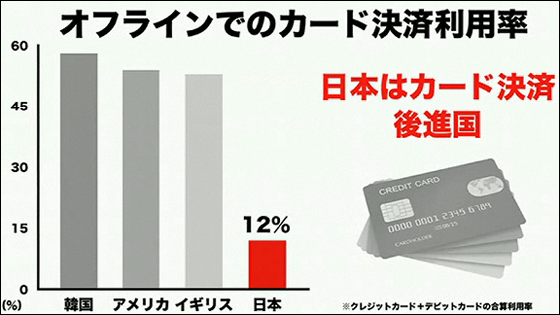

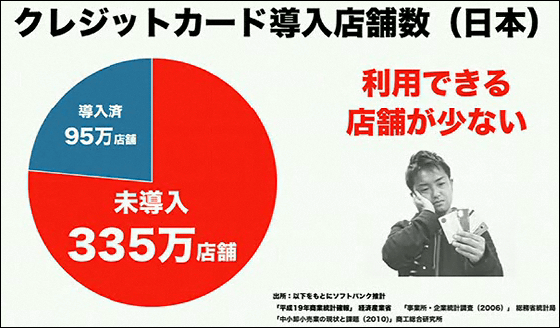

Japan has been a backward country in credit cards. Korea, the U.K., UK etc. already have nearly 60% payment done by card, but Japan is still only 12% used. Many people have cards but pay by cash.

The reason is that because the store that accepts only cash is 3/4 of the whole, the shops that accept credit cards are 1/4. There are few shops that can use credit cards, so you have to put cash in your pocket.

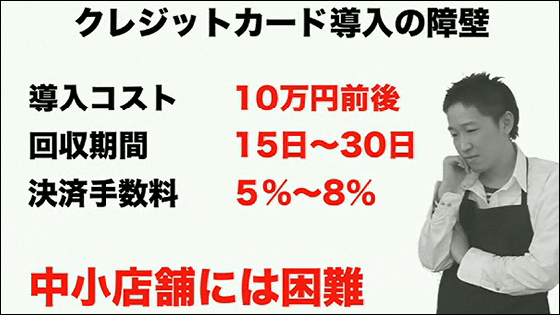

There are several reasons as to why shops that can use credit cards are few, but firstly the introduction cost will be around 100,000 yen. The card reader is too expensive. The collection period also takes 15 to 30 days. In addition, there was a triple penalty that also involves settlement fees, so it was supposed to be very hurdle for small and medium shops. Let's make this cheap as much as possible.

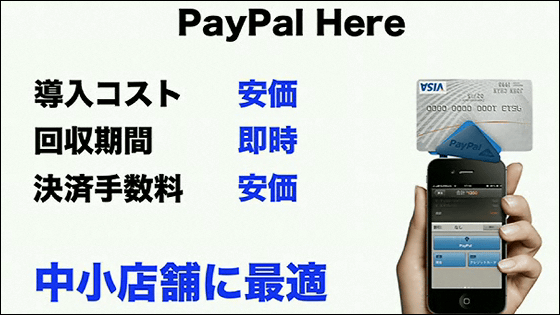

The specific cost will be explained later but the smartphone will change it all at once.

Costs are reduced at a stroke by smartphones becoming the entrance to introducing credit cards into stores. If you have even a smartphone, simply by inserting the adapter "PayPal Here" into the headphone jack, this means that it will be a credit card reader. The introduction cost is very cheap, the collection period is also instantaneous, the settlement fee also becomes cheaper than it is now, so elegantly we accepted only cash at small and medium shops, but feel free from credit cards and PayPal accounts You will be able to pay. People who have a card can use a card reader and even people who do not have a card can use it. I do not know how people who do not use it later.

SOFTBANK is the smartphone's overwhelming No. 1 position and has sales capabilities. Softbank Group takes responsibility for the ability to distribute card readers to stores and the ability to cultivate shops. I will explain how to use to shop clerk and store manager. In addition I think that it is natural to sell a smartphone.

Softbank's corporate sales force distributes this credit card terminal and triangular adapter, and I want to increase it to 100,000 cases and 1 million cases more and more. Even if our corporate sales force does not come to the shop, you can purchase this attachment yourself if you come to the SoftBank shop. Then your shop will immediately accept credit cards.

The consumer benefit is something, fast, secure, convenient. It will be possible to realize fast, reliable and convenient even in the offline world.

As merchants' side benefits, it is an increase in visitors and an increase in per-customer prices. It means that one more item can be sold to the person who thought "I would like to request one more item because I do not have cash".

I would like to revitalize small and medium-sized retail stores in Japan.

Change Softbank and PayPal to change the lifestyle of consumers, change the business model of retail stores. Online settlement No.1, to offline settlement No.1.

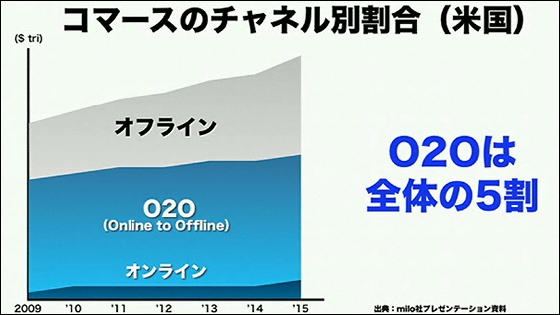

In addition, we will increase e-wallet, electronic wallet application. SoftBank, Yahoo! , PayPal, we will collect the power of our group and increase the number of electronic wallet applications. Then you will be able to manage your personal household account book electronically, and you will be able to use other things like electronic points. "O2O", online to offline, this is the keyword of a new industry. There are the words B2C and C2C, but from the online world to the offline world.

Until now, there was a case that it is not grateful from offline people in the world, even though there is a case where you buy online as it is after seeing the information online, watching the information online and buying it offline later. From now on, we will discover it online, purchase it at the actual store, until the settlement. That kind of world will come.

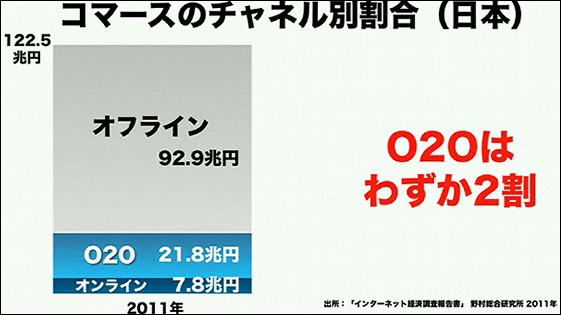

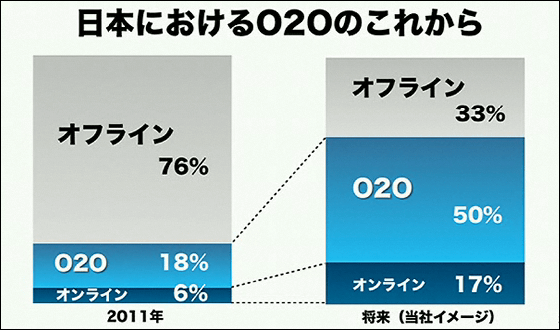

Since America is the world of O2O, 50% of the total is O2O. However, Japan still has about 20%. I think that this will be 50% of the world like the United States.

Softbank Group has Yahoo! There are 900 companies such as Ustream, ITmedia, etc. Most of them are in Japan, but these companies have more than 100 million customers to attract and have users, and have the largest net users in Japan. So PayPal Japan will be reborn as a joint venture by introducing O2O into the shop and PayPal as a business model as a business model. It is the world of O2O where the development is now in Japan, but I want to take the overwhelming No. 1.

From now on, we will make a proposal for a new lifestyle that allows young people to shop without having cash, pay freely with confidence in one account.

John Donahoe:

On behalf of eBay 27,000 employees we would like to thank you. First day today is a memorable day for PayPal. The reason for doing the first joint venture in PayPal's history is that one reaffirmed Japan as a more important market. As global payment company, we have to take number 1 in Japan as well. The other is that we do not have the best partner in SOFTBANK more than us in Japan. I am pleased to establish a partnership.

I will show you how we are looking at settlement of the world. At eBay we operate e-commerce and net business with PayPal in 190 countries and regions. Among them, innovative changes are occurring in customers. We are right at the turning point right now.

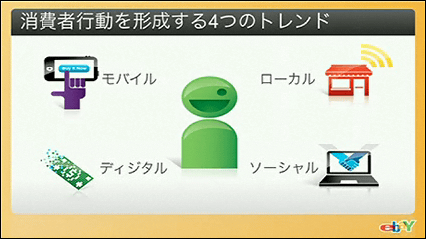

Payment and settlement at shops where there will be reforms after this will change further in a few years, I believe it will last for 20 years. I think there are four trends among them. It is mobile, local, social and digital.

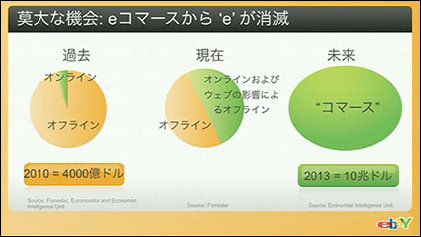

My grandson said that, smartphone, mobile device occupies a very important position. It gives the market a very big shock, trying to eliminate the boundary between online and offline. For example, by searching, you can reconfirm what kind of items are needed before actually purchasing, and find out where you can buy it at the store through the net. It gradually became possible to express "e" in e-commerce and retail as a whole by commerce.

It is obvious that the customer wants seamless shopping and wants to finish it easily and conveniently. Business operators must accept customers' behavior and must accept technological innovation. Even in small stores, I realized that I can not attract customers without having to focus on the net. You can take customers online. It can be said that this was a major turning point for retailers.

In eBay, I would like to help with such large and small stores in the world. PayPal accommodates 190 regions, 25 currencies, handles $ 118 billion and PayPal has 110 million active accounts. I think that more than half of them are outside the United States, it can be said that it is a network of the world in a true sense.

From now on, we will also borrow SOFTBANK's distribution capabilities in order to make PayPal No. 1, and we would like to offer digital payment systems online and offline, both.

David Marcus:

Commercial transactions will change. There was a remark from Donaho, but since PayPal is digital settlement, it can be used on all channels.

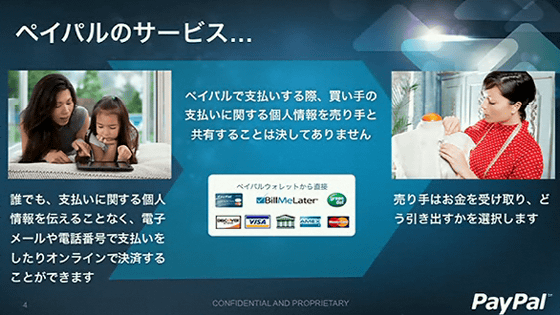

Today, it plays a central role in the connection and can be used without referring to credit card information. People with mail address, people with phone can use it, it is possible to use it with various payment methods.

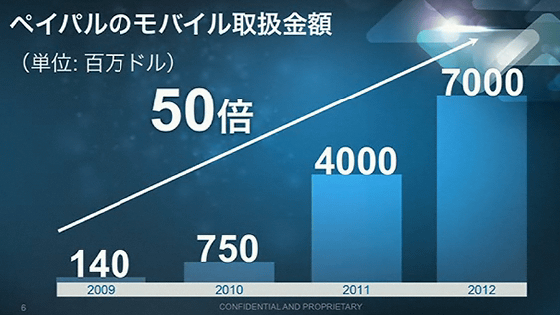

With PayPal, mobile is a very important strategy, and transaction volume is growing. It was 50 times in the past 4 years, last year was 7 billion dollars (about 560 billion yen). I think that this speed will still accelerate and I think that it will accelerate even in Japan. The entry into the offline world has also become a big wave.

The market of 134 trillion yen in Japan is attractive. There are 5 million small businesses, but only a few of them accept credit cards. Just because you can not accept it, I do not want you to lose sales opportunities. I'd like to change the situation, and we would like to offer innovative products for that.

This is "PayPal Here". We designed it with a simple device. If you install this, you can handle credit card with smartphone. Card reading is easy. This is a complete solution for small businesses, and payment acceptance with PayPal is also possible.

Case of coffee shop. The customer wants to buy coffee.

The shop side sets PayPal Here on the smartphone. Select the item you registered and display the price.

The customer passes the credit card through the device and confirms the price. If you are OK, just sign and press the button. Payment will be credited immediately to your PayPal account.

Japanese SMEs create 70% of their employment. It is PayPal Here, to ensure that companies do not lose sales opportunities. Many payment methods can be handled. Credit card, cash, invoicing by email, PayPal payment is also possible.

If you use PayPal Here you will lose payment like you have ever been. If you use the automatic check-in function, you can settle without issuing a wallet or smartphone. If it is a familiar shop, it means that face pass is possible.

Until now, credit card transactions for small and medium sized businesses cost money such as monthly fee. Moreover, there are many deposits with once or twice a month. Under such circumstances, there is no point purposely to make credit card correspondence. It is important for SMEs to be able to recover funds quickly. If you are PayPal Here, after you read the card, the price is immediately transferred to your account. The commission is 5%, there is no initial cost or monthly fee. The mobile application is also free, and the card reader is estimated at around 1200 yen. By paying a 5% fee of the settlement fee, millions of small businesses will be able to handle credit cards.

PayPal boasts the industry's highest security. The joint venture will change the settlement market significantly and the way of payment and settlement of Japan will change greatly. First of all, we will start offering to some business operators, and we will do shop sales in a few weeks. Business operator to PayPal Herehttp://www.paypal.jp/hereThe device can be registered from, and the device will be delivered in a few weeks. PayPal Here enables seamless payment of small businesses online, offline and mobile.

Akira Kita:

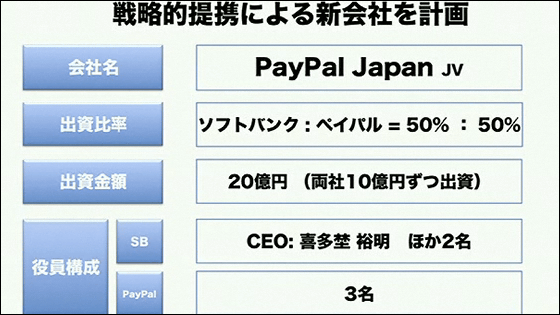

I will introduce the summary of the partnership overview from me. "PayPal Japan", the official name is now officially decided. Investment ratio will be 50% for SOFTBANK and PayPal, 2 billion yen for each company for 1 billion yen.

I originally had Yahoo! I would like to bring that experience to the new company. From now on, we will provide things that people think that they are convenient and good for shop people and consumers, so I think that nature and the company will also get excited. I will do my utmost to change the settlement market in Japan with this joint venture.

◆ Q & A

Nikkei Newspaper:

What is PayPal's revenue in Japan? Also, in Japan there are aspects such as Osaifu-Keitai where the settlement market has progressed in a somewhat different way, and there are moves over NFC, but what is your view on competition with PayPal Here?

Grandchild

There are parts that I do not know until what I am going to do with how much money and what I am going to do, but it may be that the era of five years and ten years ahead will come when carrying a wallet is bad. Amidst the new lifestyle, is not it our position as an industry standard?

Test attachment started from tomorrow and full-fledged store introduction started in July. Osaifu-Keitai is often used with a small amount, and it is troublesome to deposit money. You will have to transfer the balance as you change terminals. I think that it is actually a fact that it is not being used much in reality. In the world of PayPal Here you can use the credit card function as it is, so you can use it for hundreds of thousands of yen or hundreds of thousands of yen. Of course, even 100 yen or 200 yen can be used, widening the range of payment. Besides credit cards, you can pay from PayPal accounts you have on-line and you can also accept cash, so for a shop, at least a credit card reader costs 100,000 yen, hundreds of thousands and hundreds Things that took a lot, you can purchase a POS checkout by buying a leader at 1200 yen once by using a smartphone and can manage the customer. Customers can drink coffee on face pass and get clothes. It seems to be said in 10 years after 5 years that Osaifu-Keitai which occurred like the Galapagos in the past was a temporary business model.

Nikkan Kogyo Shimbun:

First point, what is the date of establishment of the joint venture?

Kita 埜:

I am in talks now, and it is not officially decided what day.

Nikkan Kogyo Shimbun:

There was a full-scale deployment in July, but founded around that?

Kita 埜:

I'm thinking about that.

Nikkan Kogyo Shimbun:

About Softbank's way to make money. Does it mean that the settlement fee 5% will be the sales of the joint venture and revenue sharing it?

Grandchild

Both parent companies do their utmost to just make a joint venture a success. When the joint venture makes profit, and it will be listed in the Japanese market in the future, Yahoo! It is like JAPAN, does not suck up profits, it is the overwhelming No. 1 of payment methods in Japan, and I believe that there will be a form that lists the profits and lists.

Nikkan Kogyo Shimbun:

Is the revenue source of the joint venture fee and adapter sales?

Grandchild

I do not mean to make money with adapter sales at all. Since the adapter has an IC chip inside, it encrypts and other excellent functions are included, so it costs a reasonable cost. There is an income of a settlement fee of 5% to the last, and the difference which paid a fee to a credit card company from there is a business model.

Nikkan Kogyo Shimbun:

Third point, was to say that we will issue related apps in the explanation of Mr. Sun. For example?

Grandchild

PayPal's electronic wallet is prepared, and the VISA card and Master card that I have now are electronically contained, and the things the customer has, such as point cards, are included. It will be able to manage things like your household account book, such as how much it cost your food expenses with that application. Such convenient applications come out one by one.

Nikkei Newspaper:

2 points for PayPal, 2 points for Mr. Kita. The first point, the opportunity that led to the alliance. Since when did you talk, whether it is a love call from PayPal, from Softbank? Secondly, there is a JCB card that I can not use for the time being, but if there is a prospect of when I can use it from around. The third point is to Mr. Kita. Are there warranties, insurance, remedies when there is a settlement problem? Fourth,transactionWill it surely flow, since it will be called an accounting system, how will you secure it?

Grandchild

The first point is from me. Just two and a half months ago when I visited eBay, at that time it was chatty and it was about "I want to do various things together if there is opportunity". Originally, eBay and SOFTBANK competed in the past in the Japanese market and fought in China, fighting in Alibaba and eBay in China, the history of both was a competitor. There is something that I will respect as enemy by knowing enemies well, so I told that eBay is an excellent company, so that if I have the opportunity I would like to work together. In the past, when eBay entered Japan, I talked about whether CEO and I would not do it at a joint venture company, and I thought about possibilities until the end, but in the end I decided to do it separately. I went through a similar case in China. Before Ebay listed in the United States in the first place, I talked that he wanted to invest from SOFTBANK, so there were three opportunities, and none of the three had a tie-up. This time, if I was talking about the fourth time honestly, in fact, because there are things that are preparing now, the talk went up as to whether we should do it together, which means that we finished at a stroke in the past two months.

Marcus:

It is an additional comment. I knew it only after negotiating, but both companies have similar thoughts. The purpose of introducing PayPal Here to Japan is because Japan is one of the world's largest economic powers, but the credit card usage rate is low. President Son went to visit there, so I summarized what to do in Japan. Although it is a JCB card, we are currently working towards eager handling. I can not inform you of the specific date, but I will realize it.

Kita 埜:

I am supplementary about that point. I am Yahoo! When I was in, I announced an alliance with JCB. I am planning to announce this announcement again this time and I am planning to talk about whether I can join with JCB. Regarding the warranty at the time of trouble, PayPal is still online in the world, Japan, but offline will be a future business. Yahoo! As I did with auctions, I'm thinking about watching the situation and thinking about programs for Japan if I need it. Basically, I take in the mechanism PayPal is doing in the world as it is, I'd like to decide while consulting if there is anything I need in Japan.

I think that the certainty of transactions is okay as PayPal is a very solid company. Because there is a precedent case, Yahoo! JAPAN is Yahoo! As I came along following the service of Inc., if there is a problem to occur, I think that there is also the merit of being able to know earlier in advance. I want to do it as surely as the transaction passes.

Grandchild

PayPal thinks that various companies can make something similar to PayPal's function, but it is PayPal that we are already selling 10 trillion yen in transaction amount. It has 100 million accounts and trades 10 trillion yen annually as transaction amount. Since it is a thing involving money, such as security, encryption, shop credit check, it becomes an important part. PayPal has accumulated achievements. I think that it is a decisive difference that the know-how to experience and protect the trouble has been accumulated.

Nomura Securities

Three points, it is said that this story happened to happen, but if it is SOFTBANK Group Yahoo! Does JAPAN have invested in ASKUL and is strengthening efforts to commerce? To start PayPal Here business, how does the joint venture involve other PayPal's business? Third point, it is premised that owning a smartphone at the shop side, is it diverted to a store clerk or owner's personal use, will Softbank distribute?

Grandchild

Although there was also a business tie-up with ASKUL, the idea that the SOFTBANK Group aims at all NO.1 in the business to do. Ecommerce also has a strong determination to make it scale and content much more than Amazon and Rakuten. ASKUL and Yahoo! JAPAN 's alliance will be the same scale as Rakuten already if you add both, so I want to make it to no.1 in the e - commerce world all at once. From the perspective of total strategy, we have means of settlement, commerce is No. 1, O2O also builds No. 1. We believe it will be indispensable for group strategy. Ecommerce, o2o is an important part of the total strategy of the world. It is not just a joint venture, but a joint venture is an indispensable strategic position for us. So, I am hoping for presentation on behalf of the group. It is indispensable as eBay, so head office CEO is present.

PayPal switches not only to Here but all online PayPal Japan is integrated, PayPal Japan will all be switched to a joint venture. Not only O2O, but all switches to a joint venture.

There was also a talk about small shops about smart phones, but we have to wait for big shops to line up at the cash register. Meanwhile, there are hundreds of clerks at the shop front and are serving customers. At a TV shop, a refrigerator shop, etc., we will negotiate the price there, but if PayPal Here is gifted to the smartphone held by the clerk on the spot, it can be settled on the spot. You do not have to line up. Even in the restaurant it does not line up with the cashier, when the clerk comes to the table, the settlement ends. It does not have to wait. I explained it mainly to small and medium stores, but maybe it will spread even at large stores. In that sense, everyone has a smartphone, so if you have each adapter individually, that terminal will be the business terminal and the shop side may distribute it as a business terminal.

That concludes the presentation. Can this settlement system be a standard ...?

Related Posts:

in Web Service, Posted by logc_nt